Business

Investors Eye Shopify Earnings Amid Market Uncertainty

TORONTO, Canada — Shopify Inc. (NASDAQ:SHOP), the Canadian e-commerce platform, is set to announce its fiscal first quarter earnings on May 8, 2025. The company has faced significant challenges recently, with its stock dropping over 4% on May 6, as concerns about trade tensions and economic slowdown affect market sentiment.

Since reaching a high in February 2025, Shopify shares have declined by approximately 27%. The stock saw steeper losses earlier this year, plummeting nearly 45% before recovering some ground in April. The ongoing trade negotiations between the United States and Canada, highlighted by Prime Minister Mark Carney‘s recent visit to the White House, are adding another layer of uncertainty.

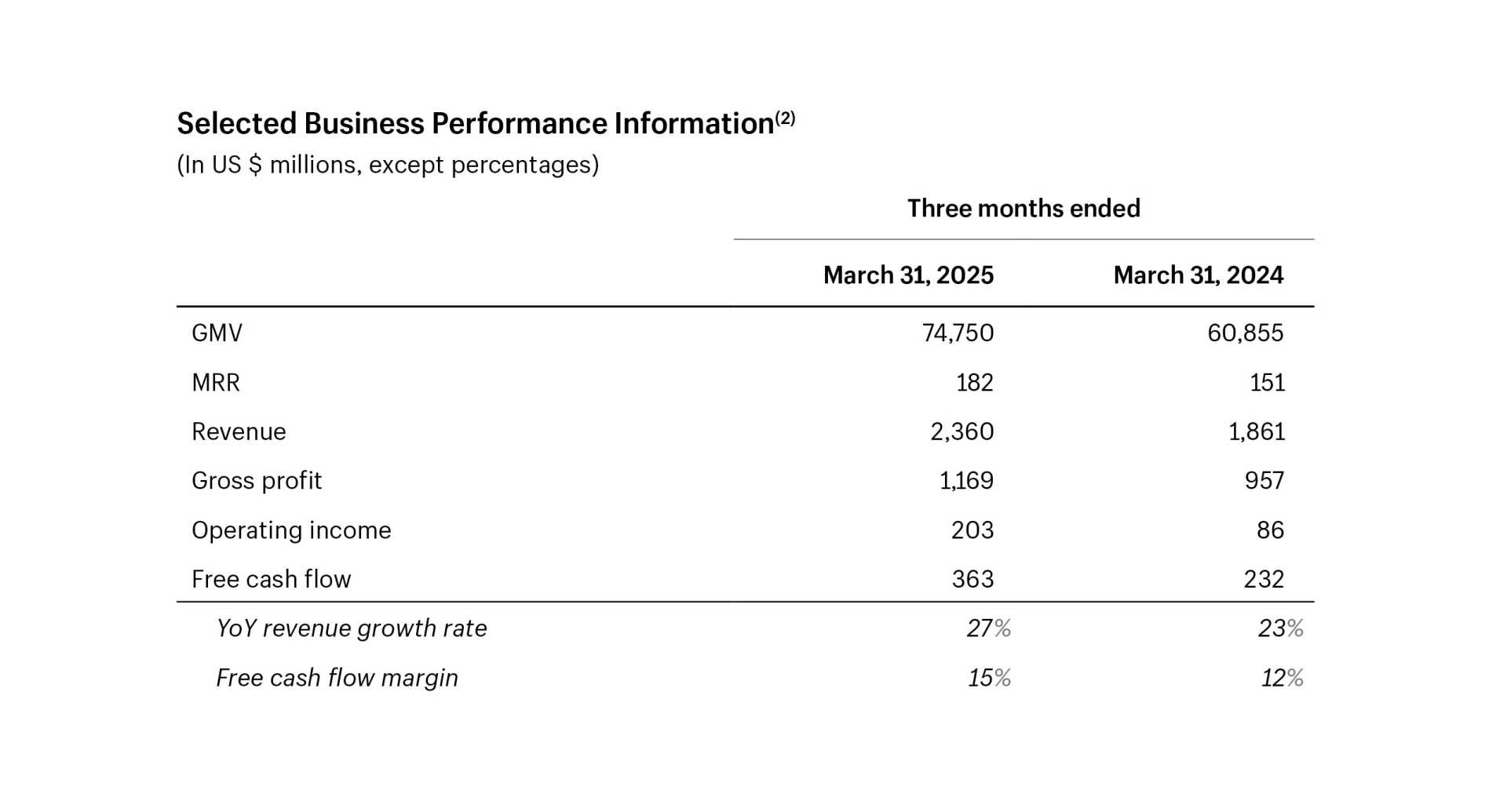

Analysts predict that Shopify will report earnings per share (EPS) of $0.25, an increase from $0.20 during the same period last year. The expected revenue for the quarter is $2.26 billion, compared to $1.88 billion last year, recovering from a fourth quarter where the company posted $2.80 billion, largely due to the holiday shopping season.

Market sentiment around Shopify remains mixed, with 33 ratings as strong buy or buy, 18 hold ratings, and three sell ratings. The average price target reflects a potential increase of about 22% from its current price, with estimates set around $115.26.

Notably, Cathie Wood’s ARK Next Generation Internet ETF (ARKW) has significantly increased its stake in Shopify, purchasing approximately $10.3 million worth of the stock since the beginning of 2025.

Despite its recent decline, there are signs of support for Shopify’s stock. The implied volatility rank is at 48.5, suggesting an average market expectation of movement around +/- 10.66 points following the earnings announcement. Support from the 21-day exponential moving average could help stabilize prices in the face of ongoing economic pressures.

As Shopify prepares for its earnings report, investors will be keenly watching how the company addresses the headwinds from the trade environment and anticipates its profitability moving forward.