Business

Jim Cramer Offers Strategies for Navigating Stock Market Selloffs

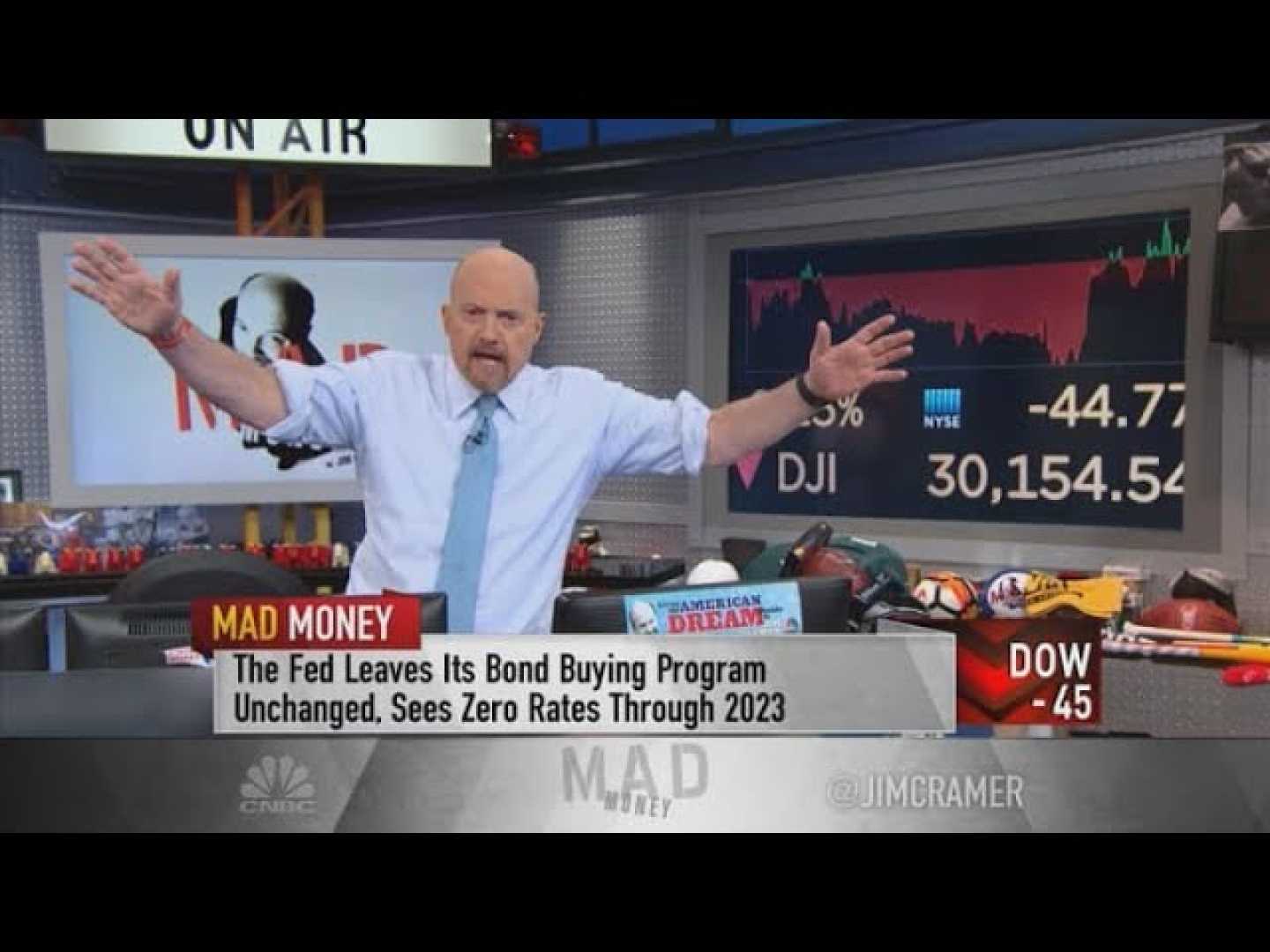

NEW YORK, N.Y. — Jim Cramer, the host of CNBC‘s Mad Money, shared his insights on managing stock market selloffs during a segment on Friday. He emphasized the importance of understanding market dynamics and identifying opportunities during downturns.

Cramer explained that investors should not panic during “mechanical” crashes, typically signified by abrupt market drops in otherwise healthy economies. He described a bottoming process that investors can learn to recognize to better navigate these fluctuations.

“One of my favorite strategies is to look for ‘accidental high yielders,’” Cramer said. “These are stocks in good financial health whose share prices have declined, resulting in unusually high dividend yields.”

He encouraged investors to compare a stock’s current yield to its historical yield and the yield on the 10-year Treasury. A stock that generally yields 2% but suddenly yields 4% could present a prudent buying opportunity if the company’s fundamentals remain solid.

Cramer also suggested using sell-offs to acquire stocks that one may have previously wanted. He advised investors to utilize limit orders when making these purchases.

During a recent broadcast, Cramer highlighted stocks that were in focus, including McDonald’s and Broadcom. He noted that despite recent downgrades from analysts, he remains confident in McDonald’s long-term value. “It has never paid to downgrade Mickey D’s. It’s incredibly well-run,” he said.

Broadcom has seen fluctuations in its stock price despite strong quarterly results. Cramer expressed continued support for the company, calling it a solid investment opportunity in light of its AI growth projections. “Despite the market’s reaction, there was plenty to like about Broadcom’s quarter,” he stated.

Cramer concluded by reminding viewers that while market volatility can be unsettling, careful research and strategic investing can lead to favorable outcomes in the long run.