Business

Is General Motors Stock a Good Buy at $50?

DETROIT, Mich., March 24, 2025 – General Motors (GM) is facing scrutiny as its stock hovers around $50, despite a recent 25% dividend increase and a $6 billion stock buyback initiative. The automaker’s retail sales rose nearly 4% last year, boosting its U.S. market share, particularly in the GMC, Cadillac, and Buick divisions. However, GM’s stock has dropped 6% year-to-date, prompting questions about its investment potential.

Industry analysts believe GM appears undervalued at its current price, but they urge investors to weigh several significant concerns before proceeding. A comprehensive analysis comparing GM’s valuation and operating performance reveals notable weaknesses in both areas. According to experts, the company’s performance across key measures—growth, profitability, financial stability, and downturn resilience—indicates potential risks for investors.

“Going by what you pay per dollar of sales or profit, GM stock looks very cheap compared to the broader market,” one analyst noted. General Motors boasts a price-to-sales (P/S) ratio of 0.3 compared to 3.2 for the S&P 500, a price-to-operating income (P/EBIT) ratio of 4.0 versus 24.3 for the S&P 500, and a price-to-earnings (P/E) ratio of 2.6 against 24.3 for the benchmark index.

On the growth front, GM has achieved an average revenue growth rate of 14% over the past three years, compared to 6.3% for the S&P 500. Revenue increased from $172 billion to $187 billion in the last 12 months, outperforming the S&P’s 5.2% growth. Moreover, quarterly revenues grew 11% recently, climbing to $48 billion from $43 billion a year ago.

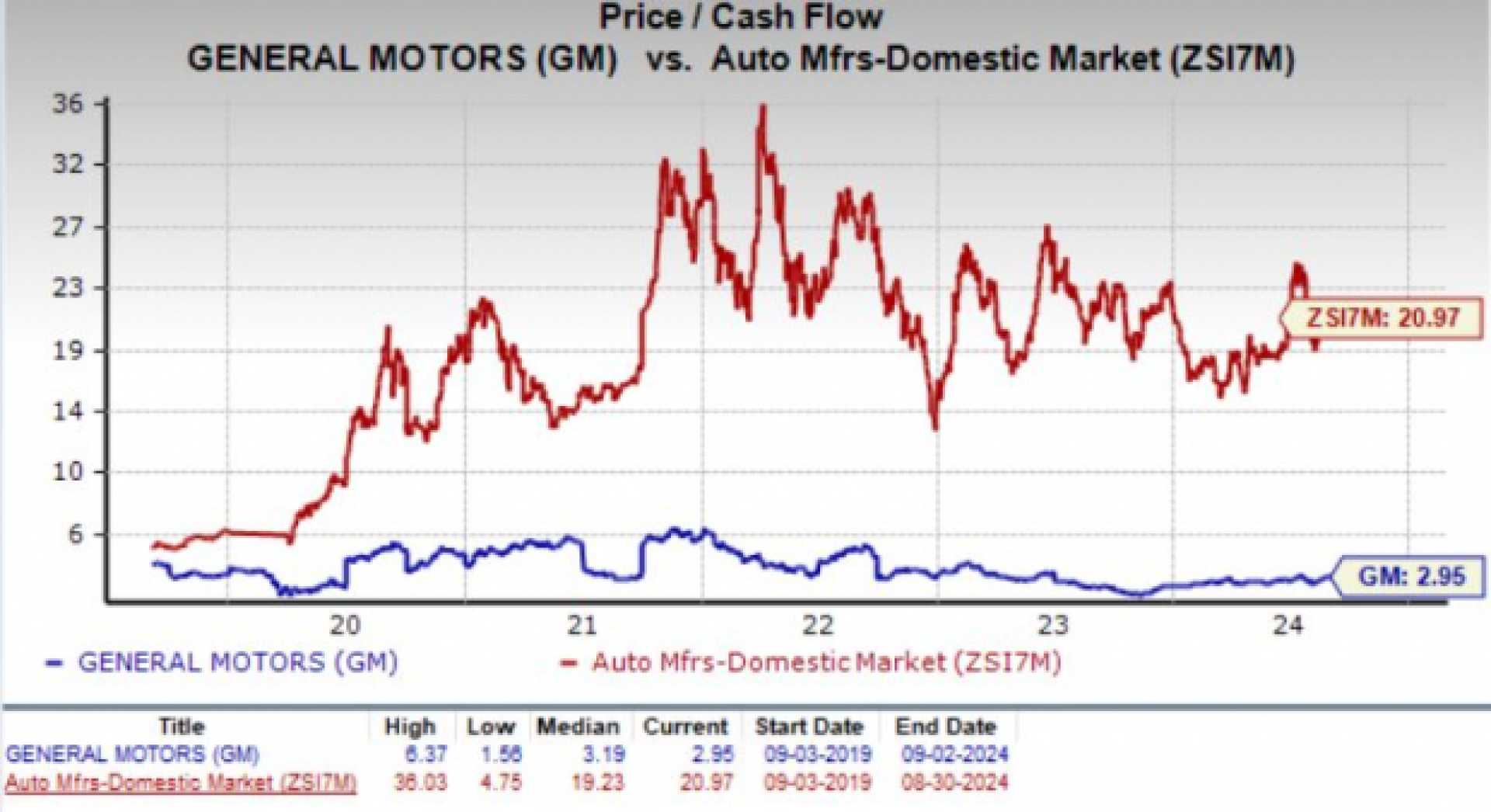

However, when it comes to profitability, GM’s margins are weaker than many competitors. The company’s operating margin over the last four quarters was just 6.8%, significantly lower than the S&P 500’s average of 13%. Despite generating $20 billion in operating cash flow, the firm’s cash flow-to-sales ratio stood at only 10.7%, compared to the industry’s 15.7%.

Financial stability remains a critical concern for GM, with a staggering $131 billion in debt compared to a market capitalization of just $52 billion as of March 21, 2025. This results in a risk-laden debt-to-equity ratio of 252.9%, far above the desirable ratio of 19% for the S&P 500. The company holds $27 billion in cash, contributing to a cash-to-assets ratio of 9.7%, which again lags behind the industry average.

Examining GM’s performance during economic downturns reveals further vulnerability. The stock plummeted 53% from a high of $65.74 in January 2022 to $30.87 by July of the same year, the worst decline among key competitors. Similarly, it fell 52.4% from $35.29 in February 2020 to $16.80 in March 2020.

Despite these challenges, GM’s electric vehicle (EV) strategy is gaining momentum, positioning the company as the second-largest player in the U.S. EV market with a 12% market share. While GM’s EV sales surged by 50% last year, they still comprise only 8% of the company’s total U.S. sales volume.

In conclusion, while GM stock is arguably undervalued, potential investors should carefully consider the company’s financial limitations and market volatility. For those seeking lower-risk options, alternatives like Trefis, which has consistently outperformed the S&P 500, might be a safer investment.