Business

Investors See Heavy Losses in K+S and Thyssenkrupp Stocks

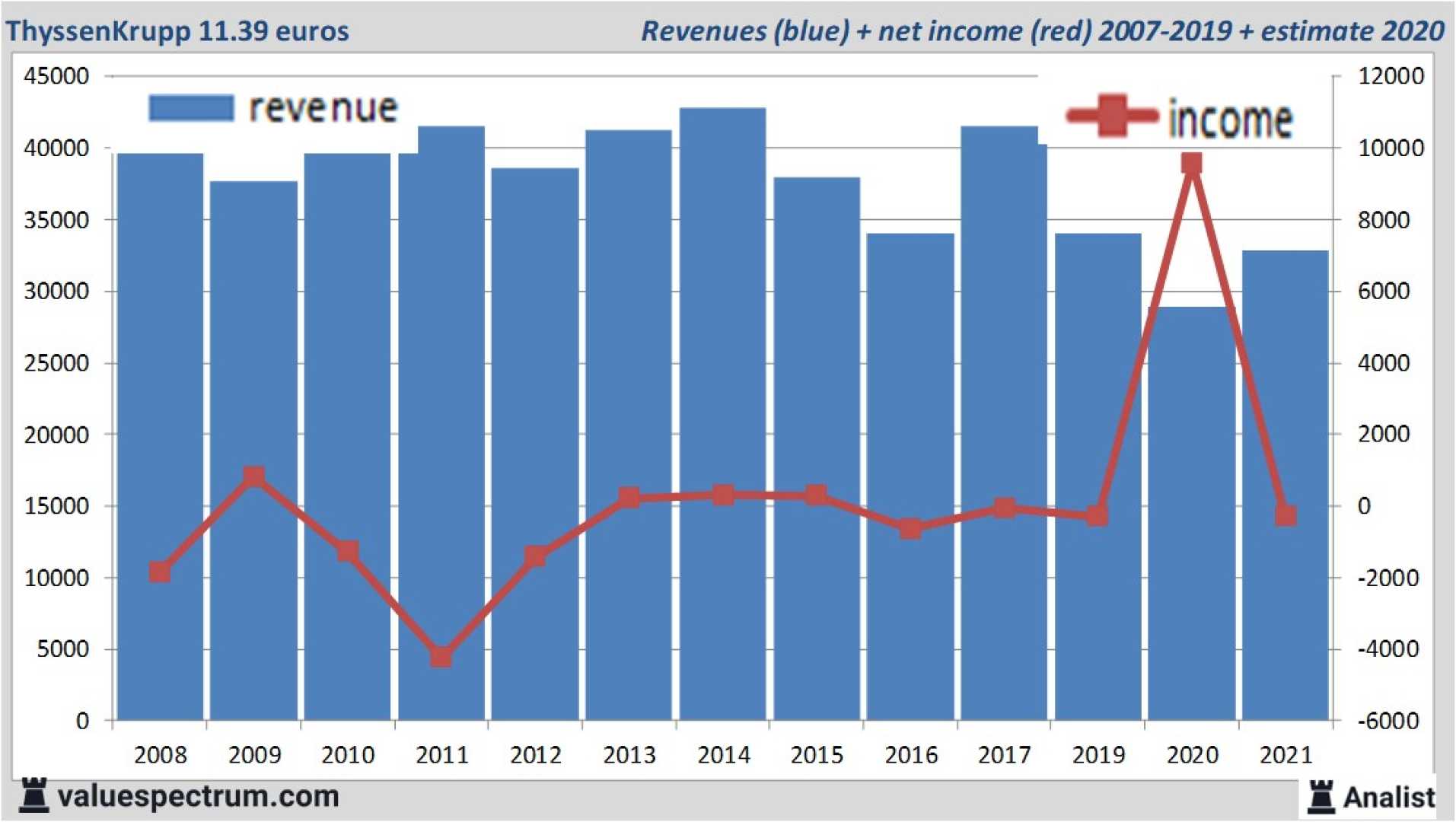

ZÜRICH, Switzerland (AP) — Investors in K+S and Thyssenkrupp stocks are facing significant losses following the latest financial reports. As of February 25, 2025, K+S shares are valued at €12.91, down from €21.80 just three years ago, marking a 40.78% decline. Similarly, Thyssenkrupp’s stock price plummeted from €23.27 a decade ago to just €6.02 today, amounting to a staggering 74.13% loss.

The downturn for K+S shareholders is stark. Those who invested €100 three years ago would own approximately 4.587 shares today, which would now be valued at €59.22. This is not only a notable decrease in value but also reflects broader volatility in European markets. K+S currently holds a market capitalization of approximately €2.35 billion.

“Investors are understandably concerned as the stock has not performed as hoped over the past several years,” said financial analyst Michael Strahl. “The losses in K+S are part of wider economic challenges impacting the entire sector.”

For Thyssenkrupp investors, the situation is similarly bleak. If an individual had invested €1,000 ten years ago, they would now possess about 42.974 shares, worth a mere €258.70 today. Thyssenkrupp’s market value stands at around €3.75 billion, showcasing the extent of its downturn.

According to Destatis, the economic challenges reflected in these stock prices are coupled with a shrinking German economy. The recent report confirmed that Germany’s gross domestic product (GDP) decreased by 0.2% during the final quarter of 2024 compared to the previous quarter. The sharp decline in exports and mixed performance in investment activities contributed to the overall economic outlook.

“We need to see significant reforms and stabilizing measures across the board to recover from this downward trend,” warned economist Julia Richter. “Continued monitoring of these sectors is critical as we navigate this economic phase.”

While both companies face immediate challenges, analysts suggest potential recovery pathways that could stabilize stock prices over the long term. However, for current investors, the outlook remains tough as market conditions evolve.