Business

GameStop Earnings Anticipation: Market Expects Significant Share Price Movement

As GameStop (GME) prepares to release its latest earnings report, market anticipation is high, with indicators suggesting a potentially significant move in the company’s share price. According to pre-earnings options data, the market is expecting a move of around 12.4% in the share price following the release of the results. This anticipated movement translates to a $3.41 change, based on current prices.

The options volume for GameStop is reported to be normal, with calls leading puts by a ratio of 7:4. This imbalance suggests that investors are more bullish on the stock heading into the earnings announcement. Historically, GameStop’s stock has shown a median move of 11.7% over the past eight quarters following earnings releases, providing a context for the current expectations.

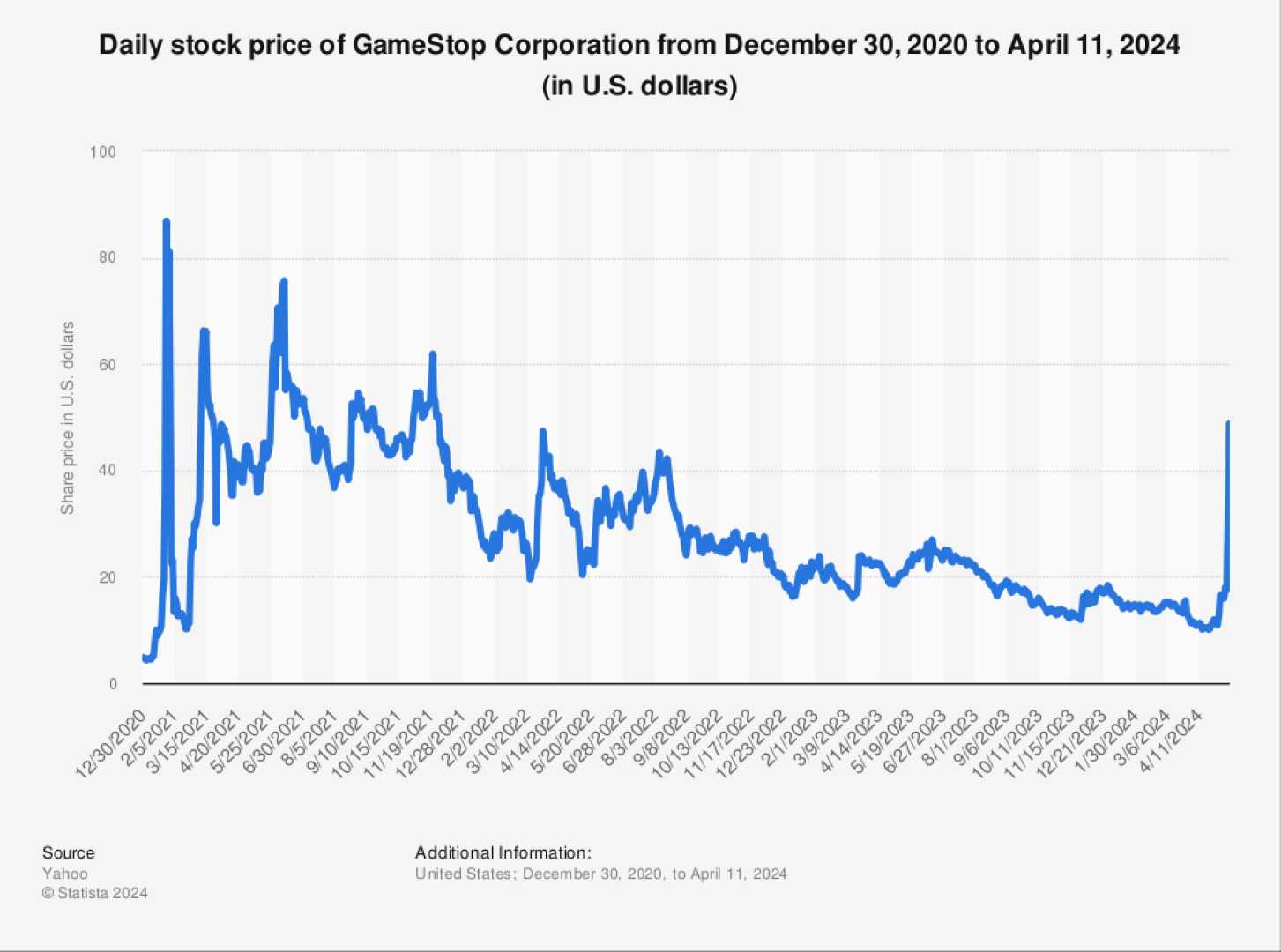

The upcoming earnings report is being closely watched, especially given the historical volatility and significant investor interest in GameStop. The company, known for its role in the meme stock phenomenon, continues to attract attention from both retail and institutional investors. As the market awaits the release of the earnings, analysts and investors are scrutinizing various factors that could influence the stock’s performance.

Investors are advised to be cautious, as trading around earnings releases can be highly volatile and risky. It is recommended to consult with a financial advisor before making any investment decisions based on market predictions or analysis.