Business

Microsoft (MSFT) Stock: Earnings Preview, AI Leadership, and Investment Outlook

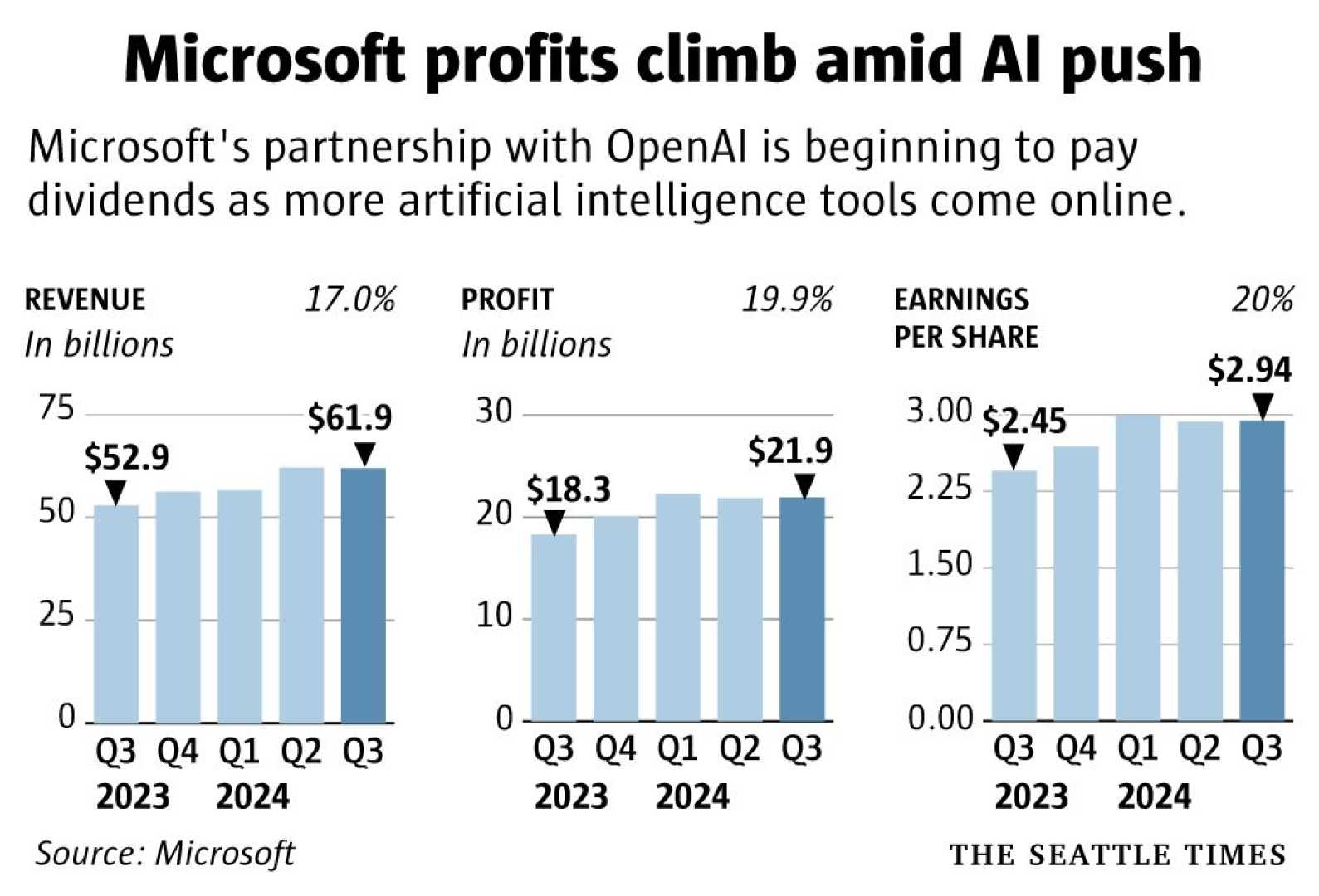

Microsoft Corporation (MSFT) is set to announce its first-quarter earnings for Fiscal 2025 on October 30, and investors are keenly watching several key metrics. Wall Street analysts expect Microsoft’s Q1 FY25 EPS to rise about 4% year-over-year to $3.11, with revenue projected to increase by more than 14% to $64.57 billion.

The focus will be on the growth of Azure, Microsoft’s cloud services platform, and the impact of the company’s significant investments in artificial intelligence (AI). Microsoft has been at the forefront of AI, highlighted by its $10 billion investment in OpenAI, the creator of ChatGPT. This investment has led to the development of innovative tools such as Microsoft Copilot, which integrates AI into its Office suite, enhancing productivity for millions.

Analysts from firms like Citi and Evercore have maintained a bullish stance on MSFT stock despite some near-term concerns. Citi analyst Tyler Radke reduced the price target to $497 but kept a Buy rating, citing stability in reseller and CIO surveys and potential for a modest surprise in Q2. Evercore analyst Kirk Materne also reaffirmed a Buy rating with a price target of $500, highlighting the solid demand for Microsoft’s cloud business and the traction gained by Copilot.

Microsoft’s venture capital arm, M12, is actively seeking the next big AI company, emphasizing long-term investments in startups that create value and delight customers. M12’s strategy involves analyzing companies based on four key factors: data, dividends, distribution, and delight. This approach underscores Microsoft’s commitment to investing in AI startups that can reach enterprise customers effectively.

The company’s financial health is robust, with a free cash flow margin exceeding 30% and free cash flow increasing to $74.1 billion over the last trailing 12 months. This financial strength supports Microsoft’s ability to pursue strategic growth investments, making it an attractive option for growth-oriented investors.

Despite potential long-term challenges, including cyclical fluctuations in AI adoption and regulatory risks, the overall sentiment on Wall Street remains favorable. With 27 Buy ratings and three Hold recommendations, Microsoft earns a Strong Buy consensus rating, and the average price target of $503.15 implies an 18% upside potential).