Business

Mexican Peso Steady Amid Trade Tensions and Economic Uncertainty

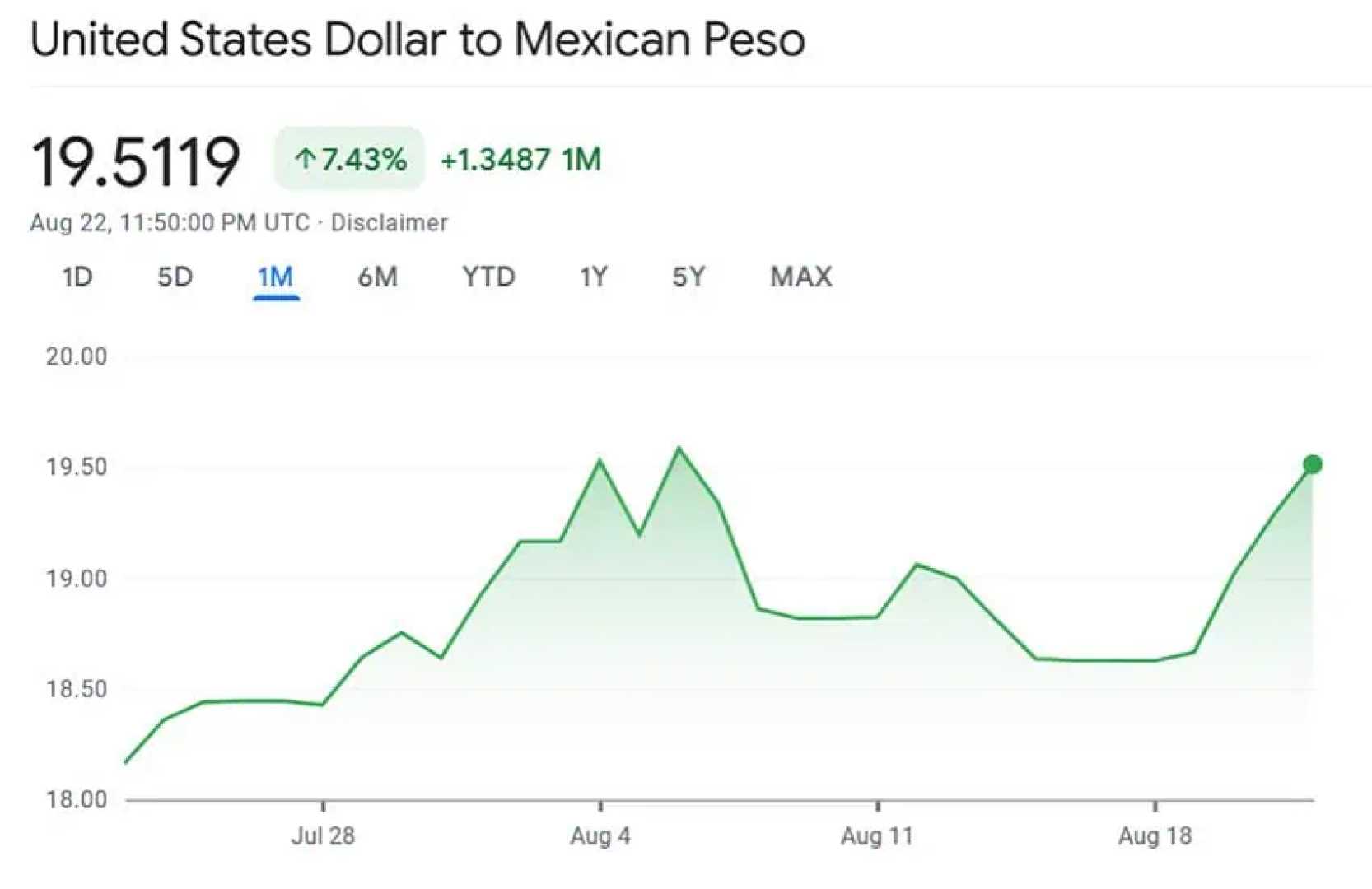

Mexico City, Mexico – The Mexican peso remained stable on April 29, 2025, trading at 19.58 per dollar as investors exercise caution amid ongoing trade tensions. Concerns over the U.S.-China tariff conflict continue to loom, as market participants await critical economic data.

The currency experienced a slight decline of 0.03 percent compared to Monday’s reference price, despite a positive opening. Analysts from Ve Por Más noted, “There is likely to be some caution, pending more certainties on the trade front, even after White House officials indicated plans to soften tariffs on the automotive sector.” They also expect employment data to be released on Friday for a clearer picture of the U.S. economy.

This week is pivotal, with significant economic data scheduled for release, including gross domestic product (GDP) figures from both Mexico and the U.S., inflation statistics, and April’s non-farm payrolls in the world’s largest economy.

As of 8:00 AM on April 29, the peso opened at approximately 19.56 pesos per dollar, reflecting an appreciation of 0.11 percent or 2.1 cents. The exchange rate fluctuated within a range, hitting a maximum of 19.6509 and a minimum of 19.5464 pesos per dollar, following the publication of the U.S. trade balance.

The preliminary trade balance report indicated a historic deficit of $161.99 billion for March, up 9.6 percent from the previous month and significantly exceeding market expectations. The increase is largely attributed to a 5.0 percent rise in imports, especially consumer goods, which saw a 27.5 percent jump.

On Monday, April 28, the peso had depreciated by 0.42 percent, closing at 19.59 per dollar, amid investor anticipation of updates surrounding the U.S.-China trade conflict. The market remains vigilant for key economic insights that could affect the currency’s performance.

In summary, as the peso fluctuates in response to trade discussions and economic announcements, analysts predict it will continue to hover between 19.52 and 19.66. They emphasize the uncertain outlook for the currency until further data clarifies the economic landscape.