Business

Meta Platforms Inc. Stock Surges Ahead of Q3 Earnings and Potential Stock Split

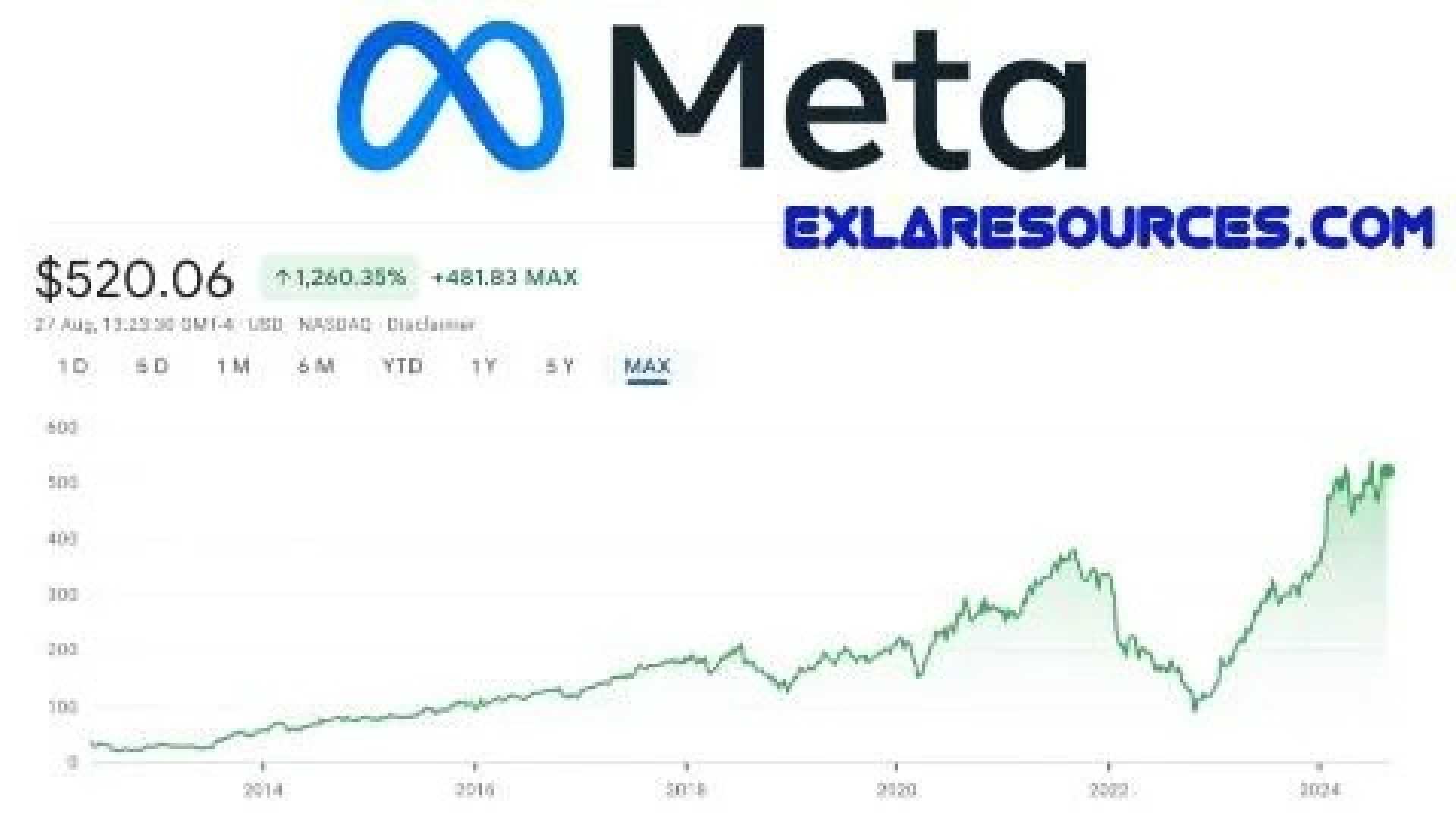

As of October 29, 2024, Meta Platforms Inc. (META) is garnering significant attention from investors and analysts, particularly with its third-quarter earnings report set to be released after the market close on Wednesday, October 30. The company, which owns Facebook, Instagram, WhatsApp, Facebook Messenger, and Threads, among other platforms, has seen its stock price surge in recent months, touching an all-time high of around $600 in October.

The anticipation is heightened by the possibility of Meta announcing its first-ever stock split. This move would align with the trend seen among other top AI-focused companies such as Nvidia, Broadcom, and Super Micro Computer, which have all conducted significant stock splits in recent months. A stock split by Meta would likely generate substantial investor interest, given the company’s significant investment in artificial intelligence, including a $10 billion purchase of AI GPUs from Nvidia for its data centers.

Meta’s financial health and operational performance are also under scrutiny. The company has attracted 3.27 billion daily active users across its family of apps, providing it with substantial ad-pricing power. Additionally, Meta is financially robust, with $58.1 billion in cash, cash equivalents, and marketable securities as of June 2024, and $23.4 billion in free cash flow generated through the first six months of the year. This financial strength allows Meta to be aggressive in its innovation and risk-taking, particularly in the AI and metaverse sectors.

Despite the company’s strong financials and market position, some analysts are cautioning investors to be cautious ahead of the earnings report. Meta’s stock is valued at 23 times forecast earnings per share for 2025, and while the company is expected to continue its double-digit EPS growth, there are concerns about its valuation and the broader market conditions.

The upcoming earnings report and the potential for a stock split make Meta one of the most watched stocks in the fourth quarter, especially as the broader market continues to be influenced by AI-driven growth and stock-split euphoria.