Business

GSK Stock Forecast and Financial Performance: Analysts’ Insights and Market Outlook

As of November 2024, GlaxoSmithKline (GSK) is under the microscope with analysts and investors closely watching its stock performance and future outlook. The company, which engages in the research, development, and manufacture of vaccines, specialty, and general medicines, has a current market capitalization of approximately $75.24 billion USD, ranking it as the 250th most valuable company globally.

Analysts have set a consensus twelve-month price target for GSK at GBX 1,842.50, with a predicted upside of 31.33% from the current price of GBX 1,403. This forecast is based on ratings from seven Wall Street analysts, with five recommending a “buy,” one a “hold,” and one a “sell”.

GSK’s financial health is characterized by a stable debt-to-equity ratio, although the company operates in a highly competitive pharmaceutical industry. The company has maintained a reasonable financial position despite market fluctuations and potential regulatory hurdles. GSK recently announced a dividend, providing investors with a return on their investment.

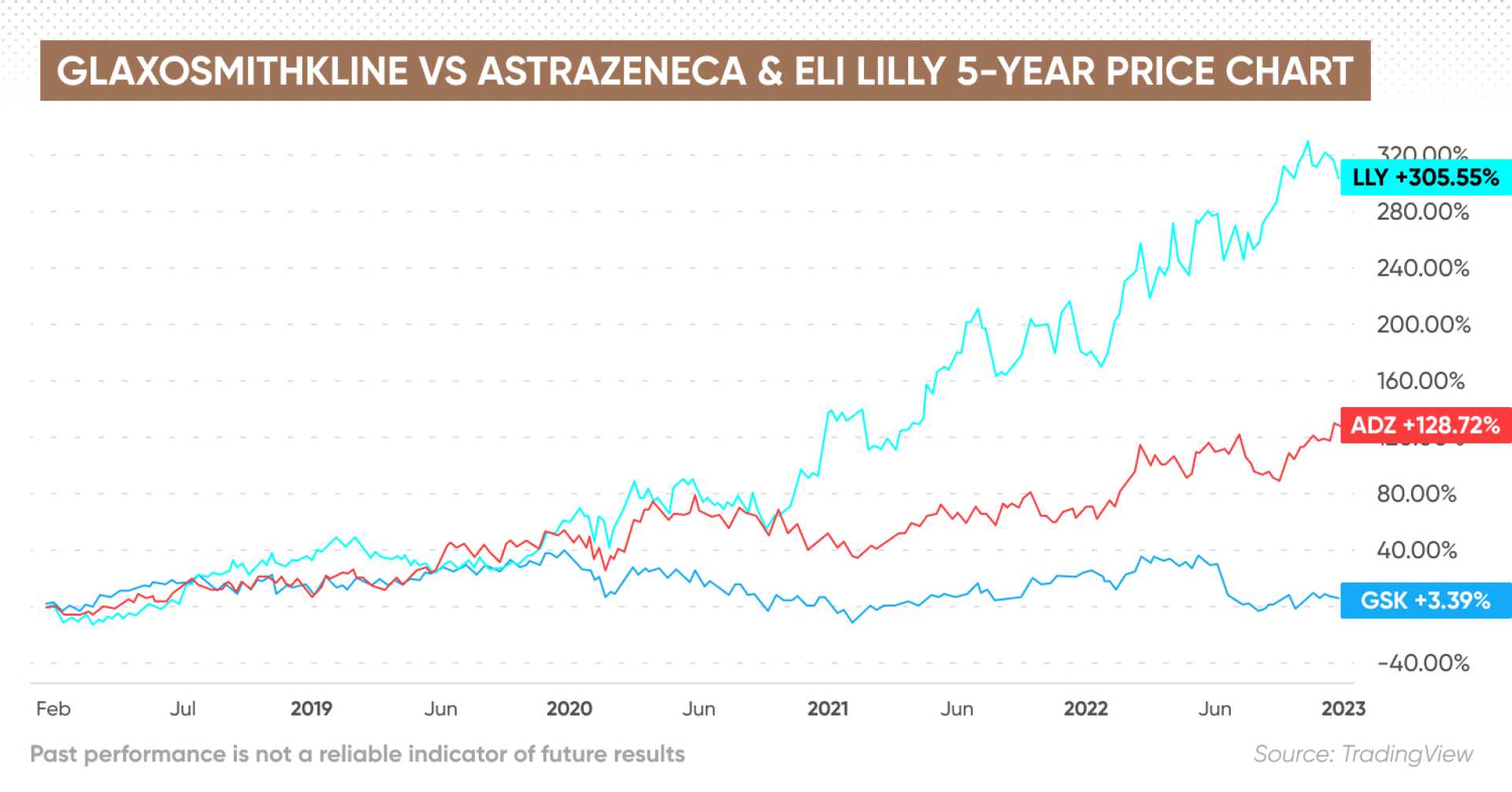

In terms of performance, GSK has shown stable share price volatility over the past three months compared to the UK market. The company’s weekly volatility has been around 3%, which is relatively stable. However, GSK underperformed the UK market over the past year, with a return of -2.5% compared to the market’s 8.7% return.

GSK continues to invest in innovative specialty medicines and vaccines, which are expected to drive future growth. The company operates through two segments: Commercial Operations and Total R&D, and it offers a range of vaccines including those for shingles, meningitis, and influenza.