Business

Hims & Hers Stock Surges: Is It a Millionaire-Maker?

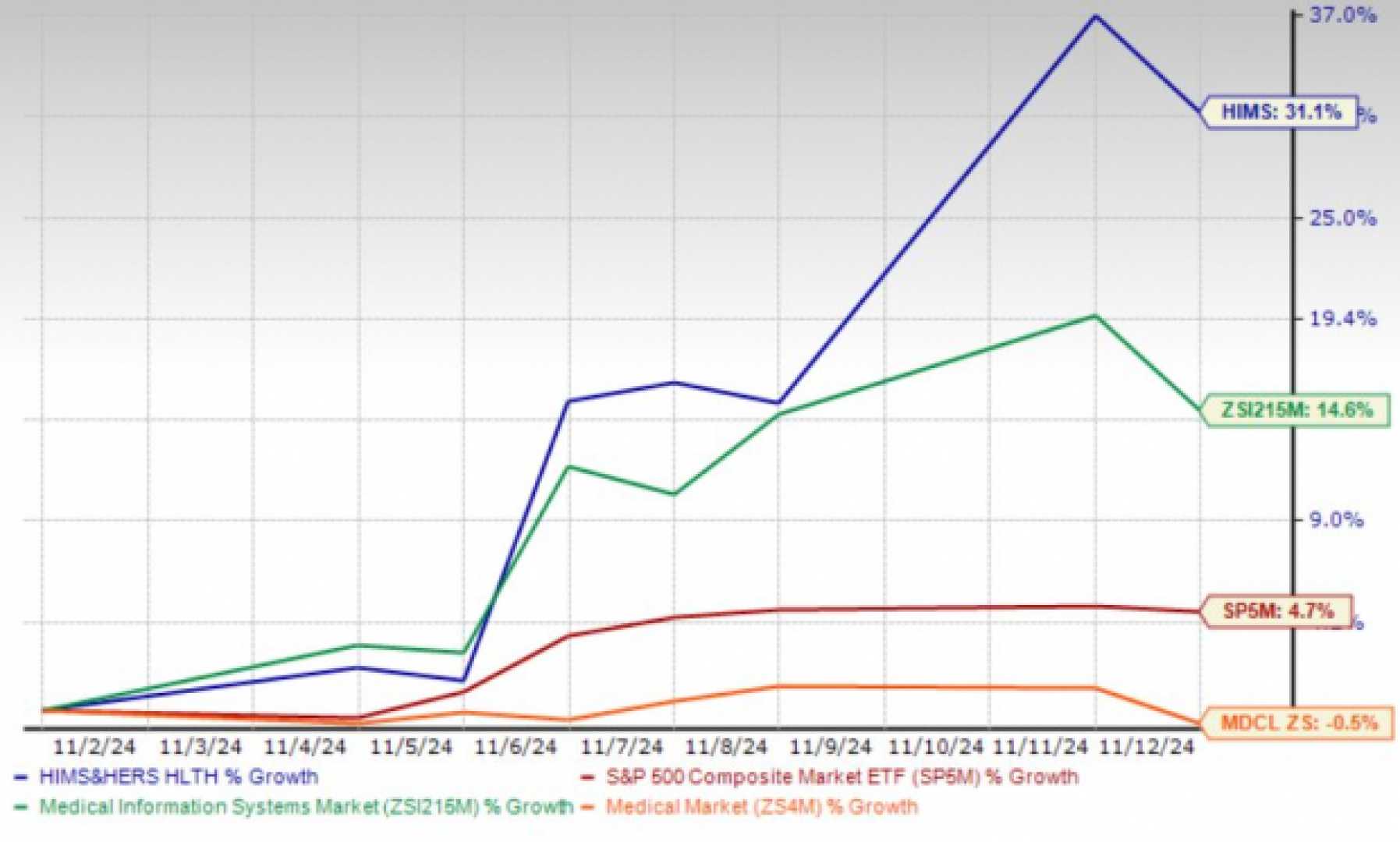

SAN FRANCISCO, Feb. 19, 2025 – Shares of Hims & Hers Health have skyrocketed over the past year, creating a buzz in the investment community. The direct-to-consumer telehealth platform has seen its stock value increase nearly 490% since this time last year, raising questions about the sustainability of its rapid growth.

The company’s market capitalization currently stands at approximately $13 billion, with the stock priced at $66.50 as of 9:44 a.m. ET on February 19, reflecting a further increase of 13.68% recently. This rise in value marks an incredible rebound from a low of just $3 per share nearly two years ago.

Hims & Hers’s growth has been attributed to its expanding subscriber base, which reached 2 million in the third quarter of 2024. The company provides various health services via a smartphone app, focusing on skin care, mental health, and sexual health treatments. Notably, Hims & Hers has gained significant attention for its compounded GLP-1 agonist drugs for weight loss, a sales category that has been bolstered by shortages in brand-name medications like Novo Nordisk‘s Ozempic and Wegovy due to overwhelming demand.

Despite the spotlight on its weight-loss drugs, it is important to note that the sales of these agonists represent only a minor segment of Hims & Hers’ overall revenue. Excluding these, the company still reported a robust 40% year-over-year revenue growth in the latest quarter. Furthermore, the company has plans to diversify its offerings, having introduced new nutrition products in November and hinting at upcoming hormone treatments.

While the growth trajectory for Hims & Hers leads many to speculate about its long-term potential, experts warn against overextending projections. Market analysts suggest that the company’s rapid ascent could attract competition, as major players like Amazon venture into the consumer healthcare space. Though Amazon has yet to significantly impact Hims & Hers, analysts agree that the potential for disruption would be unwise to disregard.

According to market insights, while Hims & Hers is currently performing impressively—meriting a price-to-earnings ratio slightly above five times next year’s revenue estimates—investors should remain cautious. With the possibility that regulatory changes could cease the sale of compounded GLP-1 agonists once shortages resolve, the company needs to sustain its growth and innovate beyond those high-demand products.

Management at Hims & Hers has effectively built its brand through strategic marketing, aiming for a competitive edge without proprietary products. By utilizing proprietary data to personalize customer experiences, the company seeks to enhance customer loyalty and retention.

In conclusion, while Hims & Hers holds significant promise as a potential healthcare giant, it is not without its risks. If it continues to capture market share and profitably expand its services, investors could see life-changing returns. As the market evolves, prudent strategy and diversification remain vital to navigating investments in rapidly rising stocks like Hims & Hers.