Business

Ford Shares Struggle Amid EV Challenges and Market Uncertainty

DETROIT, Mich. — Shares of Ford Motor Company (NYSE:F) have experienced a sharp decline, falling 15.3% over the past year, significantly underperforming against the S&P 500, which posted a 10% increase during the same timeframe. The automaker is grappling with a myriad of challenges ranging from consumer confidence issues to uncertainties surrounding electric vehicle (EV) tax credits and tariffs.

As customers tighten their budgets amid economic pressures, large purchases such as automobiles are being deprioritized. This sentiment was echoed by analysts who have issued varied predictions about Ford’s future, underscoring the mixed market outlook. Ford has faced particular scrutiny in light of President Trump‘s recent one-month reprieve from proposed tariffs on automobile parts imported from Mexico and Canada, a crucial aspect of Ford’s supply chain.

“If tariffs persist, it would mean billions of dollars of losses for the domestic car industry,” said Ford CEO Jim Farley. Investor sentiment remains cautious following the company’s disappointing 2025 adjusted EBIT guidance of $7 billion to $8.5 billion, which falls short of 2024’s $10.4 billion.

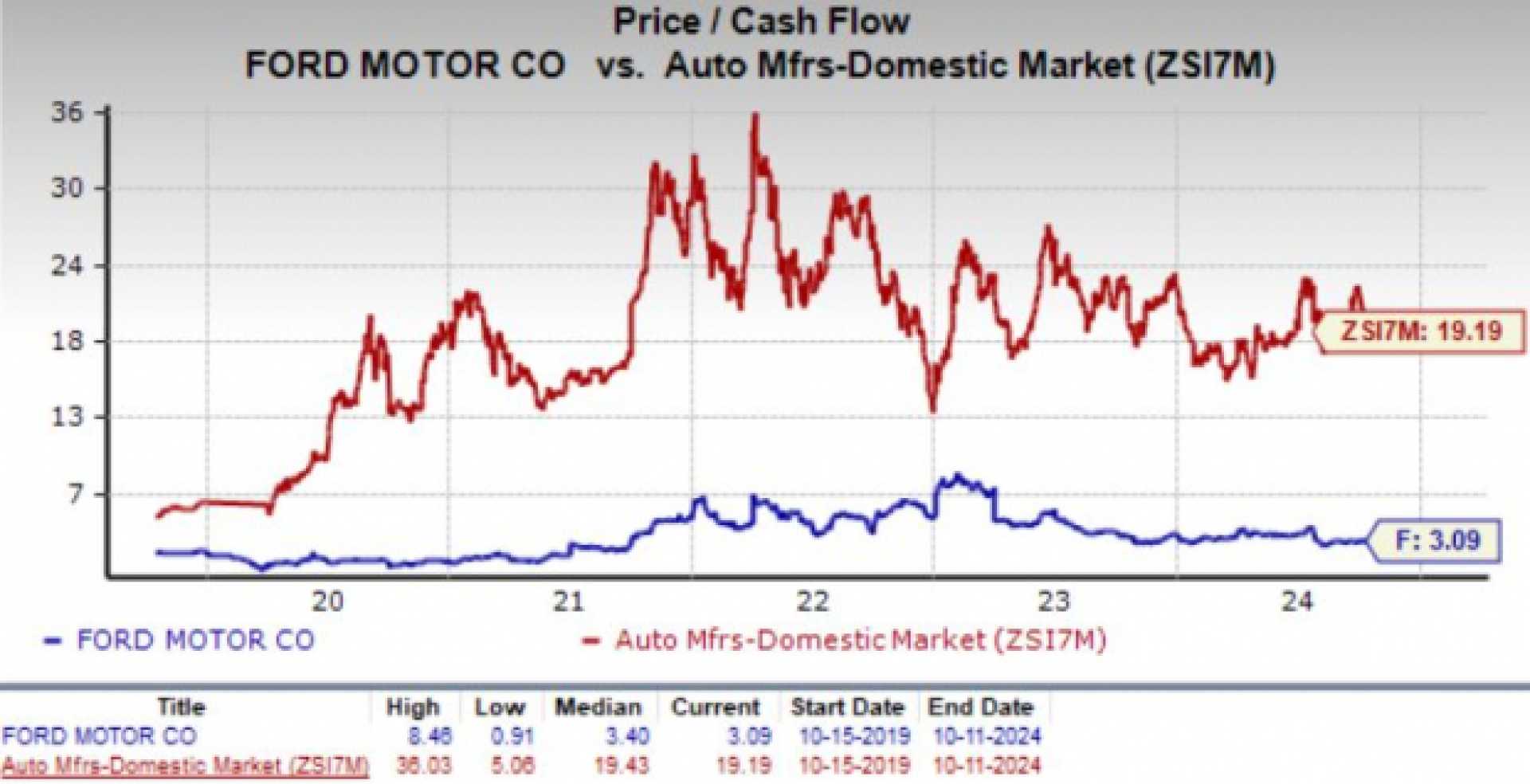

Despite these headwinds, some market observers remain optimistic about Ford’s value, prompting a reexamination of its stock. With the current share price trading at a forward valuation of 7.2 times projected earnings of $1.37 per share in 2025, analysts suggest there may be significant upside potential for investors willing to navigate the volatility.

“The old investing adage says to buy when there’s blood in the streets,” remarked an analyst, who believes that the company’s steep dividend yield of 7.54% further enhances its attractiveness amid its falling stock value. This yield significantly eclipses the S&P 500’s yield of just 1.3%.

Moreover, Ford’s operational fundamentals reflect resilience, reporting record revenue of $185 billion for 2024 and marking a fourth consecutive year of revenue growth. However, uncertainty continues to cloud the company’s future, particularly due to substantial losses of $5.3 billion within its EV division during 2024.

Investment firms have exhibited mixed strategies regarding Ford, with Wells Fargo lowering its price target from $9 to $8, reflecting an “underweight” stance. In contrast, Bank of America maintained a “buy” rating while reducing its target from $19 to $15.50. This diverse range of perspectives highlights the ongoing challenges Ford faces as it balances traditional vehicle sales with ambitions in the electric market.

In recent quarterly performance reports, released on February 5, 2025, Ford announced earnings of $0.39 per share, exceeding expectations. Amid ongoing tariff and EV loss struggles, Ford’s institutional investor landscape illustrates robust support, with Vanguard Group Inc. boosting its stake by 16.6% during the last quarter. This influx indicates a strategic commitment to offsetting potential losses and harnessing Ford’s long-term value proposition.

As Ford navigates through these hurdles, including shifts in consumer demands and competitive pressures in EV technology, the company’s operational focus remains crucial. Analysts project a potential EPS of $1.47 for the fiscal year, suggesting prospects for growth remain despite the volatility in the current market.

Ultimately, while Ford shares are facing significant headwinds, the current valuation, dividend yield, and established revenue streams may offer patient investors an opportunity to capitalize on future recoveries as the automotive landscape continues to evolve.