Business

Micron Technology Set for Earnings Report: What to Expect

SAN JOSE, Calif. — Micron Technology is scheduled to announce its fiscal second-quarter earnings on March 20, 2025, after the market closes. Analysts anticipate strong results, predicting earnings per share (EPS) of $1.43, a significant increase from $0.42 during the same quarter last year. Revenue is projected to reach $7.9 billion, marking a 36% year-over-year rise.

The anticipated results are largely attributed to surging demand for high-bandwidth memory (HBM), primarily driven by artificial intelligence data centers. Micron is currently ramping up production of its HBM3E memory chips, designed to support the latest GPU technology with improved efficiency and capacity.

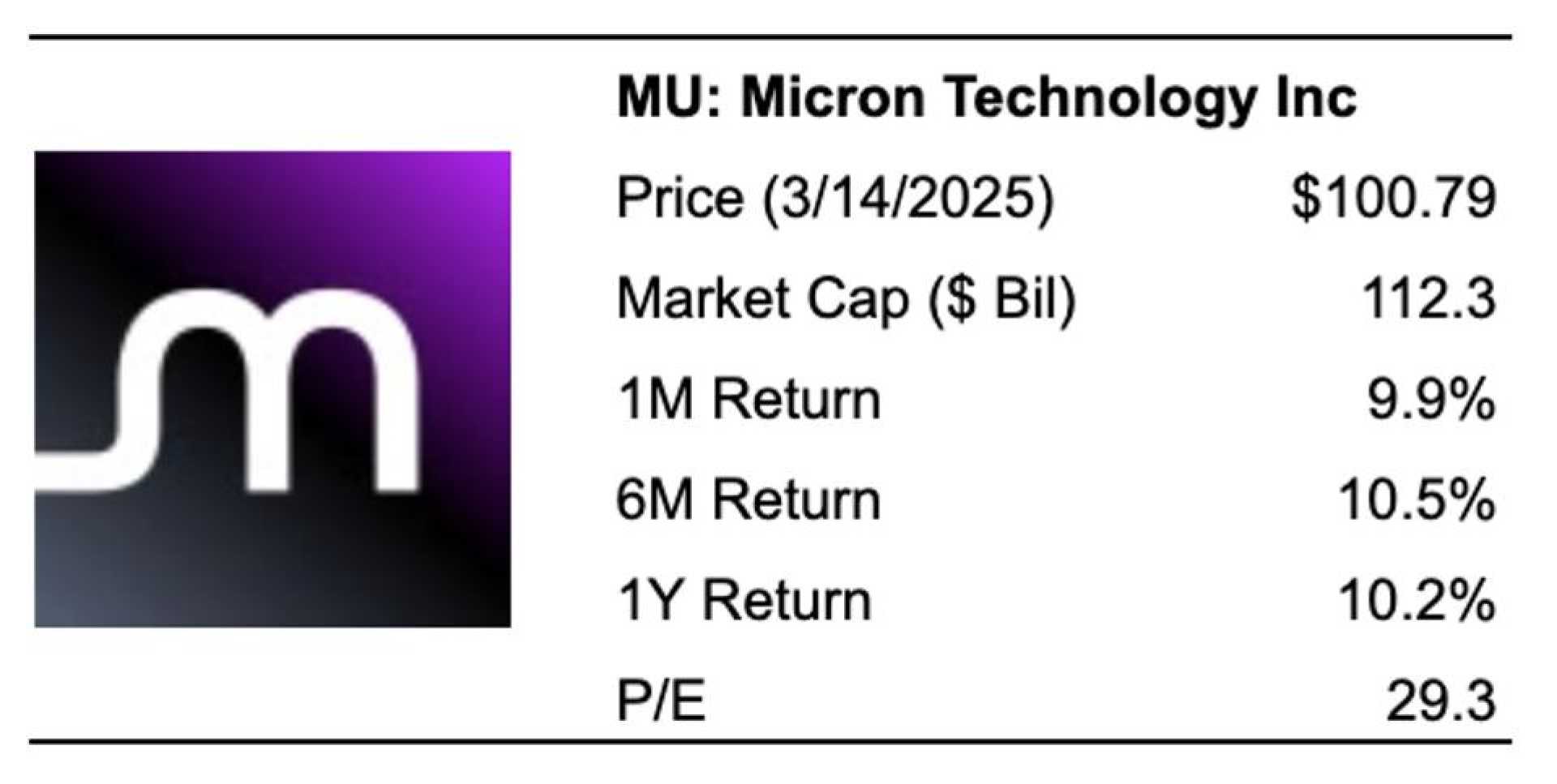

Micron’s current market capitalization stands at approximately $112 billion, with revenue of $29 billion over the past year, yielding operating profits of $4.6 billion and net income of $3.9 billion. Despite fluctuations in the broader stock market, Micron’s shares traded near their highs from late February before the recent downturn.

“We are on track to achieve our HBM targets and expect to deliver substantial revenue improvements in fiscal 2025,” said Micron President and CEO Sanjay Mehrotra, addressing the company’s outlook for the current fiscal year during a recent earnings call. Mehrotra highlighted that inventory adjustments from customers have affected bit shipments but remains optimistic about a recovery by spring.

Investors look for Micron to continue its streak of beating earnings estimates. The company has exceeded expectations on both EPS and revenue for four consecutive quarters, yet stock performance has remained stagnant within a $25 price channel over the past year. Market analysts are projecting that a solid earnings report, coupled with increased 2025 estimates, could finally catalyze a breakout.

A recent analysis from UBS raised its price target for Micron shares from $125 to $130, citing an improved pricing outlook for its memory products. Most analysts covering Micron remain optimistic, with 10 out of 12 ratings indicating a ‘buy’ and only two suggesting a ‘hold’. The consensus price target suggests a potential upside of over 20% from Thursday’s intraday value.

As Micron approaches its earnings release, option traders are anticipating increased volatility, with estimated price fluctuations potentially reaching $10.84 for the week following the announcement.

Should Micron meet or exceed earnings expectations, it could provide a much-needed boost to the stock, countering prevailing market challenges. However, a shortfall in anticipated performance could raise concerns among investors, given the company’s robust historical performance.

As the tech market remains sensitive to earnings reports, all eyes will be on Micron on Thursday afternoon to gauge its financial health and outlook for the remainder of 2025.