Business

Gold Prices Surge Amid U.S. Economic Tensions and Tariff Threats

WASHINGTON, D.C. — Gold prices have surged to record highs as U.S. President Donald Trump called for interest rate cuts amidst rising inflation concerns, igniting fears of a potential trade war.

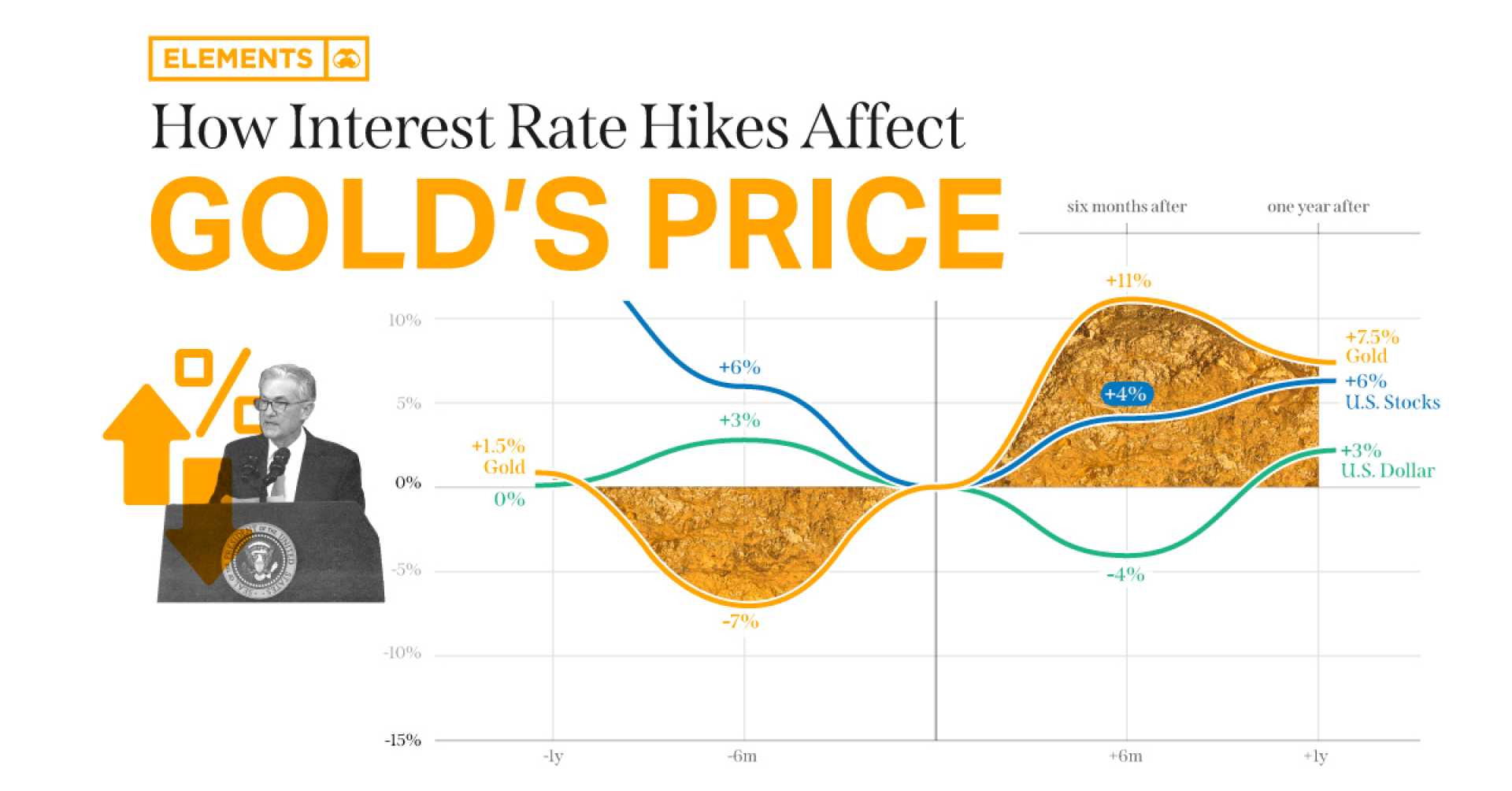

During his semi-annual testimony before Congress, Federal Reserve Chairman Jerome Powell indicated that there is no immediate need to cut interest rates, asserting that inflation is under control. However, critics argue that the Fed’s policies may inadvertently be stoking inflation. Commodity prices have risen over 20%, with gold nearing $3,000 an ounce, signaling a weakening dollar.

Powell has emphasized the importance of focusing on economic indicators, yet market signals suggest otherwise. “The dollar appears strong, but that’s a deceptive indicator,” one economic analyst remarked, referencing the current state of global currencies. “Gold prices reflect a much different narrative.”

The conversation about inflation is becoming increasingly urgent; January’s Consumer Price Index (CPI) rose to 3.0% annually, with core inflation at 3.3%, significantly exceeding the Fed’s target. “This rise puts pressure on the Fed to act,” said financial strategist Adrian Ash.

Trump’s recent tweets advocating for a reduction in borrowing costs may complicate Fed policy. He stated, “Interest Rates should be lowered, something which would go hand in hand with upcoming Tariffs!” These comments contradict Powell’s testimony and underscore the tension between the executive branch and the central bank.

The implications of these events are significant. During Powell’s address, he cited the Phillips Curve, a theory suggesting a trade-off between inflation and unemployment, as a guiding principle. However, periods of both low unemployment and high inflation have called this theory into question.

Historically, the Fed has yielded to pressures from the White House in economic matters, as seen during the Treasury-Fed Accord of 1951. “Investors need to prepare for potential turbulence ahead as inflation remains a pressing issue,” noted economist Shane Oliver.

As fiscal policies evolve, the central bank may need to shift its focus. “Instead of attempting to micromanage the economy through interest rates, the Fed should prioritize maintaining the dollar’s value,” stated a financial analyst.

The stakes of this ongoing battle between the Fed and the White House could affect economic stability for years to come. As gold continues to hover around record prices, industry experts are closely monitoring the situation. “The current approach is flawed,” Ash added. “If inflation isn’t effectively addressed, we’ll likely see continuing cycles of economic instability.”

With gold standing at approximately $2,942.70 per ounce, many see it as a barometer for financial health in the current climate. “Gold has always served as a hedge against inflation, and amidst uncertainty, its appeal rises significantly,” concluded Otunuga.