Business

Gold Prices Surge Near Record High Amid Market Uncertainty

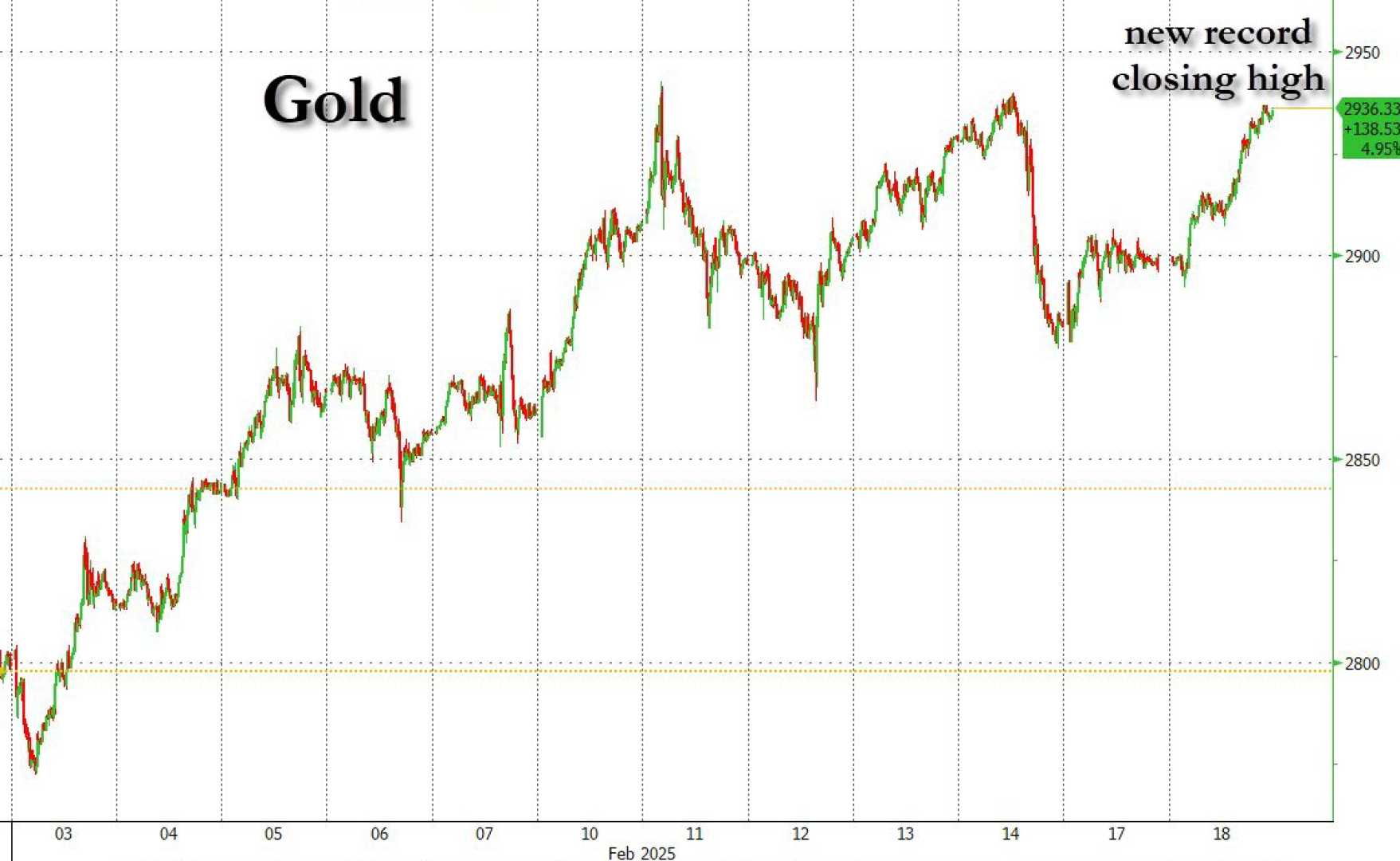

BENGALURU, India — Gold prices increased on February 24, 2025, moving closer to their record peak, as a weakening U.S. dollar bolstered the metal’s appeal. Spot gold rose 0.3% to $2,943.50 an ounce by 0957 GMT, following a previous high of $2,954.69 reached last week.

U.S. gold futures also saw gains, adding 0.2% to $2,958.20 as traders monitor the upcoming inflation report, which could influence the Federal Reserve’s interest rate decisions. Han Tan, chief market analyst at Exinity Group, noted, “The dollar’s decline this month has allowed spot gold to hover around its record highs, buoyed by strong inflows into bullion-backed exchange traded funds.”

The U.S. dollar index’s weakness makes gold less expensive for those using other currencies, thus attracting more buyers. Last week, geopolitical tensions surrounding U.S. President Donald Trump’s trade policy further fueled interest in gold, pushing it above the critical $2,950 mark.

Trump’s recent threats to impose tariffs on various imports, including lumber, semiconductors, and pharmaceuticals, have raised concerns about a potential trade war, thereby increasing the safe-haven status of gold. Tan emphasized that “bullion bulls appear to be biding their time” as traders anticipate the Fed’s next move on interest rates, with the first rate cut of the year projected for September.

Market participants are particularly focused on the Personal Consumption Expenditures (PCE) print, which is the Fed’s preferred measure of inflation, due on Friday. Given the uncertainties surrounding economic growth and consumer health in the U.S., any signs of stickiness in inflation could deter the Fed from cutting rates significantly, which would negatively impact gold’s attractiveness.

Support for gold prices is also drawn from the ongoing global economic uncertainties and the perceived value of gold as a hedge against inflation. Spot silver edged down 0.1% to $32.50 an ounce, while platinum lost 0.4%, trading at $966.13. Palladium, too, experienced a decline, shedding 1.2% to $957.32.

Traders remain cautious as the market awaits further data that could influence gold’s trajectory, including how tariffs might shape the economic landscape in the weeks to come. The potential for new highs remains as investors navigate the complexities of the current economic climate.