Business

Gold Prices Surge Past $4,000 Following Fed Rate Cuts

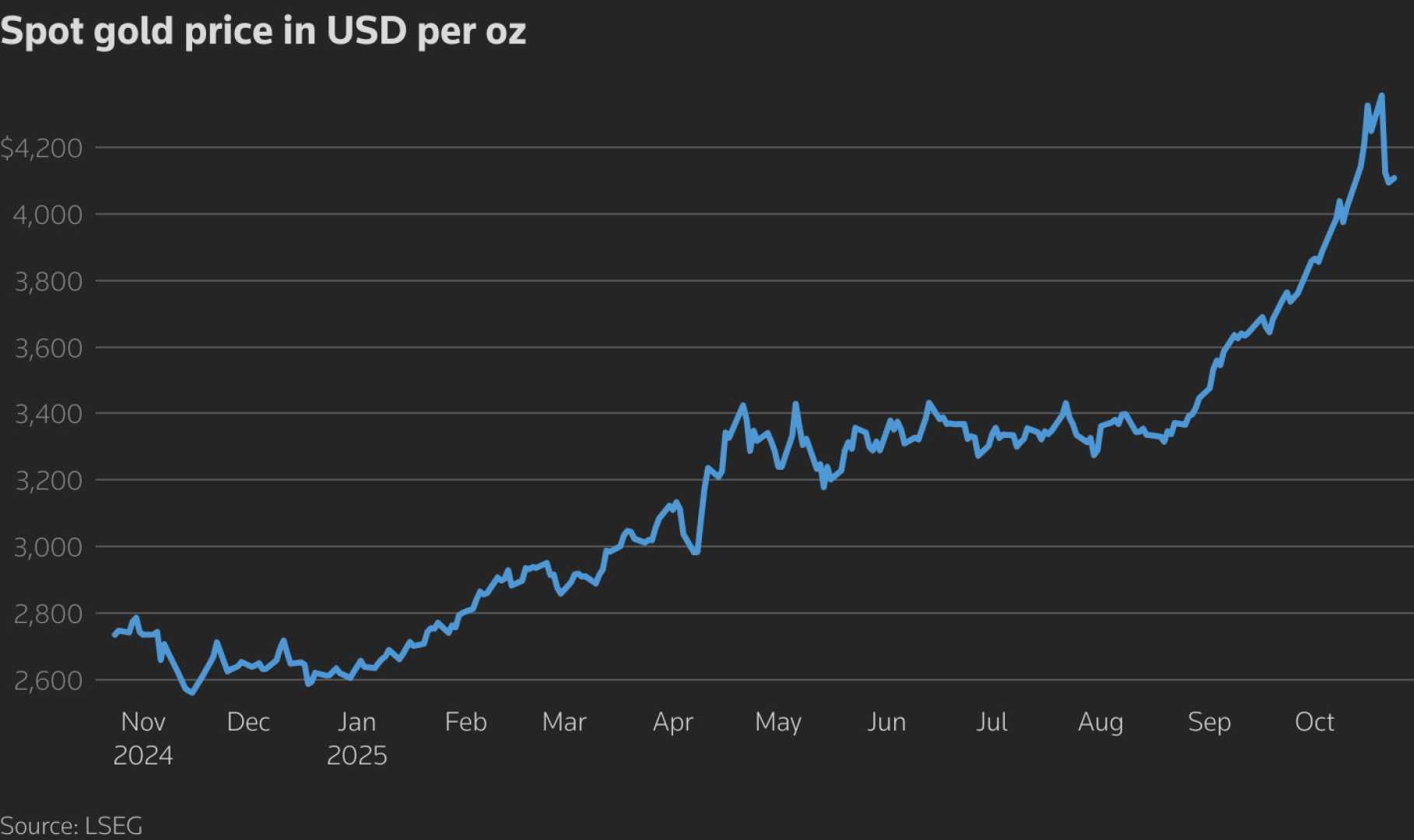

HANOI, Vietnam — On Friday, October 31, 2025, global gold prices surged more than $100, reaching $4,030 per ounce. The increase followed a significant rise of $94 from the previous day, closing October 30 at $4,023 per ounce. The market gained momentum after the U.S. Federal Reserve (Fed) announced a rate cut, prompting cautious optimism among investors amidst geopolitical uncertainties following discussions between Chinese President Xi Jinping and U.S. President Donald Trump.

Trump announced a 10% import increase on fentanyl from China, prompting Beijing to restore soybean purchases from the U.S. and regulate fentanyl exports. Jeffrey Christian, an analyst at CPM Group, commented, “Earlier, gold prices dipped slightly, but once the details of the U.S.-China agreement were revealed, it became clear that the deal was not substantial. The market is not optimistic that trade tensions have eased.”

Despite the Fed’s predictions being accurate, the agency hinted that this might be the last rate cut for the year. The ongoing government shutdown also affected the information at their disposal for making decisions. Since the beginning of the year, gold prices have risen by over 50%, making it a favored asset during periods of low interest rates and economic-political instability.

Wells Fargo Investment Institute has revised its gold price forecast for the end of 2026 to $4,500 – $4,700 per ounce, an increase of $600 from previous predictions, citing instability in trade policy and geopolitics as main drivers. “We believe these factors will continue to support demand for gold in both the private and public sectors, pushing prices higher,” the report stated.

In addition to gold, other precious metals also saw price increases on October 30. Silver rose 2.7% to $48.8 per ounce, platinum increased by 1.2% to $1,604, and palladium climbed 3.4%, closing at $1,447.