Business

Is Google Stock Undervalued Amid Economic Headwinds?

NEW YORK, NY — Analysts are divided on whether Google’s stock, currently priced at approximately $156, represents a buying opportunity during a challenging economic climate. As of March 28, 2025, Google’s stock has fallen 18% this year, a decline attributed to investor concerns regarding the potential impact of trade tensions and proposed auto tariffs under the current U.S. administration.

Despite these short-term setbacks, many experts maintain that Google, owned by Alphabet Inc., possesses strong fundamentals that could make it an attractive investment at its current valuation. The company has shown greater resilience compared to the broader market, especially during previous economic downturns.

“While the market is jittery, particularly in the tech sector, Google’s performance metrics indicate substantial long-term value,” stated a market analyst who requested anonymity. “Their robust growth, profitability, and financial stability speak to the health of the company despite current market fluctuations.”

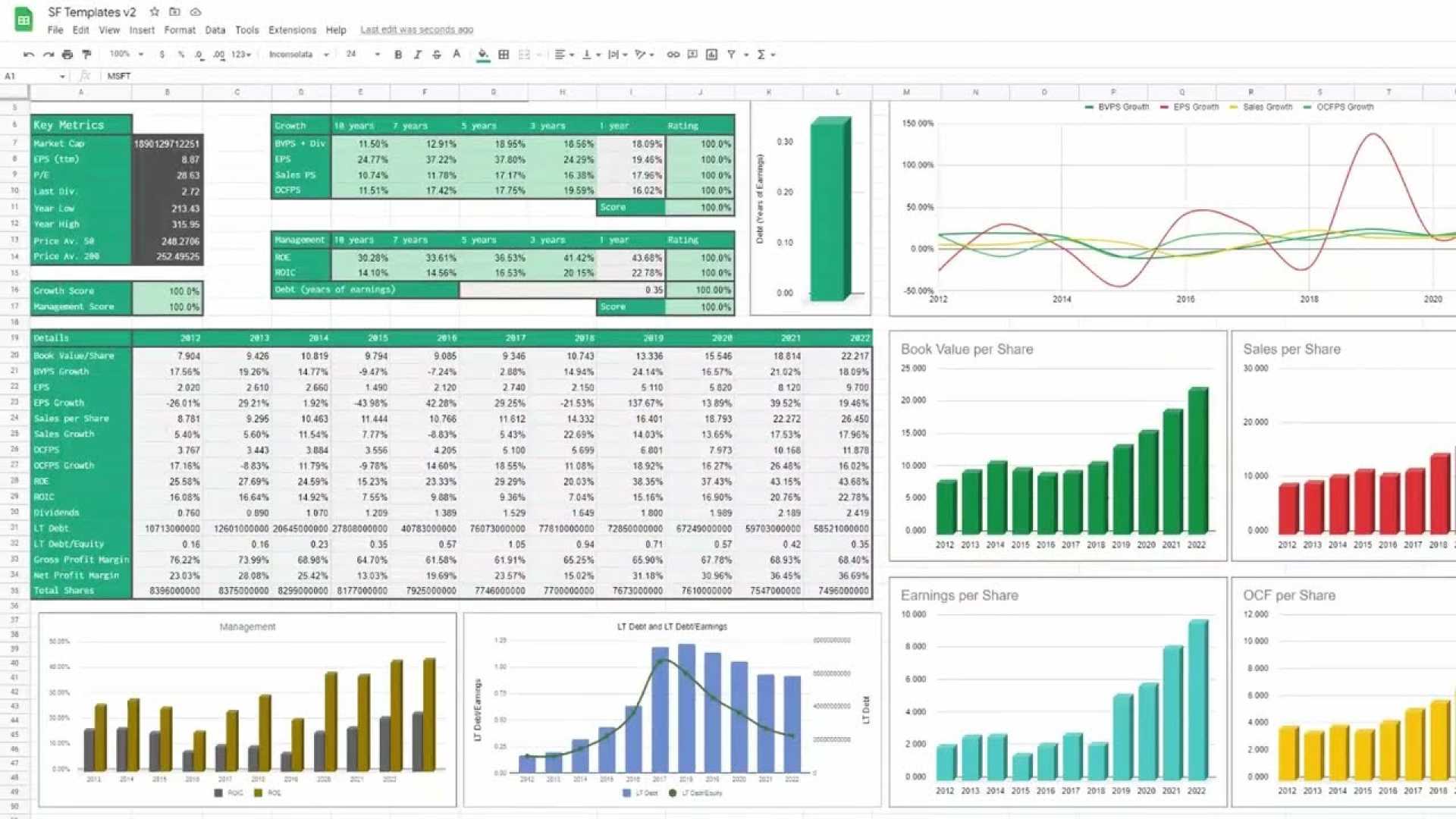

Key performance indicators reveal that Alphabet has exhibited a very stable growth trajectory. Its profit margins significantly outperform those of most companies within the Trefis analytics unit. Although Google’s current valuation stands at approximately six times trailing revenues, this figure is slightly above the S&P 500 average and below its five-year price-to-sales (P/S) ratio of 6.2.

A report summarizing Alphabet’s financial standing highlights strong growth potential driven by ongoing initiatives in artificial intelligence (AI) and cloud services. “The market is underestimating the impact that advancements in AI and cloud infrastructures will have on Google’s valuation,” noted the finance expert. “These sectors not only promise revenue growth but also play into longer-term consumer technology trends.”

Moreover, analysts have pointed to Alphabet’s sound balance sheet and cash reserves as indicators of financial strength. “Even amid economic turbulence, Alphabet has maintained its financial stability and resilience,” the expert added. “For those looking for growth with less volatility, Google could present an appealing opportunity.”

Despite ongoing uncertainties, including inflation fears and potential recessions, the strength of Alphabet’s performance suggests that investors should look beyond short-term fluctuations. “If one is seeking a long-term investment, Google’s expansion in AI and cloud technology positions it for potential gains that may exceed historical valuations,” explained another financial analyst.

In conclusion, while the current stock price of $156 may appear daunting against recent declines, the underlying operational strengths and strategic positioning of Alphabet indicate that this is a favorable moment for potential investors. Market conditions are fluid, but Google’s strong fundamentals provide confidence that it remains a valuable asset in a diversified investment portfolio.