Business

Investors Question Sirius XM’s Future Amid Market Plays

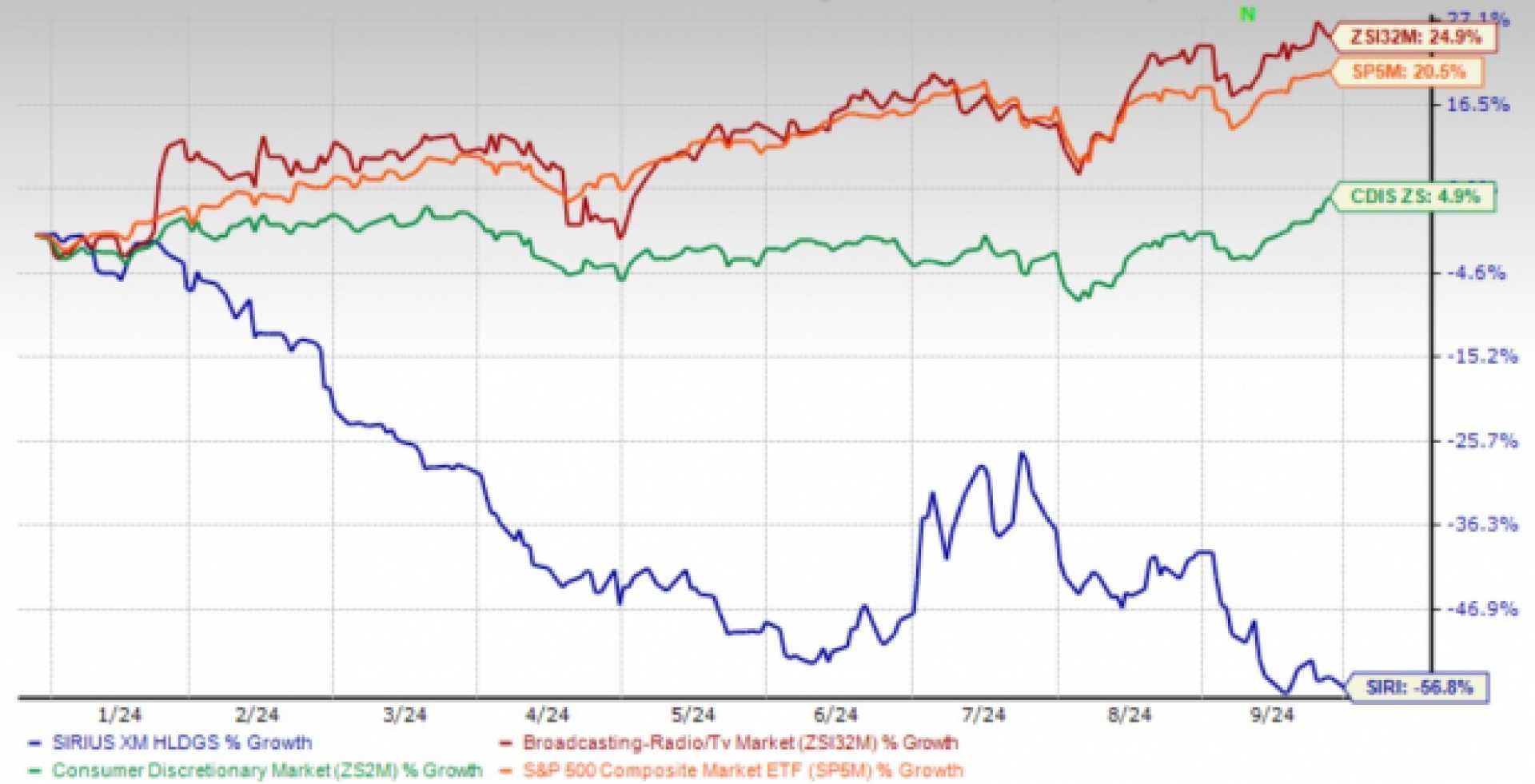

NEW YORK, N.Y. — As of October 20, 2025, the S&P 500 index has soared 29.3% since April of this year, yet Sirius XM‘s stock trails significantly with a mere 6.4% increase. This discrepancy raises questions among investors about whether to hold onto or buy into Sirius XM.

Analysts express doubt about Sirius XM’s growth potential, citing three main issues. First, the company’s core subscriber base, which totaled 32.8 million last quarter, has seen a disappointing annual decline of 1.7% over the past two years. This decline raises concerns about competition and market saturation, making it likely that Sirius XM may need to lower prices or enhance product offerings to boost growth.

Second, the company’s earnings per share (EPS) have plummeted by 36.9% annually in the last five years, despite a modest revenue gain of 1.6%. This disparity suggests that while revenue might be growing, profitability on a per-share basis is actually decreasing.

Lastly, the return on invested capital (ROIC) has dwindled for Sirius XM, indicating a decline in effective use of capital. Investors seek strong returns, yet the company’s return trends have prompted concerns about the availability of profitable growth opportunities.

Sirius XM currently trades at 6.9 times its forward price-to-earnings ratio, or $21.45 per share. While this valuation appears appealing, analysts argue its underlying fundamentals may present significant risks.

The market’s recent fluctuations were partly influenced by former President Trump’s tariff measures announced in April 2025, which initially prompted fears of a trade war. However, investors who sold in panic missed a recovery that restored most losses.

Meanwhile, analysts have compiled a list of high-quality stocks that have generated a remarkable 183% return over the last five years, suggesting there may be better investment options than Sirius XM. This includes companies like Nvidia, which saw its stocks rise by 1,545% between March 2020 and March 2025.

As market conditions continue to evolve, investors are advised to weigh their options carefully before making decisions on holdings like Sirius XM.