Business

Lower Mortgage Rates Signal Potential Recovery in Housing Market

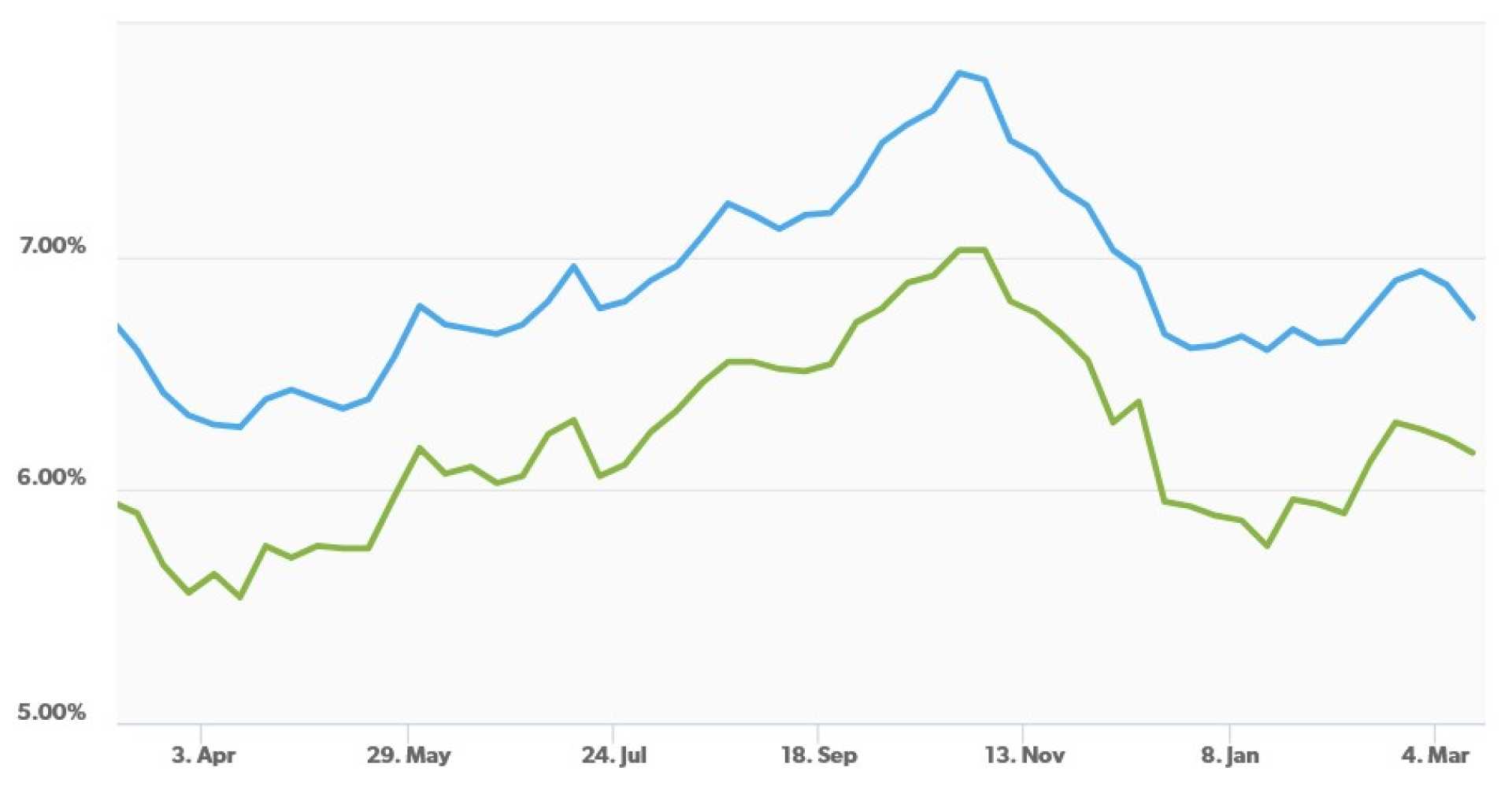

Washington, D.C. – October 17, 2025 – Mortgage rates have taken a notable decline this week, offering a fresh opportunity for potential homebuyers and those considering refinancing. As of October 16, 2025, the average rate of a 30-year fixed mortgage stands at 6.27%, down from previous highs, according to Freddie Mac data.

This decrease comes on the heels of signals from the Federal Reserve that additional interest rate cuts may occur before the end of the year. Federal Reserve Chair Jerome Powell mentioned on October 14 that the labor market is showing signs of softening, leading to an expectation of a quarter-point cut during the Fed’s upcoming meeting on October 28-29.

The current market environment has sparked a renewed interest in home purchasing and refinancing, with rates not climbing as quickly as in recent years. “It’s a significant moment for buyers and homeowners,” said Powell, highlighting that lower rates create more favorable conditions for making informed financial decisions.

As home prices stabilize and more homes come on the market, many homeowners are also exploring refinancing options. The drop in rates results in tangible savings: a hypothetical $300,000 mortgage at the current 30-year fixed rate results in monthly savings of around $58, or over $700 annually.

Realtors report an uptick in inquiries as potential buyers seize the moment to act. “If you’ve been on the fence about buying or refinancing, now is the time to talk with a mortgage professional,” advised Marco Santarelli, founder of Norada Real Estate Investments. Santarelli emphasizes the importance of taking advantage of these market trends.

Additionally, new home sales surged to a three-year high in August, revealing that buyers responded to the combination of falling mortgage rates and builders offering incentives, such as price reductions and mortgage buydowns.

Economists are cautiously optimistic about the trends in the housing sector. While mortgage rates may stabilize in the mid-6% range through early 2026, the potential for further reductions anticipates a rejuvenated housing market. However, experts caution that economic uncertainties could shape the pace of these developments.

Market analysts project that if current trends continue and more affordable financing becomes available, the housing market may rebalance, providing opportunities for both buyers and sellers. “Patience is key,” said Santarelli. “The upcoming months will significantly impact the affordability and activity levels in the housing market.”

Overall, as the Federal Reserve navigates monetary policy with future rate cuts, homebuyers and investors are encouraged to stay informed about incoming economic indicators that will provide insights into the evolving financial landscape.