Business

Johnson & Johnson Reports Strong Q1 Earnings, Ups Sales Forecast

NEW BRUNSWICK, N.J. — Johnson & Johnson announced strong first-quarter earnings on April 14, 2025, exceeding Wall Street expectations, fueled by robust sales of its cancer treatment drugs, specifically Darzalex for multiple myeloma. The company reported quarterly revenues of $21.89 billion, an increase of 2.4% compared to the same period last year.

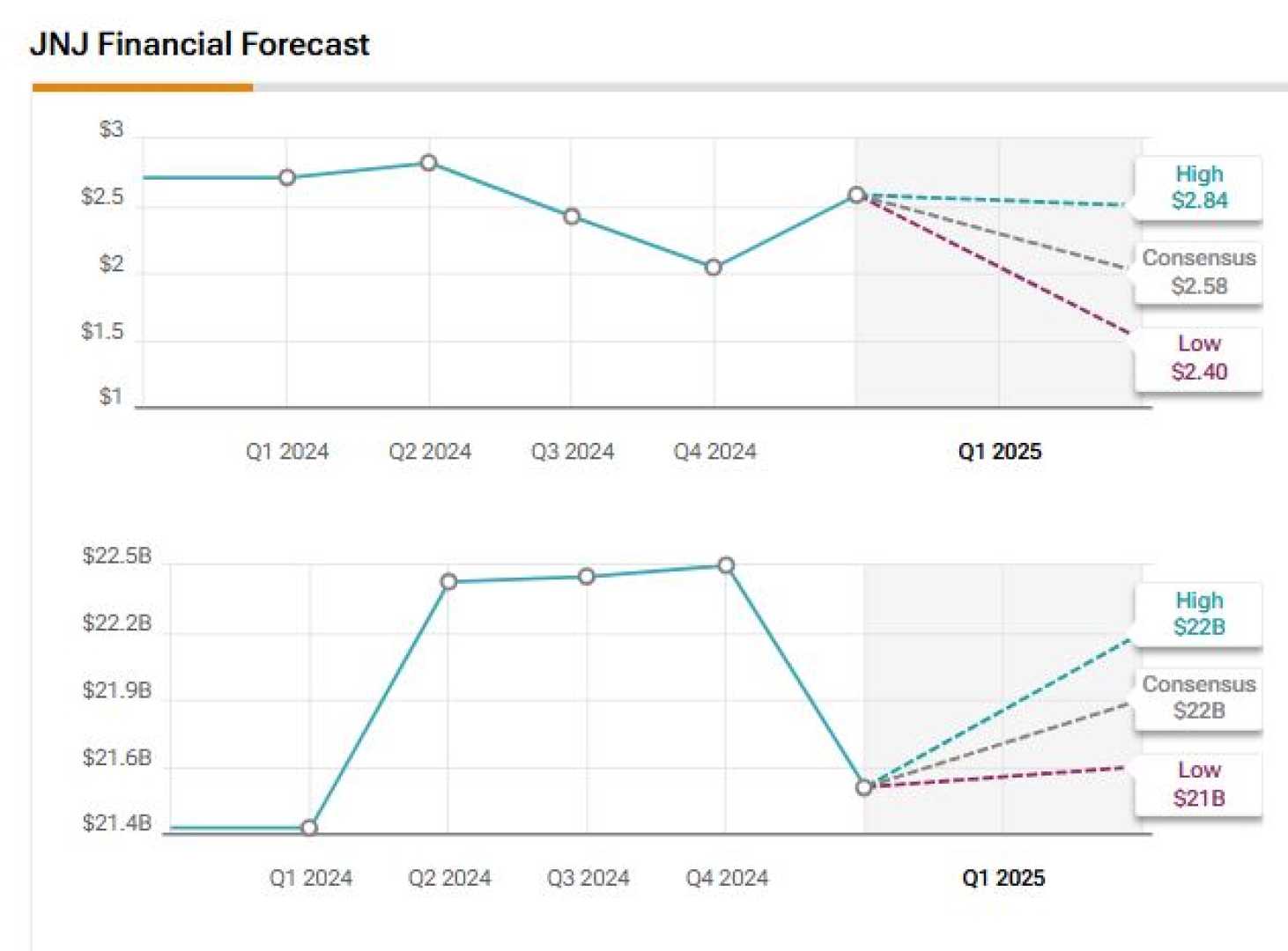

Analysts had forecasted revenues of $21.56 billion, making the results a positive surprise for investors. J&J’s earnings per share came in at $2.77, up 2.2% from the previous year and above analysts’ estimates of $2.59.

In light of these figures, Johnson & Johnson has raised its sales forecast for the full year by $700 million, predicting total sales to be between $91.6 billion and $92.4 billion. This revision includes the expected contributions from Caplyta, the company’s new schizophrenia drug recently acquired from Intra-Cellular Therapies.

However, J&J tempered its profit expectations, projecting adjusted earnings of $10.50 to $10.70 per share, slightly less favorable than previous estimates of $10.75 to $10.95. Chief Financial Officer Joe Wolk stated that this adjustment accounts for approximately $400 million in tariff-related expenses affecting the medical technology segment.

The pharmaceutical segment, which constitutes about 64.1% of J&J’s sales, remains a focal point, with innovative medicines generating revenue of $13.87 billion, surpassing analyst predictions of $13.43 billion. Sales of Darzalex, a key cancer treatment, surged by 20%, reaching $3.24 billion for the quarter against forecasts of $3.05 billion.

Conversely, sales of the psoriasis treatment Stelara have declined over 33%, amounting to $1.63 billion, although it managed to beat estimates of $1.42 billion. The drop follows the introduction of biosimilar competitors across various international markets.

J&J’s stock saw a modest increase of nearly 1% during pre-market trading, closing at $155.59. This reflects a 6.7% gain for the year, largely resisting broader market fluctuations amid tariff concerns since pharmaceuticals were initially exempted from the new tariffs proposed by U.S. President Donald Trump.

In summary, Johnson & Johnson’s robust performance in the first quarter, particularly within its oncology division, along with the strategic acquisition of Caplyta, positions the company favorably as it navigates potential challenges related to tariffs and market competition.