Business

Hologic Turns Down $16 Billion Take-Private Offer from TPG, Blackstone

CAMBRIDGE, Mass. — Hologic, Inc., a leader in women’s health products, has rejected a take-private offer exceeding $16 billion from TPG and Blackstone, according to a report from the Financial Times. The company, known for its diagnostic and medical imaging systems, informed the investment firms of its decision recently.

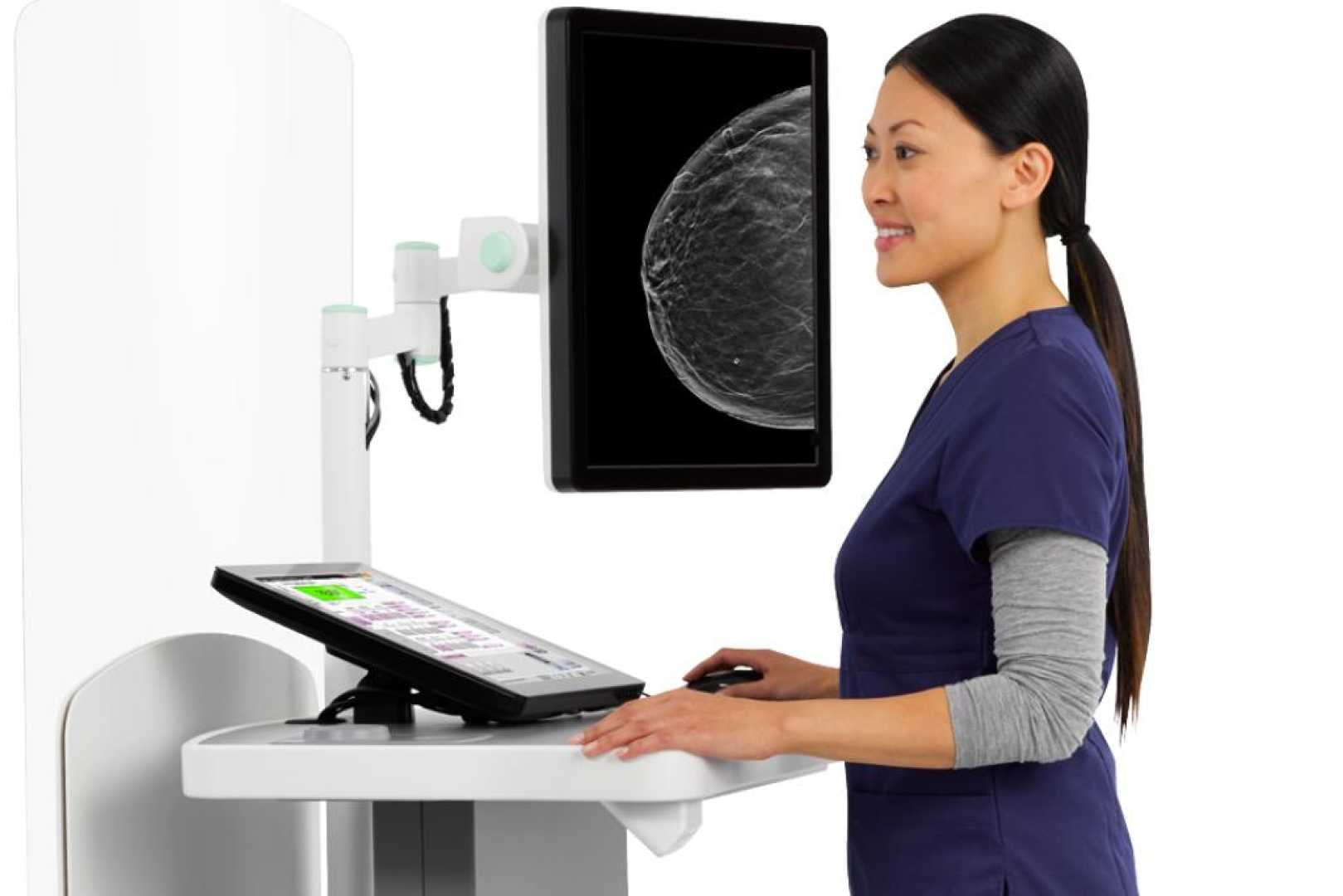

The proposed buyout bid was viewed as undervaluing Hologic, which has a strong market presence and consistently high sales. The firm reported a net revenue breakdown where 44.2% comes from molecular diagnostics, 37.8% from breast health, and 15.9% from gynecological surgery products.

“While we appreciate the interest from TPG and Blackstone, we believe that our future growth potential is not reflected in this offer,” said a spokesperson for Hologic. The company, which employs over 7,000 people, has been at the forefront of innovations in health technology, focusing on addressing a wide range of diseases affecting women.

Hologic’s net sales are predominantly generated from the United States, comprising 75% of total revenues. The company engages in diverse applications, including rapid diagnostic tests for various diseases and digital mammography systems. The rejection of the bid indicates the company’s confidence in its organic growth strategy and future market prospects.

With an average target price of $67.14 per share, which implies a potential upside of 23.69% from its last close at $54.28, analysts remain optimistic about Hologic’s stock performance despite the recent corporate maneuvering.