Business

U.S. Inflation Rate at 2.1% Amid Tariff Uncertainty

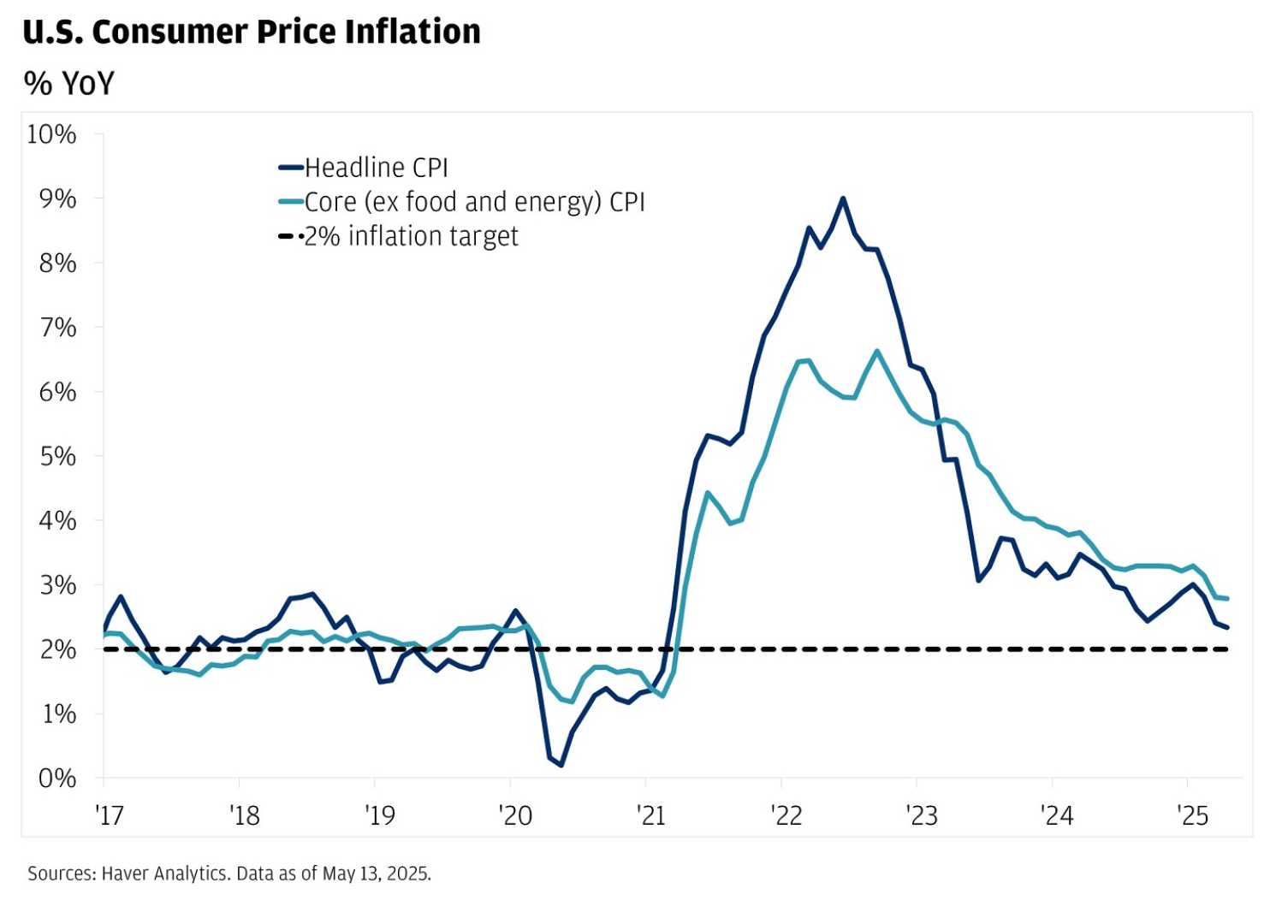

WASHINGTON, D.C. — The inflation rate in the United States slipped to 2.1% in April, as reported by the Commerce Department on Friday. This figure came in lower than expected, with the personal consumption expenditures price index, the Federal Reserve‘s preferred gauge, increasing by just 0.1% for the month.

This modest rise helped to lower the annual inflation rate by 0.1 percentage point. Excluding food and energy, the core index showed similar results, with increases of 0.1% monthly and 2.5% annually, which fell short of the forecasted 2.6%.

Despite the lower inflation numbers, consumer spending slowed significantly, rising only 0.2% in April, compared to a 0.7% growth in March. This decline reflects increasing caution among consumers, represented by a substantial jump in the personal savings rate from 0.6% to 4.9%, marking its highest level in nearly a year.

Personal income in the U.S. rose by 0.8%, exceeding the anticipated 0.3% increase, which may hint at future spending potential despite recent growth hesitancy.

Stock futures showed a continued downward trend in response to these economic updates, with mixed Treasury yields further demonstrating market uncertainty. Recent tariffs imposed by President Donald Trump in early May are believed to have not yet impacted consumer prices significantly, leading to uncertainty in future valuation.

Trump has been advocating for the Federal Reserve to cut interest rates, aiming to stimulate a stagnating economy, while central bank officials expressed caution as they observe longer-term effects of trade policies. Recently, Trump enacted new tariffs of 10% on all imports, aiming to address a significant trade deficit.

As the Federal Reserve awaits more data regarding consumer reactions and price effects, concerns remain over potential inflation from tariffs. Some economists are cautious, noting that tariffs historically yield minimal immediate inflationary impacts, yet they may disrupt economic growth.

The latest economic developments coincide with ongoing policy discussions at the Fed, where officials are weighing any adjustments to interest rates while keeping a close eye on trade negotiations and their effects on domestic economic stability.