Business

Intel Stock: Dividend Pause and Reduced Capital Spending Spark Investor Concerns

Intel Corporation (NASDAQ: INTC) has announced significant financial adjustments that are causing ripples in the investment community. As of recent reports, Intel is pausing its dividend payments and reducing its capital spending to manage cash outflows. This move is part of the company’s broader strategy to control expenses amid a massive expansion push.

The decision to pause dividend payments and slow down capital spending is a strategic move aimed at conserving cash. This comes at a time when Intel is heavily investing in its expansion and technological advancements. The company’s efforts to manage its financial resources are critical as it navigates a competitive and rapidly evolving tech landscape.

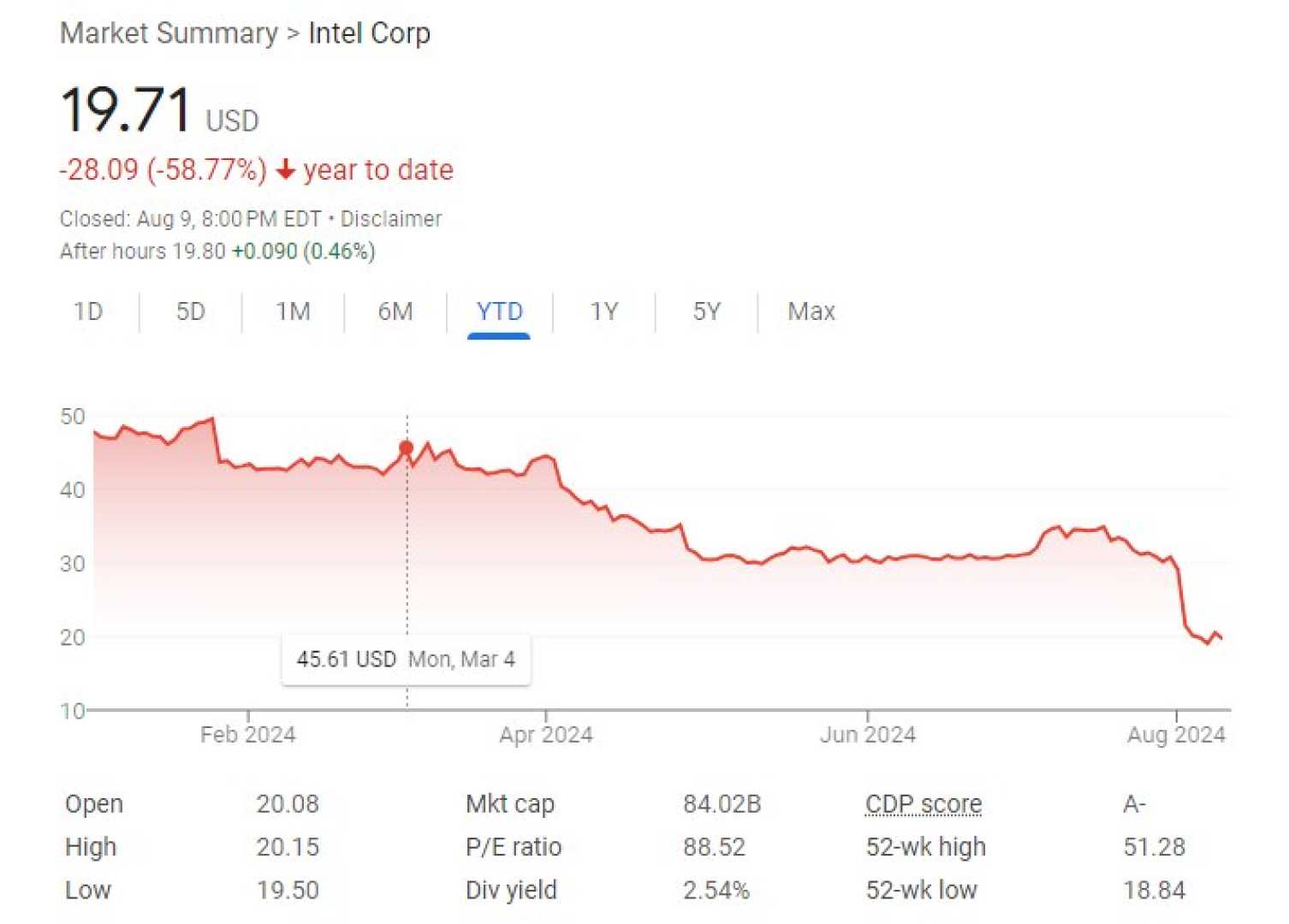

Investors are closely watching these developments, as they reflect on the company’s financial health and future prospects. Intel’s stock has seen significant volatility, with a year-to-date change of -54.43% as of October 30, 2024. This decline has led to increased scrutiny and decreased investor confidence in the short term.

Analysts and financial experts are weighing in on whether this is an opportune time to invest in Intel stock. While some argue that the company’s long-term strategy and technological advancements could lead to future growth, others are more cautious due to the current financial adjustments and market performance.

The pause in dividend payments and reduction in capital spending are seen as temporary measures to ensure the company’s financial stability during this period of expansion. However, these moves have raised questions among investors about the immediate future of Intel’s stock performance.