Business

Korean Conglomerates Caught Off Guard by Won-Dollar Exchange Rate Surge

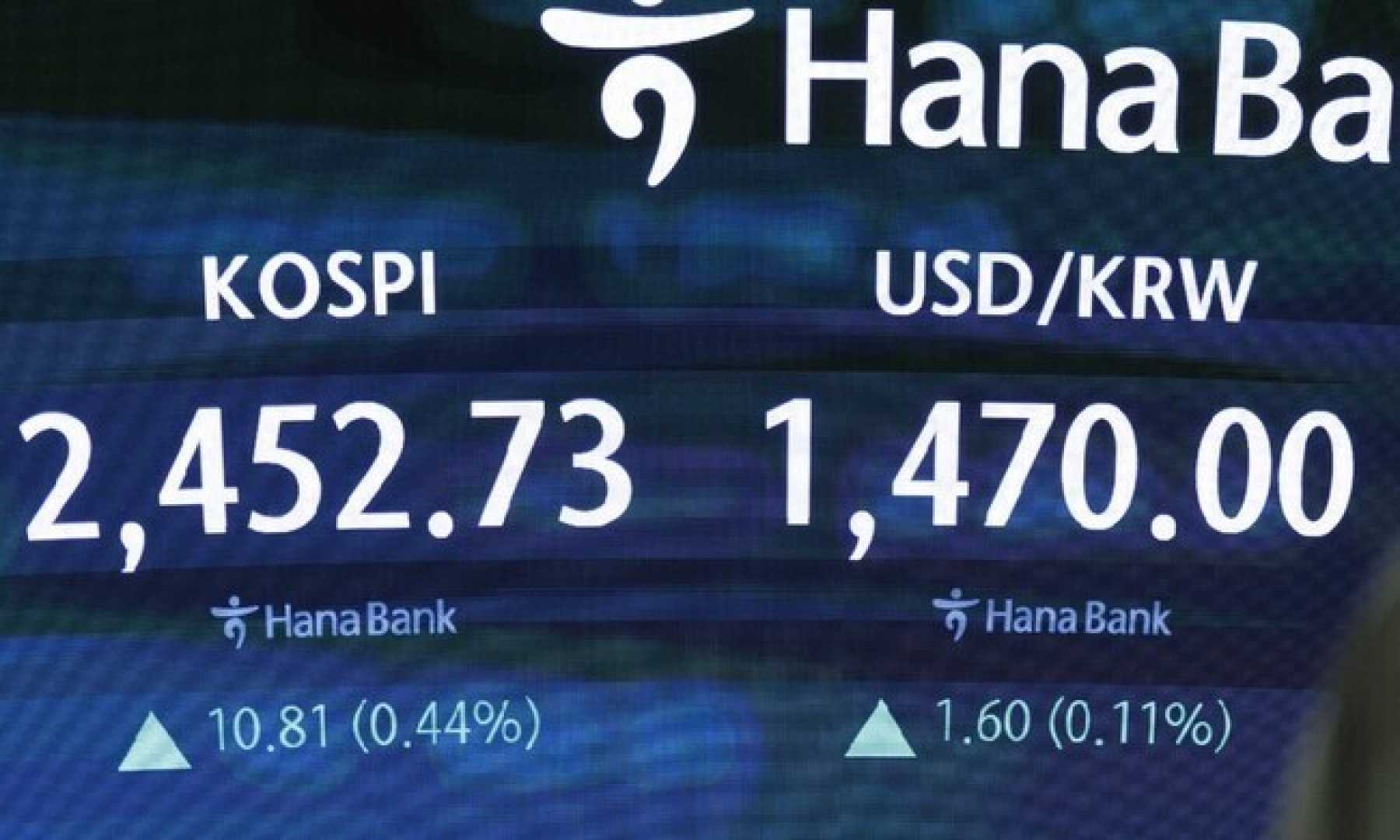

Barely 10% of South Korea‘s largest conglomerates anticipated the recent surge in the won-dollar exchange rate, leaving most unprepared for the financial strain caused by the unexpected spike, according to a survey released Thursday by the Korea Chamber of Commerce and Industry. The survey, which included 31 affiliates of the country’s 50 largest conglomerates, revealed that over 80% of respondents had expected the exchange rate to remain below 1,400 won per dollar, far below the current rate of 1,450 to 1,500 won.

The won-dollar exchange rate, based on the closing weekly rate in Seoul, rose from 1,402.90 won on Dec. 3, 2023, to 1,455 won on Jan. 8, 2025. This sharp increase has forced companies to revise their business plans and implement measures to mitigate the impact of higher costs for raw materials, foreign investments, and foreign currency loans. Among the surveyed firms, 44.4% predicted the exchange rate would remain between 1,450 and 1,500 won during the first half of 2025, while 18.5% expected it to exceed 1,500 won.

Domestic political uncertainty was identified as the primary risk factor driving exchange rate volatility, with 85.2% of respondents citing it as a concern. Other factors included the Trump administration‘s new trade policies (74.1%), delays in U.S. interest rate cuts (44.4%), imbalances in South Korea’s foreign currency management (22.2%), and a potential downgrade in the country’s sovereign credit rating (22.2%).

To address the challenges posed by unstable exchange rates, companies called for expanded subsidies in foreign currency liquidity and emergency measures to stabilize the foreign exchange market. The survey highlighted the need for proactive policy responses to support businesses navigating the volatile economic landscape.