Business

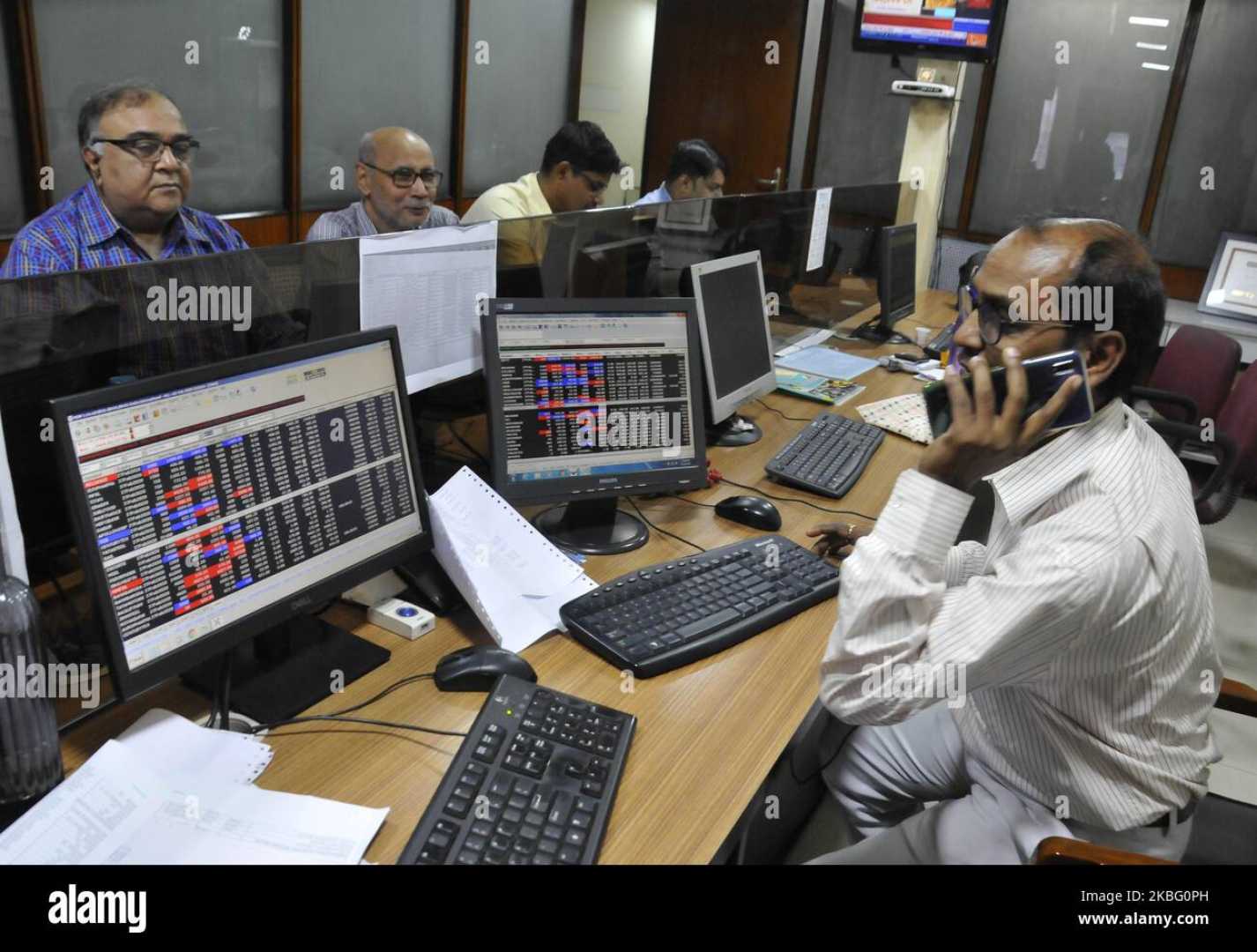

Indian Stock Market Dips Amid Earnings Concerns, IT Sector Shines

Indian bluechip indexes fell on Friday, marking weekly losses driven by concerns over corporate earnings, while IT stocks gained following optimistic comments from sector leader Tata Consultancy Services (TCS). The Nifty 50 dropped 0.4% to 23,431.5 points, and the BSE Sensex declined 0.31% to 77,378.91. Both indexes fell approximately 2.4% this week, ending a two-week winning streak.

Twelve of the 13 major sectors logged weekly losses, with small-cap and mid-cap stocks losing 7.3% and 5.8%, respectively. The IT sector, however, rose 3.4% on Friday, closing the week with a 2% gain. TCS surged 5.6% on Friday and 4% for the week, driven by its positive outlook on demand revival in North America, a key market for Indian IT firms.

G Chokkalingam, founder and head of research at Equinomics Research, noted that concerns about earnings moderation intensified after recent data signaled a potential economic slowdown. Foreign portfolio investors added to the market turmoil, with net outflows of $2.2 billion in six of seven January sessions.

Private lender IndusInd Bank fell 4.4% after Goldman Sachs downgraded the stock to “neutral” from “buy,” citing rising defaults in its commercial retail portfolio. Fast-moving consumer goods company Adani Wilmar dropped 10% following a stake sale by the Adani group at a 15% discount to Thursday’s closing price.

Market analysts caution that the Indian equity market remains under strain, with heightened volatility expected as the earnings season progresses. Investors are advised to adopt a hedged approach and focus on robust risk management amid ongoing uncertainties.