Tech

Meta’s WhatsApp AI Chatbots Could Generate Billions in Revenue by 2030

MENLO PARK, Calif. — Meta Platforms Inc. could see a “massive financial windfall” from generative AI-powered chatbots on its WhatsApp messaging service, according to a new analyst report. The company’s stock rose 3% in morning trading Wednesday as investors reacted to the bullish outlook.

William Blair analyst Ralph Schackart told clients Tuesday that generative AI will allow WhatsApp chatbots to evolve into “intelligent conversations” with businesses, potentially driving e-commerce sales. Meta is currently testing GenAI tools for businesses on WhatsApp in English-speaking countries, charging 2.5 cents per conversation every 24 hours.

With an estimated 2.7 billion WhatsApp users, Schackart projects generative AI chatbots could deliver incremental revenue of $16.6 billion in 2025 and up to $45 billion by 2030. Meta is projected to post $186.7 billion in 2025 sales, according to FactSet data.

“We believe GenAI will allow WhatsApp (and eventually Instagram and Facebook) chatbots to evolve into ‘intelligent conversations’ or more personal conversations with businesses,” Schackart said. He added that there is “runway” to increase pricing as customers become more accustomed to interacting with chatbots.

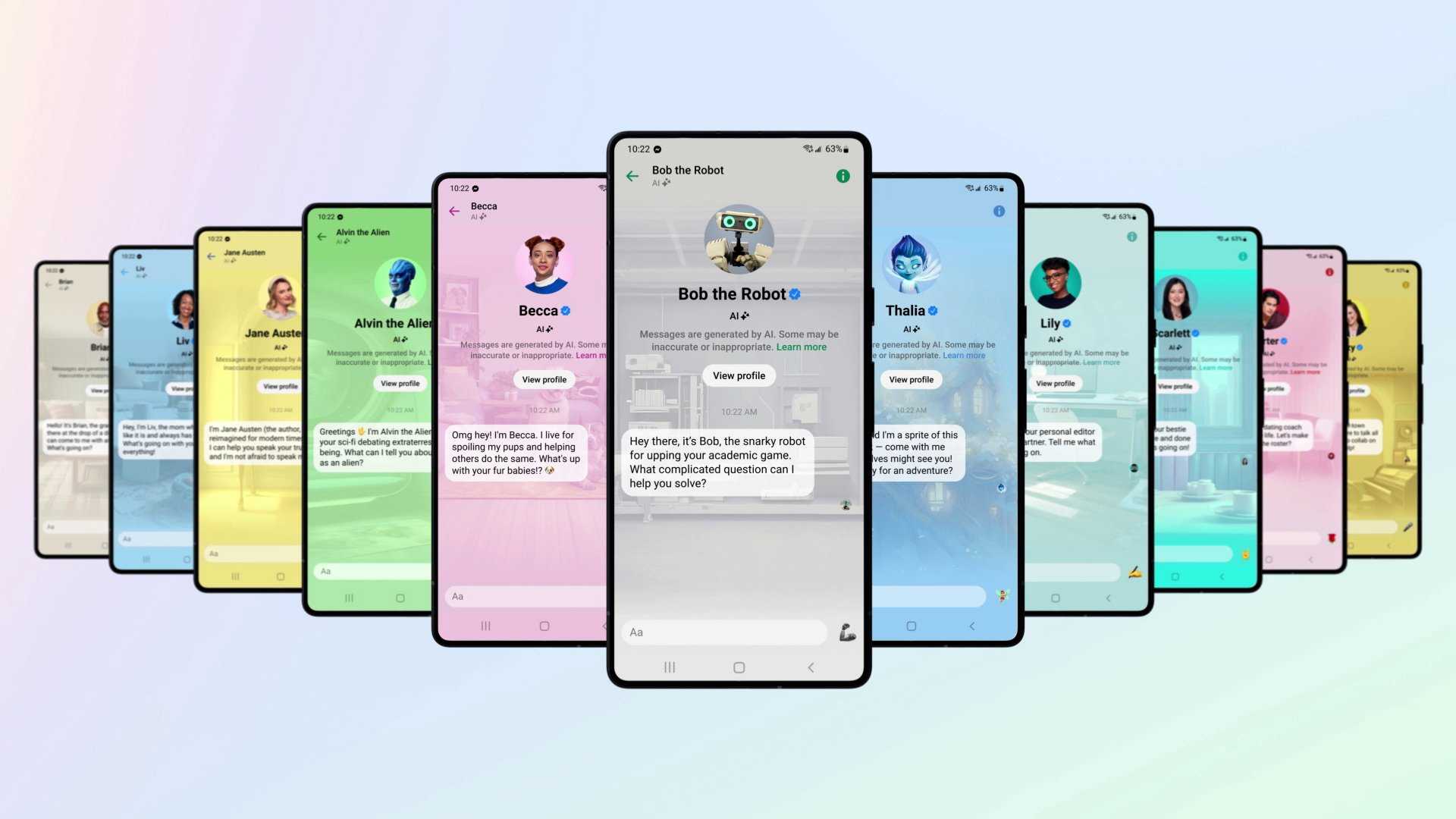

Meta’s push into AI comes as the company continues to develop its own large language model, Llama, which powers the Meta.ai chatbot integrated into Facebook, Instagram, and other apps. The company has also hired Clara Shih, Salesforce‘s AI CEO, to lead a Business AI group.

WhatsApp, acquired by Meta for $19 billion in 2014, is central to the company’s AI strategy. Meta already offers click-to-message ads on Instagram and Facebook that launch conversations between users and businesses on WhatsApp or Messenger.

The bullish outlook from William Blair coincides with Meta’s broader AI initiatives and comes as the company’s stock retook a $602.95 flat base buy point. Meta shares have a Composite Rating of 98 out of 99, according to IBD, indicating strong growth potential.

Meanwhile, Meta is also benefiting from broader market trends, including a cooler-than-expected inflation report and the potential TikTok ban in the U.S. The company recently announced plans to lay off 5% of its workforce, a move that has historically boosted its stock price.

In an internal post, CEO Mark Zuckerberg described 2025 as “an intense year,” hinting at new products or an aggressive ramp-up of existing offerings. As Meta continues to invest in AI and adapt to changing market conditions, analysts remain optimistic about its growth trajectory.