Business

India VIX Hits Two-Month High Amid Investor Uncertainty

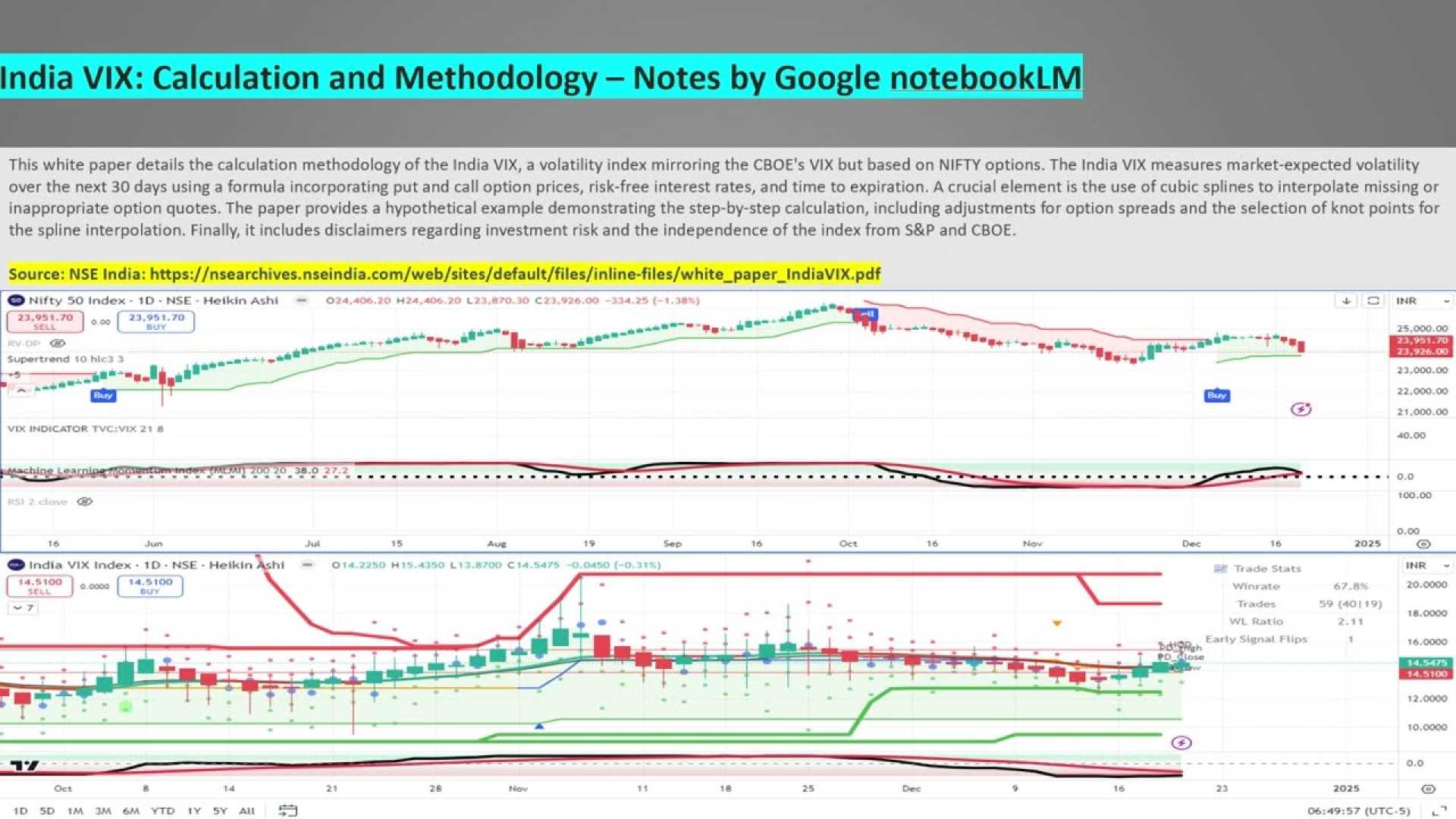

MUMBAI, India — The India VIX index, a key measure of market volatility, surged to a two-month high on Tuesday, reaching 17.45, its highest level since November 2024. The index, often referred to as the ‘fear index,’ has risen nearly 15% over the past 30 days, reflecting growing investor unease about the near-term outlook for the Nifty.

The India VIX, which measures anticipated market volatility over the next 30 days, has been oscillating between 12 and 17 since August. A higher VIX typically signals investor apprehension about large, unpredictable market moves, particularly on the downside. The index is calculated based on the price of options contracts, which track how much investors expect an asset to fluctuate.

Analysts attribute the recent spike in volatility to both domestic and global factors. Domestically, the upcoming Union Budget and uncertainty around potential policy changes and economic forecasts are contributing to the nervousness. Globally, the uncertainty surrounding the U.S. market following the Trump administration’s return to power is adding to the volatility.

“The elevated VIX underscores investor concerns about the direction of the markets over the next few weeks,” said a market analyst. “Both institutional and retail investors are expected to remain cautious, with many opting for hedging strategies to navigate the turbulent times ahead.”

As the India VIX continues to climb, market participants are bracing for potential surprises in the coming weeks. The anticipation of market reactions to upcoming announcements is creating a nervous environment, with traders closely monitoring developments both at home and abroad.