Business

Federal Reserve Poised for Rate Cuts This Fall Amid Economic Uncertainty

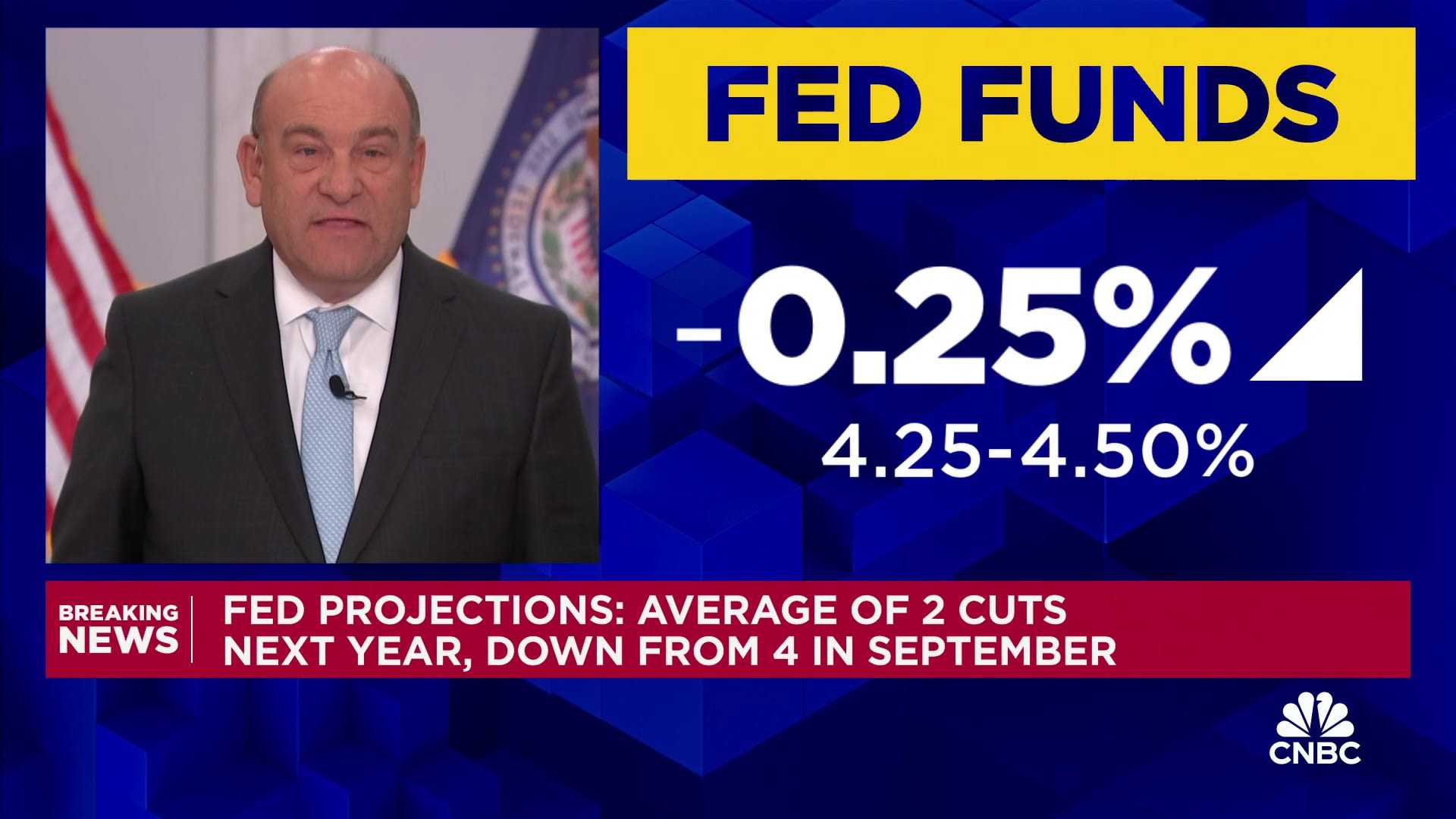

WASHINGTON, D.C. — The Federal Reserve is expected to lower interest rates for a second consecutive time this week, with another quarter-point reduction that could bring the federal funds rate to a range between 3.75% and 4.00%. This decision follows recent trends of diminishing borrowing costs.

The Federal Open Market Committee (FOMC) sets the federal funds rate, which is the rate at which banks lend to each other overnight. While the rate is not directly indicative of consumer lending rates, the Fed’s actions generally influence various consumer loan rates, including mortgages and credit cards.

Predictions are set for another rate cut in December, but beyond that, the fiscal path remains uncertain. President Biden, amidst these discussions, hinted that a replacement for current Federal Reserve Chair Jerome Powell could be determined by the year’s end.

However, the trajectory of consumer interest rates might not follow the Fed’s reductions as closely as in the past. Mike Pugliese, a senior economist at Wells Fargo, explained that certain loan types respond differently to shifts in Fed rates. For instance, short-term floating rates fluctuate more closely to the federal funds rate, while long-term fixed rates such as 30-year mortgages are influenced by diverse economic factors such as inflation.

This situation raises questions for millions of American households burdened by credit card debt. As of now, more than 40% of U.S. households carry credit card debt, with average annual percentage rates (APRs) exceeding 20%. These credit products, primarily with short-term, variable rates, display a direct relationship with Fed rate fluctuations.

Matt Schulz, chief credit analyst at LendingTree, noted that even though Fed cuts may lead to lower prime rates and potentially reduce interest payments, recovering from high debt rates would take time. For instance, Schulz indicated that a quarter-point reduction in APR may only save a consumer approximately $61 over the lifetime of a $7,000 credit card debt.

Concerning car loans and mortgages, current figures show a 7% average rate for new five-year auto loans. Jessica Caldwell, head of insights at Edmunds, said that while a modest Fed rate cut might not drastically reduce monthly payments, it could enhance buyer sentiment going forward.

As borrowers remain cautious leading into the holiday season, Housing Market Survey statues indicate homebuyer expectations about future mortgage rates remain guarded. As rates sway amid potential downward adjustments, economic indicators suggest consumers are carefully weighing their financial futures in a climate marked by rate volatility.