Business

fuboTV Shares Rise Amid Competitive Streaming Landscape

New York, NY — fuboTV (FUBO) shares increased by 7% over the past month, despite the competitive streaming market. Investors are now watching to see if this momentum can continue as viewing habits evolve.

The company’s one-year total shareholder return is just 1.6%. However, the recent price uptick suggests some investors believe there may be growth ahead or are reassessing the company’s risk. This rise comes after several challenging years for shareholders.

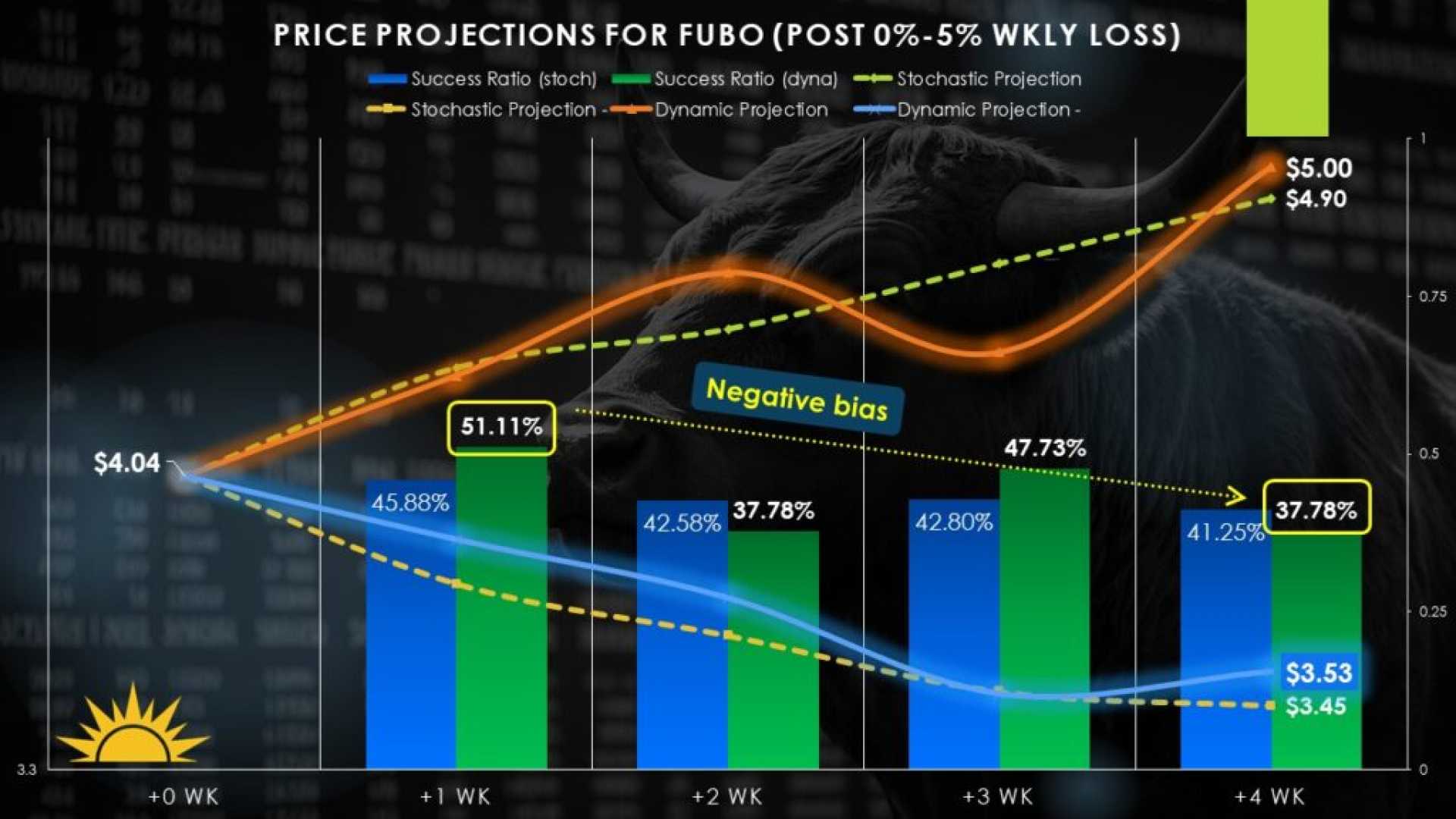

Shares are currently trading slightly below analyst price targets. The critical question is whether fuboTV is undervalued or if the market has already incorporated expectations for future growth. Analysts indicate the fair value of fuboTV may be significantly higher than its current trading price, reflecting optimism about upcoming growth drivers.

Enhancements to user experience, including features like Catch Up To Live and Game Highlights, are likely to meet the growing demand for personalized content. This could lead to higher user engagement and improved financial stability for the company.

Despite this positive outlook, fuboTV faces challenges such as ongoing subscriber losses and competition from larger streaming services, which could quickly reverse current positive sentiment.

For anyone looking to assess fuboTV’s potential, detailed analyses are available, highlighting key metrics and forecasts that could influence investment decisions. Simply Wall St emphasizes that their commentary is based on historical data and not intended as financial advice.

With a fair value estimate of $4.50, some analysts suggest fuboTV could be undervalued, positioning it as an intriguing option for investors.