Business

GameStop Faces Pressure Ahead of Critical Q4 Earnings Report

NEW YORK, March 19, 2025 — GameStop Corp., the well-known video game retailer, is set to announce its fourth-quarter earnings for fiscal 2024 on March 25, after market close. Analysts are forecasting a decline in both earnings and revenue, reflecting ongoing struggles in GameStop’s core business as consumer trends shift toward digital platforms.

The anticipated adjusted earnings per share for Q4 FY24 is projected at $0.09, significantly lower than last year’s $0.22 per share. Revenue is expected to fall around 18%, hitting approximately $1.48 billion, primarily due to decreasing hardware and software sales. This trend highlights the challenges GameStop faces in transitioning from traditional retail environments to modern e-commerce platforms.

GameStop’s stock has seen a downturn of 21% in 2025 yet has appreciated by 81% over the past year. Despite this volatility, analysts have refrained from issuing ratings on the stock recently, citing that GME’s price movements are largely driven by its meme status rather than solid fundamentals.

Investors are particularly interested in any signs of improvement in sales and profitability during the upcoming earnings call. There is also speculation regarding a potential partnership with Qatari investor Sultan Almaadeed, with whom CEO Ryan Cohen reportedly met in Qatar. Such collaboration could divert focus from the anticipated financial decline, potentially boosting stock prices.

Beyond earnings, analysts are questioning whether GameStop may allocate part of its roughly $4.5 billion cash reserve toward investments in Bitcoin, following a social media post by Cohen alongside MicroStrategy CEO Michael Saylor. While the market remains apprehensive, any positive hints regarding this investment strategy could resonate well with investors and lead to further stock price increases.

As of the recent data, traffic to GameStop’s website has dropped by 25.2% year-over-year, contributing to the gloomy revenue outlook. Despite this, sequential web visits rose by 41% in the past quarter, indicating some potential recovery in interest.

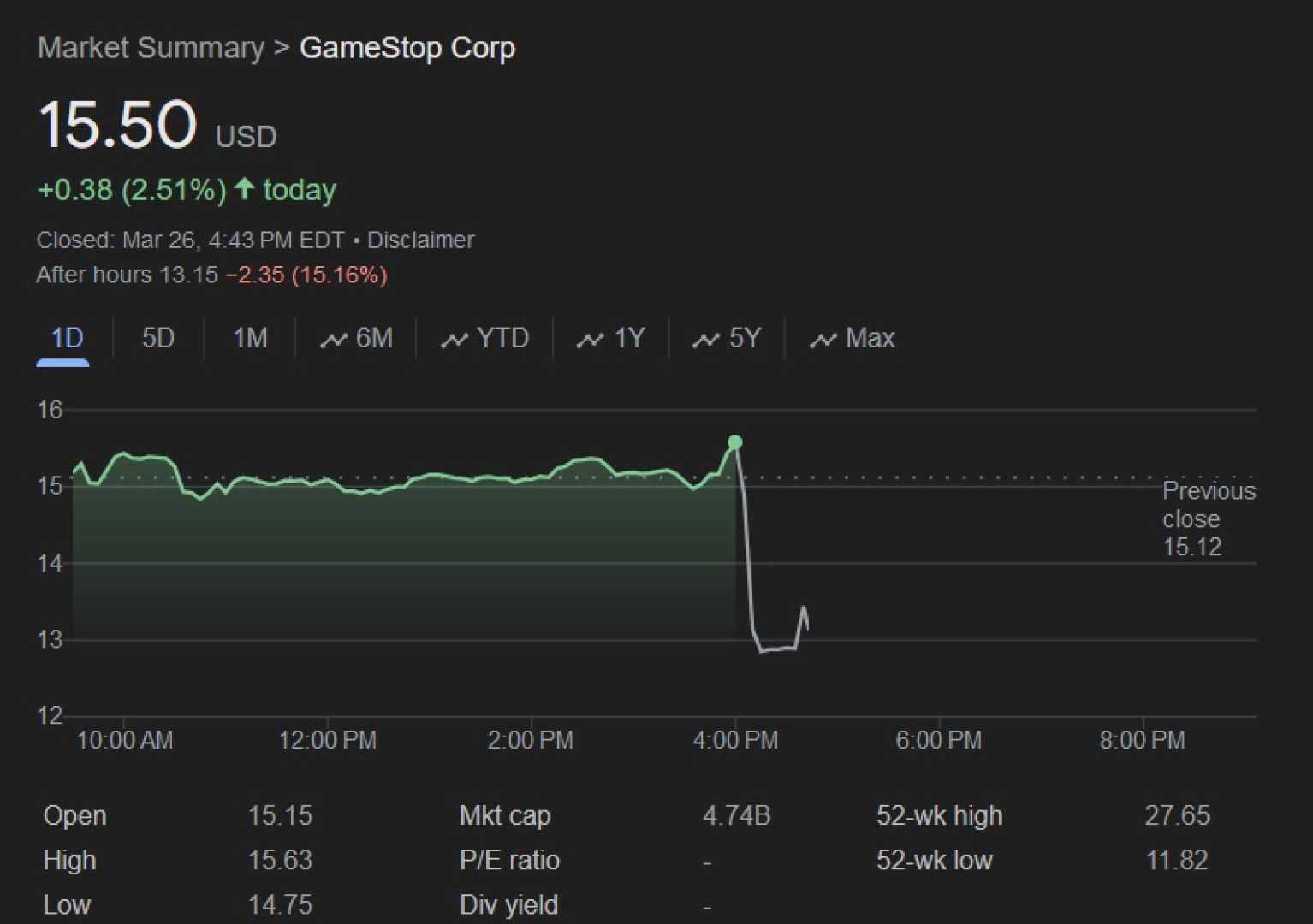

Technical metrics suggest GME stock could experience significant movement post-earnings, with options trading indicating an expected price fluctuation of around 13%. Current analyst ratings show six sell recommendations, with an average target price of $10 per share, which reflects a pessimistic outlook as it indicates a possible over 50% decrease from its current levels.

Given the persistent uncertainties facing GameStop—coupled with its speculative nature following the meme stock phenomenon—investors are advised to approach this stock with caution. Major decisions from management regarding the cash reserves, competing market pressures, and the anticipated earnings report will all contribute to the stock’s volatile performance in the upcoming week.