Business

Intuit Reports Strong Q3 Growth Amid Tax Season Success

MOUNTAIN VIEW, Calif.–(BUSINESS WIRE)–May 22, 2025– Intuit Inc., the global financial technology platform, announced financial results for the third quarter of fiscal 2025, which ended April 30. The company reported revenues of $7.75 billion, an increase of 15% from the previous year, beating analysts’ expectations of $7.56 billion.

Sasan Goodarzi, Intuit’s CEO, noted the momentum in their operations, saying, “We have exceptional momentum with outstanding performance across our platform. We’re redefining what’s possible with AI by becoming a one-stop shop of AI agents and AI-enabled human experts to fuel the success of consumers and small to mid-market businesses.”

The company’s Consumer Group revenue reached $4 billion, up 11% year-over-year. TurboTax Live showed significant growth, indicating a shift in the assisted tax service industry. Intuit’s Global Business Solutions Group also reported strong performance with a revenue increase of 19% to $2.8 billion.

Sandeep Aujla, Intuit’s CFO, highlighted the success of the tax season and ongoing growth in various segments, stating, “We delivered a strong third quarter of fiscal 2025, driven by an outstanding tax season and continued momentum in our Global Business Solutions Group and Credit Karma.”

In addition, Credit Karma saw a revenue increase of 31% to $579 million, driven largely by demand in credit cards, personal loans, and auto insurance. Given this strong performance, Intuit has raised its full-year guidance for fiscal 2025 across all company metrics.

Intuit plans to share more insights during its conference call scheduled for 1:30 p.m. PT on May 22, where executives will discuss these financial results in detail.

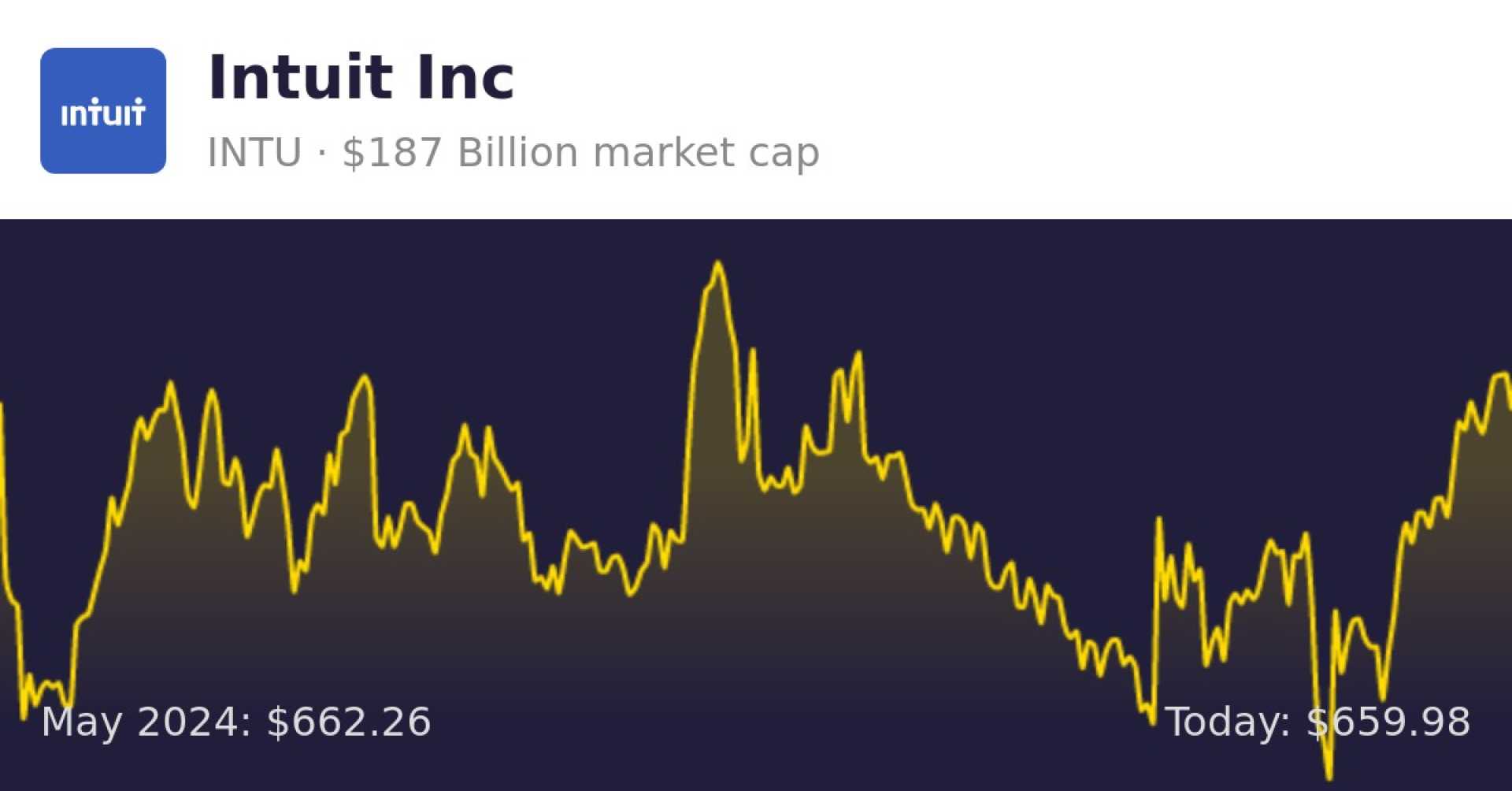

Analysts project that Intuit’s stock is set for a 5.65% upside from its current price, with an average target price of $703.34. One brokerage group rates Intuit as “Outperform,” underscoring the firm’s positive growth trajectory.

Intuit remains committed to finding new, innovative ways to foster prosperity for the communities it serves while navigating the evolving financial landscape.