Business

Global Markets Plunge Amid Intensifying U.S.-China Trade War

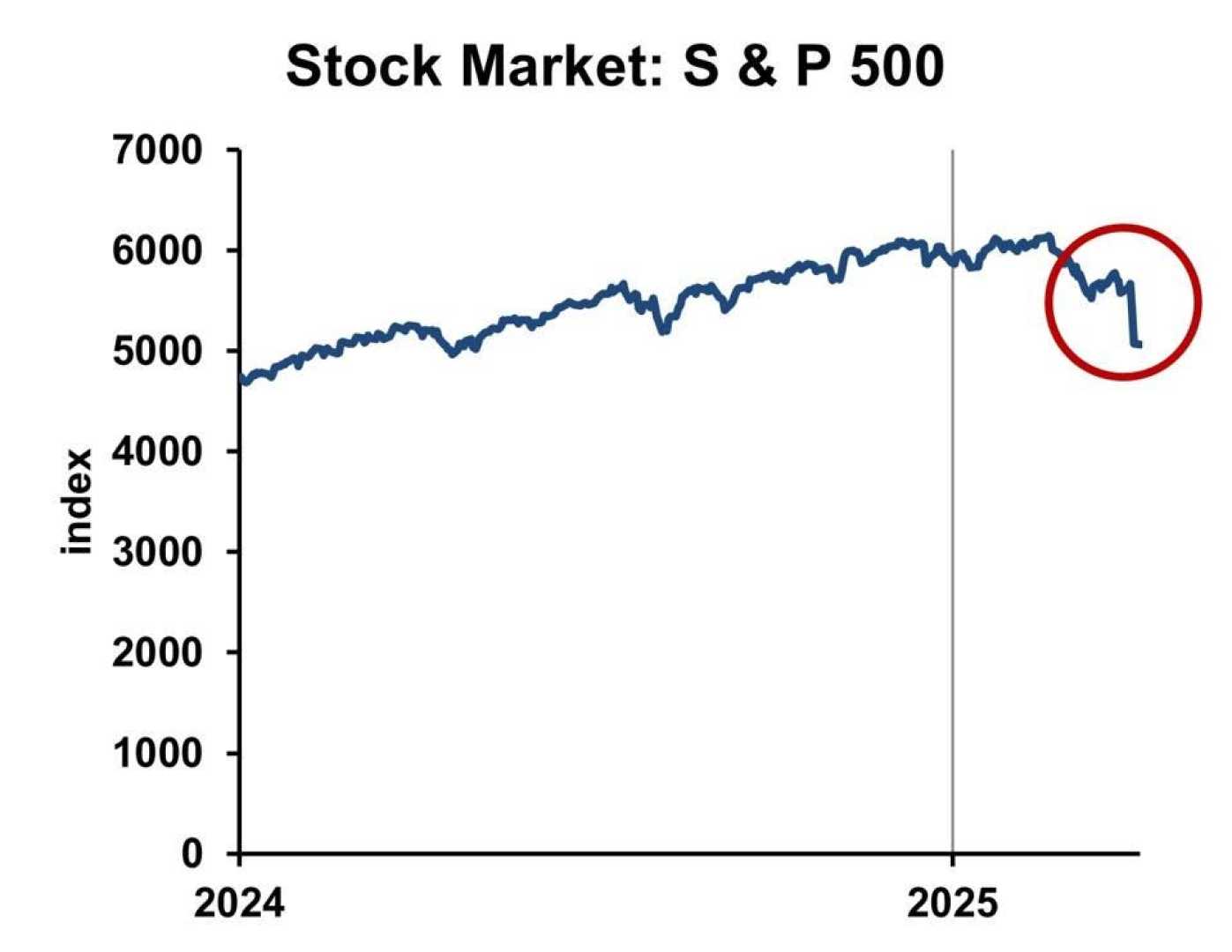

NEW YORK, USA — The global financial markets are experiencing their worst crisis since the onset of the COVID-19 pandemic, with steep declines following China’s announcement of retaliatory tariffs in an escalating trade conflict with the United States. The S&P 500 index plummeted 6% on Friday, April 7, while the Dow Jones Industrial Average fell by 2,100 points, marking one of the largest daily declines in recent history.

Traders reacted sharply to news that China would impose a 34% tariff on U.S. products starting April 10, mirroring President Donald Trump’s recent tariff increases. This escalation is compounding existing market anxieties, significantly affecting investor sentiment globally.

“This is an unprecedented sell-off triggered by the trade confrontation, and investors are fearful of the economic implications,” said Julia Spies, chief of trade and market intelligence at the International Trade Center. The sharp losses in the market came despite a positive employment report that typically boosts market confidence.

Markets had initially opened lower, with futures for the S&P 500 down 3.6%. The declines continued throughout the day, as investors weighed the repercussions of the trade war. Stocks in Europe witnessed even steeper declines, with Germany’s DAX dropping 5% and France’s CAC 40 slipping 4.2%.

Experts have warned that the tariffs could lead to significantly increased costs for American consumers and businesses, with predictions that inflation will rise as a result. “These tariffs disrupt not only U.S.-China trade but can also have a ripple effect on global supply chains,” Spies explained further.

President Trump dismissed concerns from investors, insisting that the situation would ultimately favor American businesses, stating, “We are going to come out stronger and investors will benefit.” He communicated his intent to remain firm on trade negotiations and tariffs, highlighting his belief in the long-term value of his economic policies.

Trade analysts, however, cautioned that Trump’s approach lacks standard economic reasoning. “The tariffs are higher than reciprocal rates and create unnecessary tensions in international trade relations,” noted Maros Sefcovic, a senior EU trade official. Sefcovic emphasized the need for negotiation rather than escalation.

The dramatic shifts in the stock market signal growing unrest among investors, with many now predicting a prolonged period of volatility as the trade conflict evolves. Following the announcement of the tariffs, oil prices dropped to their lowest levels since 2001, further indicating the possible economic downturn.

As this trade war continues to unfold, analysts will closely monitor both U.S. and international responses to determine the overall impact on global markets and economic stability.