Business

Goldman Sachs Stock Soars to All-Time High Following Trump’s Presidential Win

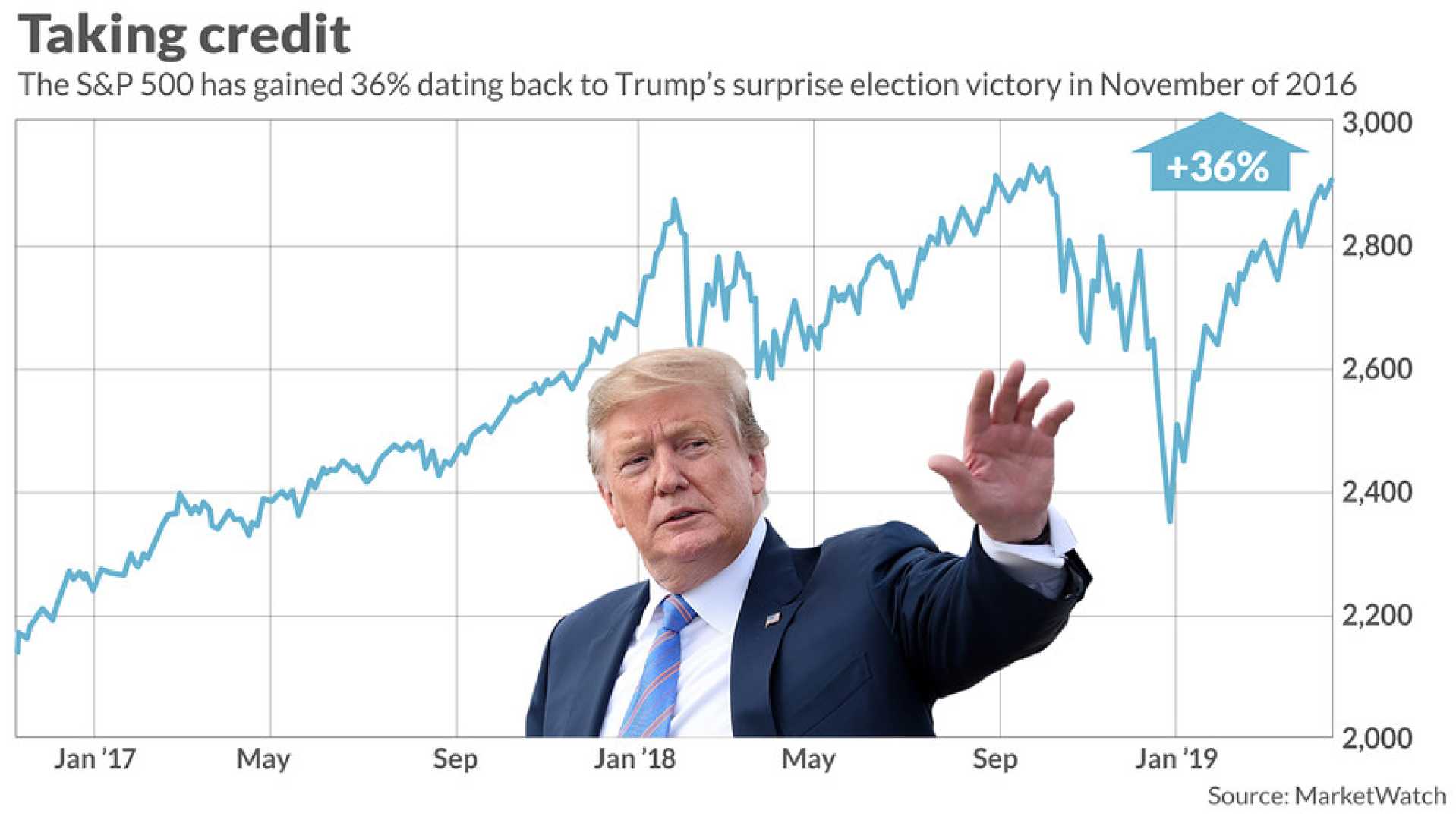

Goldman Sachs Group Inc. (GS) has seen a significant surge in its stock price following the victory of Donald Trump in the U.S. presidential election. On Wednesday, November 6, 2024, Goldman Sachs shares reached an all-time high of $568.05, reflecting a marked increase in investor confidence and market optimism.

The stock’s performance is closely tied to the expectations of financial deregulation and higher interest rates under a Trump administration. Analysts from UBS and Barclays anticipate that Trump’s policies, including higher deficits and tariffs, will lead to increased interest rates, which would be beneficial for banks like Goldman Sachs and JPMorgan. Both banks saw their stocks rise by as much as 7.5% in Wednesday’s premarket trading.

This surge is part of a broader trend for Goldman Sachs, which has seen its stock value increase by an impressive 80.28% over the past year. The company’s strong financial performance and strategic initiatives have resonated well with investors, contributing to its robust market position.

In addition to the stock price increase, Goldman Sachs has also been active in other financial activities. The company recently issued $5.5 billion in new debt securities and made amendments to its articles of incorporation, including changes to its preferred stock series. These moves are part of its ongoing capital management strategy.

The market’s reaction to Trump’s victory has also impacted other financial indicators. The US Dollar has rallied, affecting currency pairs such as EUR/USD and GBP/USD, while gold prices have dropped below $2,700 due to the surge in US Treasury bond yields.