Business

How a $500 Investment Can Grow to $10,000 Over a Decade

CHARLOTTE, N.C. — Investors looking to build wealth without starting with a substantial amount can find success through consistent saving and smart investment choices. A $500 initial investment in the Schwab U.S. Dividend Equity ETF (SCHD) can mature into over $10,000 after ten years, thanks to disciplined saving and the ETF’s performance.

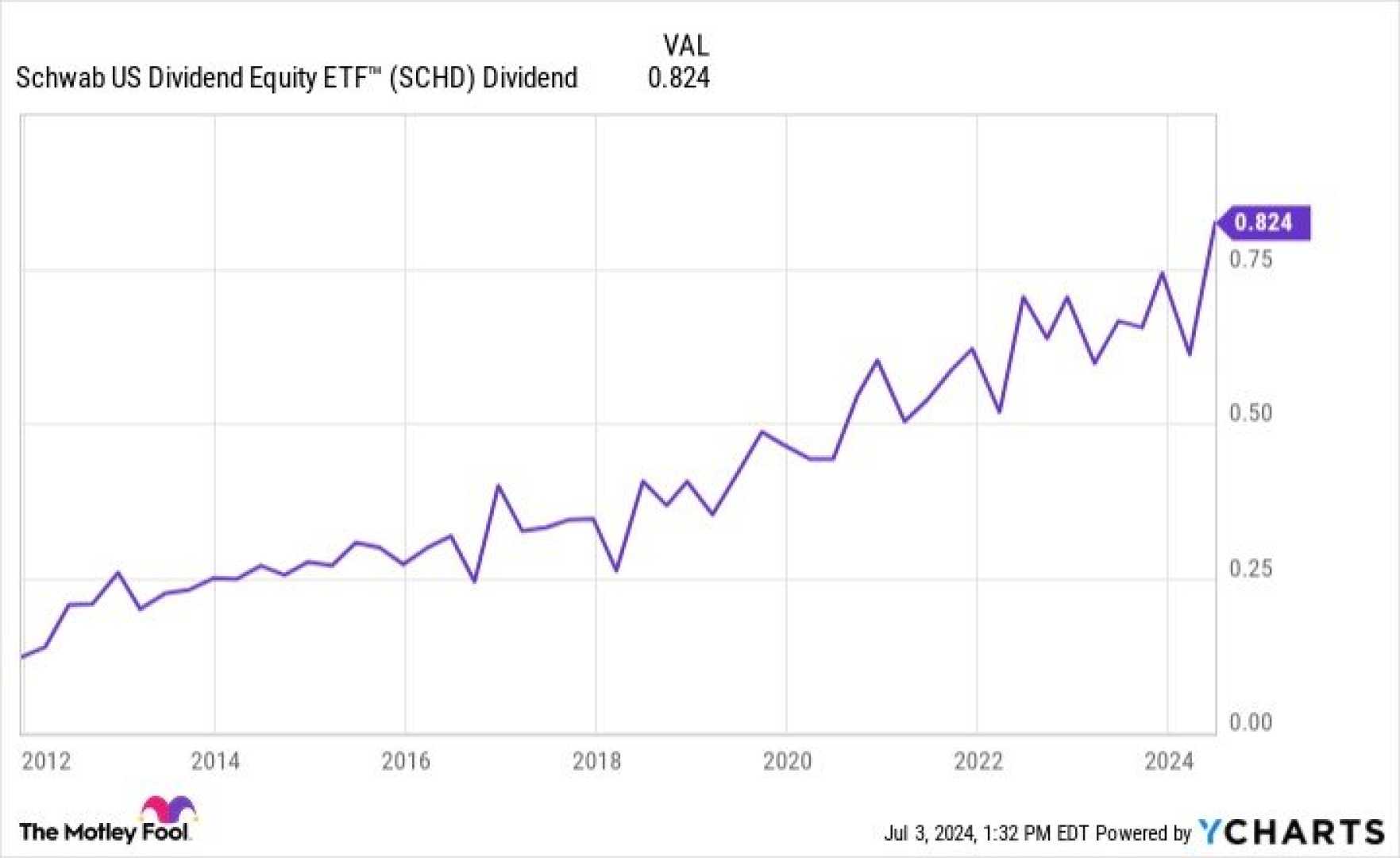

The Schwab U.S. Dividend Equity ETF focuses on high-quality companies that have increased their dividends for at least a decade. This strategy excludes real estate investment trusts (REITs), which often skew income-focused funds. The ETF, launched in late 2011, aims to provide both income and capital appreciation with a low expense ratio of just 0.06%.

The ETF employs a composite scoring method to assess potential investments based on cash flow, dividend yield, and a company’s five-year dividend growth rate. The top 100 companies with the highest scores are included in the index, and they are weighted by market capitalization. The current dividend yield stands around 3.5%, contributing to its appeal among long-term investors.

Investors who allocate $500 into SCHD and hold it for a decade, assuming an annualized return of 12%, would see their investment grow to approximately $1,550. However, if they contribute an additional $500 each year, their total investment would exceed $10,300 by the end of the ten years. Out of this total, about $4,800 would be attributed to investment returns generated by the ETF’s performance.

“The investment landscape requires patience,” said an unnamed financial analyst. “It’s about understanding the importance of compounding returns and long-term commitment.” This commitment involves not just initial investment capital but also consistent contributions, which can significantly bolster a retirement portfolio.

In addition to contributions and capital gains, reinvesting dividends is crucial to maximizing growth. The overall growth potential of SCHD benefits from reinvested dividends, elevating the investment value by more than 185% over the past decade, compared to a mere doubling of the stock price without reinvestment.

“The trend of increasing dividends over time can provide a critical income stream when you retire,” the analyst noted. “It’s essential to recognize that as dividends rise, the income potential during retirement grows, making this ETF an attractive choice for those focused on future financial stability.”

Despite past performance, investors are cautioned that it does not guarantee future results. Regular investments in funds like the Schwab U.S. Dividend Equity ETF emphasize the value of consistency and sound financial strategies. “Building wealth takes time and discipline, but with the right approach, turning small amounts into significant savings is achievable,” the analyst concluded.