Business

MicroStrategy Shares Surge as Bitcoin Prices Rise Sharply

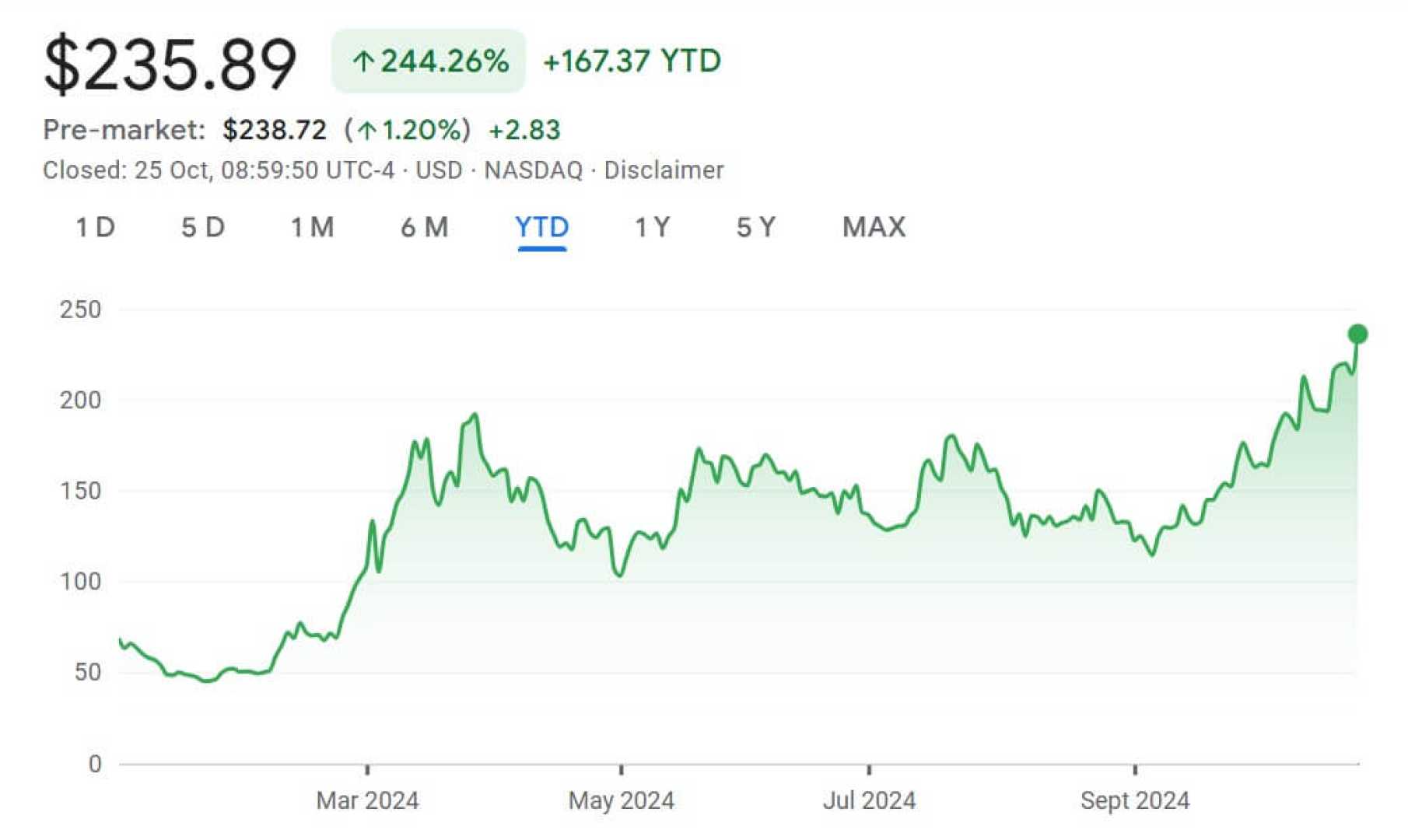

Tysons Corner, Virginia — Shares of Strategy, formerly known as MicroStrategy, increased significantly on Tuesday as Bitcoin prices surged. The rise follows the company’s latest Bitcoin purchase announcement.

On Monday, Strategy disclosed in a regulatory filing that it acquired 7,390 Bitcoin from May 12 to May 18. This latest purchase brings its total holdings to 576,230 Bitcoin, valued at approximately $61 billion based on the current market price.

Strategy’s stock has appreciated by 75% since a low in April, aligning with a general recovery in the cryptocurrency market as concerns over global trade tensions recede. Bitcoin, which hit $107,000 on Tuesday, reached its highest level since January, nearing its all-time high of over $109,000.

Since breaking above the 200-day moving average in January 2023, Strategy shares have shown a bullish pattern. Although the stock retraced to the 50-day moving average in March, it has recently rebounded back toward the high levels it maintained in April and May.

Notably, this surge is taking place with lower trading volumes compared to prior price jumps, suggesting that some large investors may still be hesitant to enter the market. Key resistance levels to watch include $440, which could act as a significant barrier if the stock continues its upward trend.

While upward movement could target an estimated $945, any potential declines may see the stock test support near the $230 level, aligning with previous trading periods in February and March. Additionally, a further drop could lead to a test of around $180.

This rally isn’t solely limited to Strategy. Bitcoin’s dynamic movements have been fueled by renewed interest in Bitcoin ETFs and a backdrop of mixed economic signals that are influencing investments. Data shows spot Bitcoin ETFs attracted over $2.8 billion in net inflows in the first half of May, amidst cautious Federal Reserve policies concerning interest rates.

As Bitcoin’s trading approaches record levels, investors are wary of possible corrections if the price fails to maintain momentum above crucial resistance points around $106,000.