Business

August Inflation Dips to Three-Year Low as Australian Households Experience Marginal Relief

Australia’s inflation rate fell to its lowest level in three years in August, aided by government cost-of-living measures and decreasing petrol prices. According to the Australian Bureau of Statistics (ABS), headline consumer price inflation was recorded at 2.7% for August, representing a slowest rate of increase since August 2021. This figure aligns with the predictions made by economists.

The trimmed mean, a measure excluding volatile price changes, also saw a decrease, showing a rate of 3.4% in August, down from 3.8% in July. Michelle Marquardt, head of prices statistics at the ABS, highlighted that electricity prices saw a significant reduction of 17.9% due to government rebates. Without these rebates, electricity prices would have increased slightly during the same period.

Despite these positive trends in certain areas, rental prices continued to pressure Australian households with an annual increase of 6.8%, albeit slightly improved from previous months. Food and non-alcoholic beverages experienced a price rise of 3.4% compared to August 2023, marking the lowest increase since February 2022.

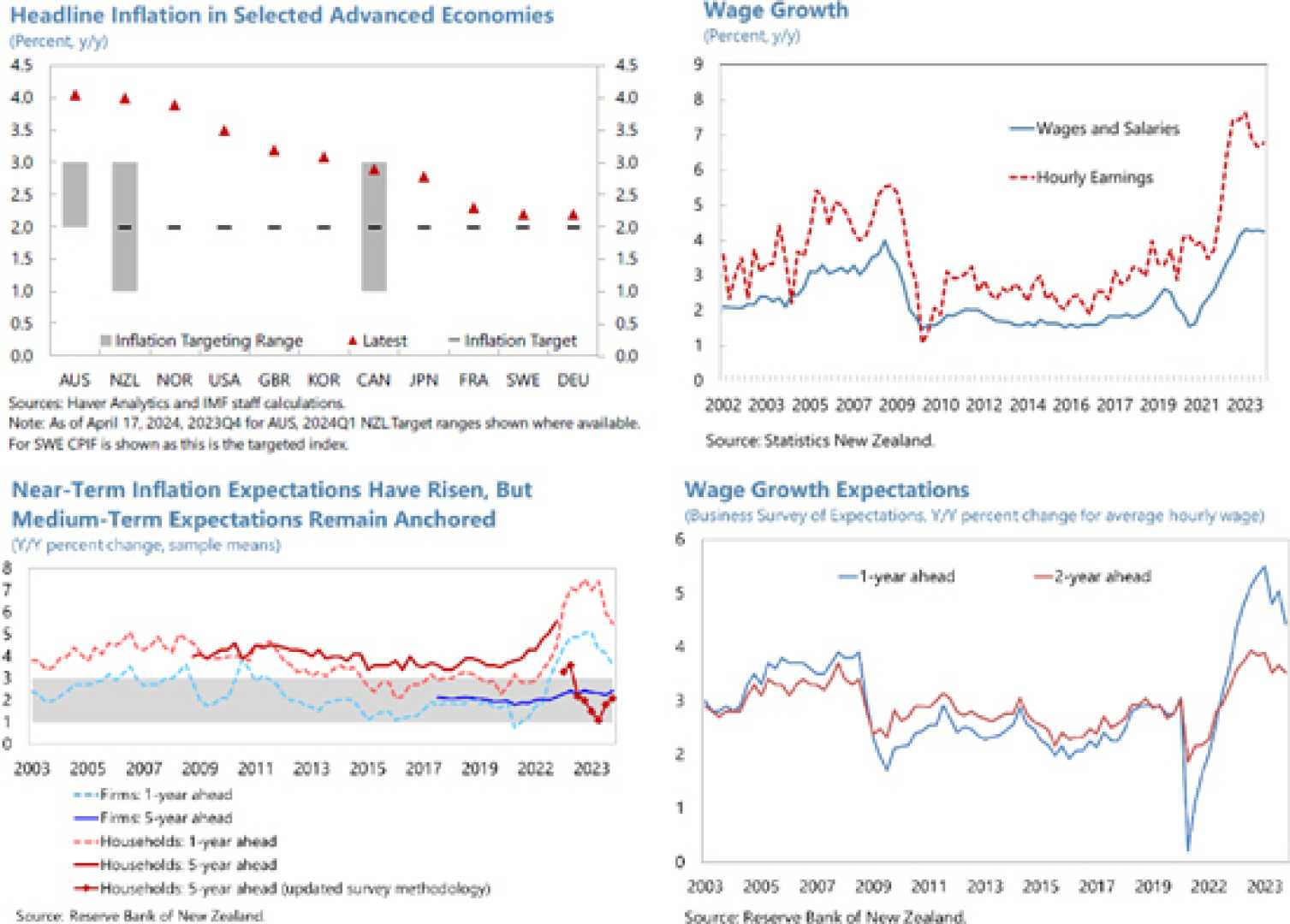

In spite of the inflation decline, the Reserve Bank of Australia (RBA), led by Governor Michele Bullock, remains cautious. Bullock noted the importance of more comprehensive figures from the September quarter, due by the end of October, before considering interest rate cuts. The current inflation target remains between 2-3%, and progress towards this target has been sluggish.

Market expectations shifted slightly as it was revealed that the RBA board had not considered increasing the cash rate in their recent meeting. Following this announcement, investors estimated a one-in-four chance of a rate cut by November, increasing to a two-in-three chance by December.

Prominent economist, David Bassanese from Betashare, indicated that should the current trajectory of underlying inflation persist, it might meet the RBA’s target by year-end, possibly prompting a rate cut before Christmas. Meanwhile, the costs of constructing new homes or major renovations have remained steady at around 5% over the past year due to higher labor and material costs.

Australian Treasurer Jim Chalmers welcomed the inflation figures, attributing improvements partially to government policies while acknowledging that it reflects a broader economic situation. However, Shadow Treasurer Angus Taylor criticized the government’s handling, noting high core inflation compared to other advanced economies.

The Australian dollar remained relatively stable, hovering just below 69 US cents, and stock markets showed little change following the release of inflation data. Tapas Strickland, a senior economist at National Australia Bank, predicts that significant underlying inflation remains too high to suggest an imminent rate cut, with the first cut likely anticipated for next year.