Business

IRS Begins 2025 Tax Season with Major Changes for Refunds

WASHINGTON, D.C. — The Internal Revenue Service (IRS) kicked off the 2025 tax season on January 27, processing over 11 million returns within the first week. The agency projects receiving more than 140 million individual tax returns before the April 15 filing deadline, drawing attention to one significant question: when can taxpayers expect their refunds?

According to the IRS, about 28% of the returns processed in the initial week resulted in direct-deposit refunds. Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center, noted, “The IRS was coming in in a strong position. That’s good for taxpayers,” attributing the positive start to the agency’s recent improvements in customer service.

The IRS has emphasized the efficiency of electronic filing and direct deposit methods, advising taxpayers to choose these options for quicker refunds. The agency suggests that most refunds will be issued within 21 days of filing. However, those claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) may experience delays due to requirements established under the PATH Act of 2015. Holtzblatt elaborated, saying, “Refunds would not begin to be paid until after February 15, which translates into people not getting it until early March.”

The IRS’s free Direct File service has grown significantly, now available in 25 states, an increase from 12 last tax season. This initiative targets individuals with simpler tax situations, offering online guidance for filing without charge. Holtzblatt commented on this expansion, describing it as a “big step for the IRS and for taxpayers.” Direct File is currently accessible in major states such as New York, Texas, and California, although it has limitations on the types of income it can handle.

The IRS also benefitted from a historic funding boost of $80 billion from the Inflation Reduction Act in 2022, intended for upgrading computer systems, enhancing customer service, and improving tax compliance efforts. Despite this, Congress has sought to reduce the IRS’s budget, prompting concerns about potential staffing challenges and the sustainability of ongoing improvements.

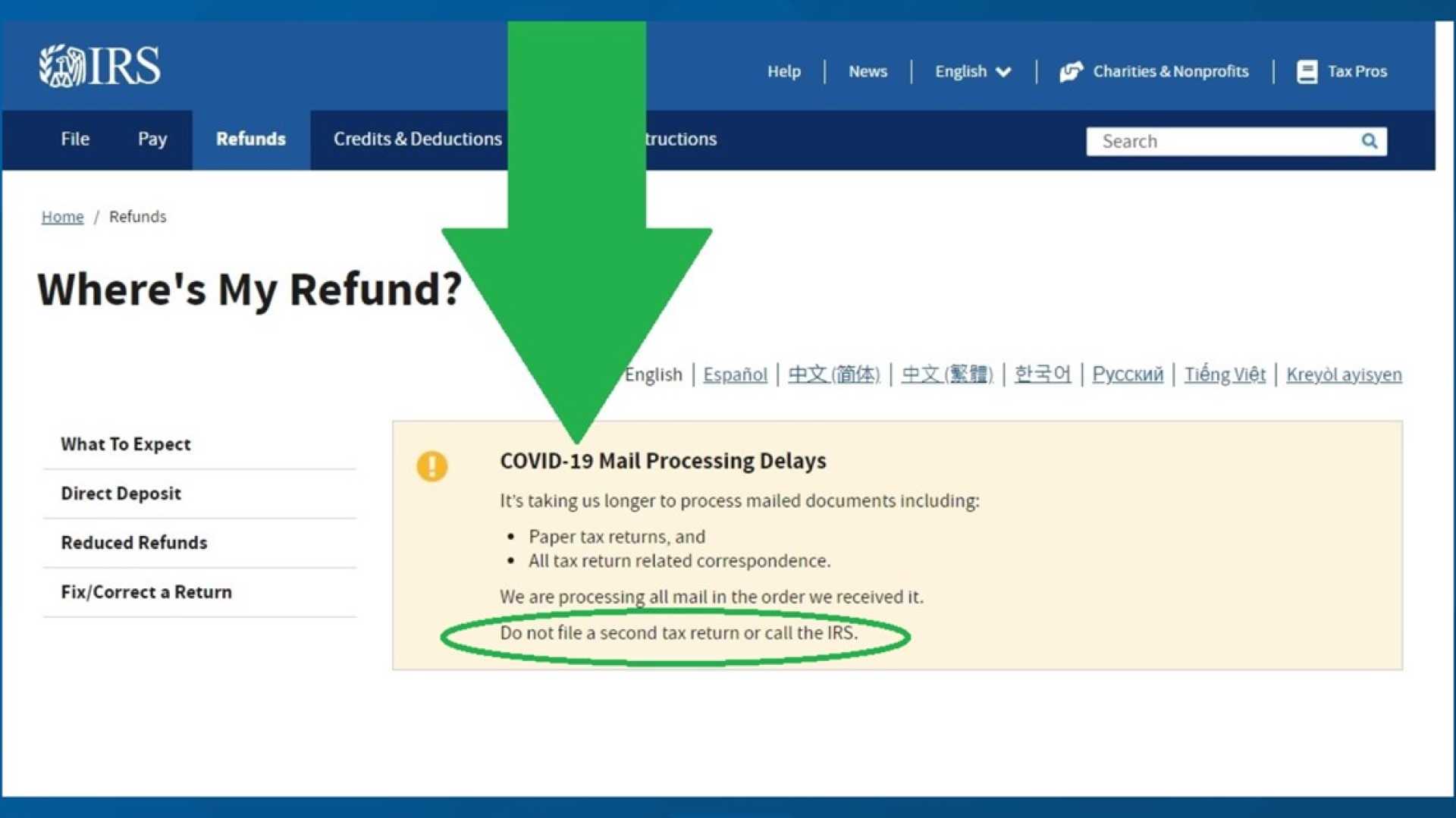

The latest IRS updates show that taxpayers can track their returns online, with a dedicated tool available within 24 hours after electronic filing. This resource allows users to monitor the status of their returns through distinct phases: receipt, approval, and issuance of refunds.

The IRS reiterates that early filers with straightforward returns may see their direct deposit refunds as early as mid to late February, contingent on filing dates and adherence to other prerequisites.

As inquiries about refund timelines increase, the IRS outlines clear expectations while emphasizing the variability of individual tax situations. For assistance with complexities, taxpayers are encouraged to consult qualified tax professionals, who can provide essential guidance through the filing process.