Business

Meta Platforms Inc. Faces Criticism Over Automated Ad Adjustments and AI-Driven Strategies

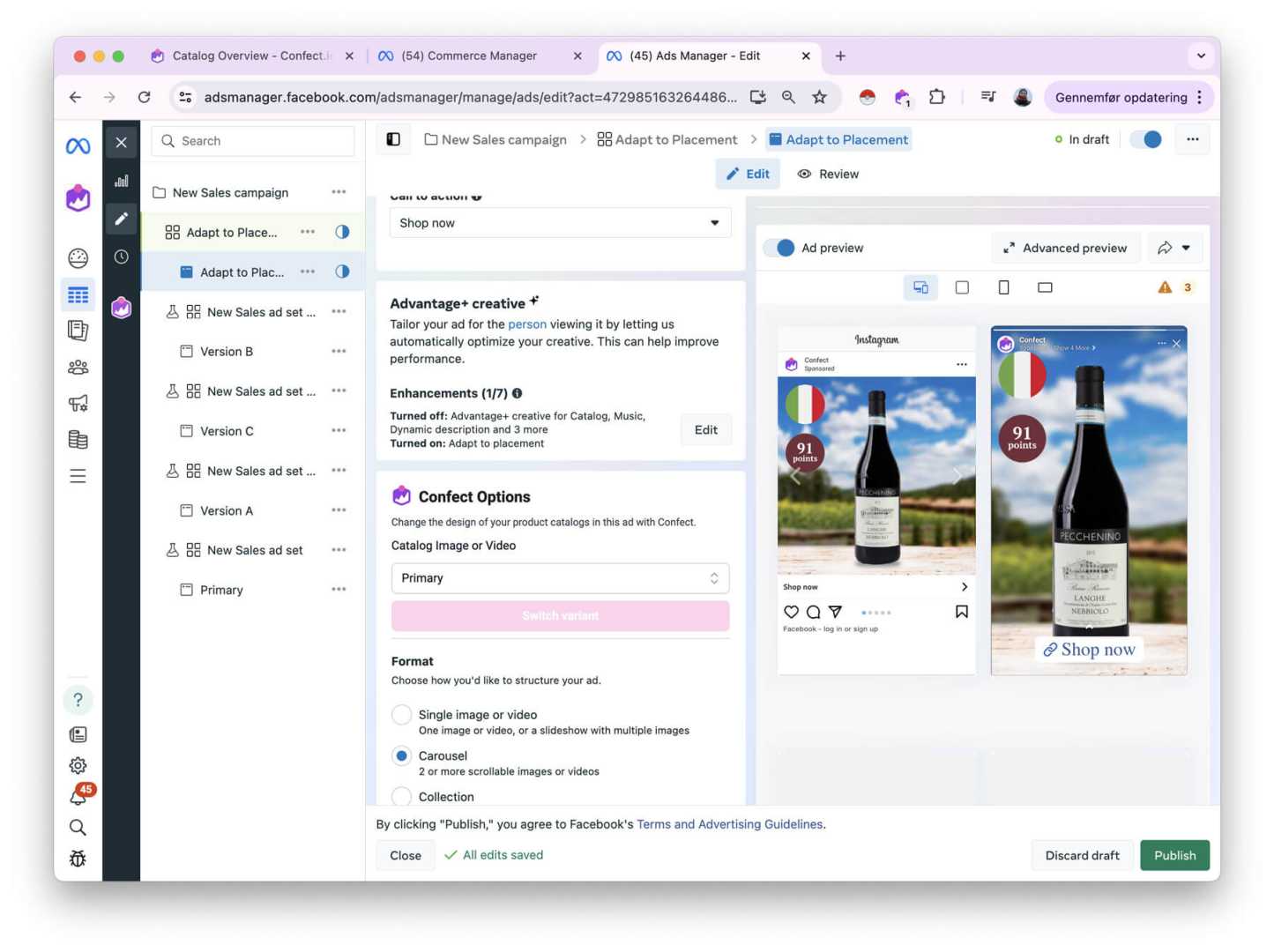

Meta Platforms Inc., the parent company of Facebook, Instagram, WhatsApp, and Messenger, is currently under scrutiny from advertisers and marketers due to issues with its automated ad adjustments. A recent thread on Reddit highlighted the frustrations of several media buyers who have experienced negative impacts on their account performances due to Meta’s Automatic Adjustments feature.

The feature, which is sometimes activated automatically by Meta, has been criticized for optimizing ads in a way that disables high-performing ads and keeps those that only break even. This has led to media buyers having to constantly monitor and manually disable the feature to prevent unwanted changes to their ad campaigns. The community expressed strong skepticism towards Meta’s automated tools, citing past experiences where manual controls consistently outperformed automated optimizations.

Despite these challenges, Meta continues to invest heavily in artificial intelligence (AI) and other innovative technologies. The company’s Q2 2024 report showed significant growth, with a 22% year-over-year increase in advertising revenue and a 73% increase in earnings per share. Meta’s advancements in AI, particularly its open-source Llama models, have enhanced click-through rates by 11% and conversion rates by 7.6%, contributing to the company’s revenue growth.

Meta’s strategic focus on the metaverse, augmented reality (AR), and smart glasses also positions the company for long-term success. The development of its own AI chip and the integration of AI with its hardware and social media platforms are key components of its growth strategy. However, the company’s heavy investment in these areas has raised questions about when these investments will start generating returns.

Analysts remain optimistic about Meta’s future, noting its strong financial base and history of innovation. The company is among the most profitable stocks of the last decade, with a 10-year net income compound annual growth rate (CAGR) of 35.97% and a trailing twelve-month net income of $51.43 billion.