Business

MicroStrategy Stock Soars to Record High After Significant Bitcoin Acquisition

MicroStrategy Inc. (MSTR) has seen its stock price surge to a new all-time high, driven by the company’s latest significant acquisition of Bitcoin. On November 11, 2024, MicroStrategy announced that it had acquired 27,200 additional bitcoins, valued at $2.03 billion, bringing its total Bitcoin holdings to 279,420.

This substantial purchase was funded through at-the-market equity offerings, which raised approximately $2.03 billion. The move reflects MicroStrategy’s ongoing strategy of leveraging stock issuance to finance its Bitcoin acquisitions. As a result, the company’s BTC Yield, a key performance indicator, has shown a year-to-date increase of 26.4%.

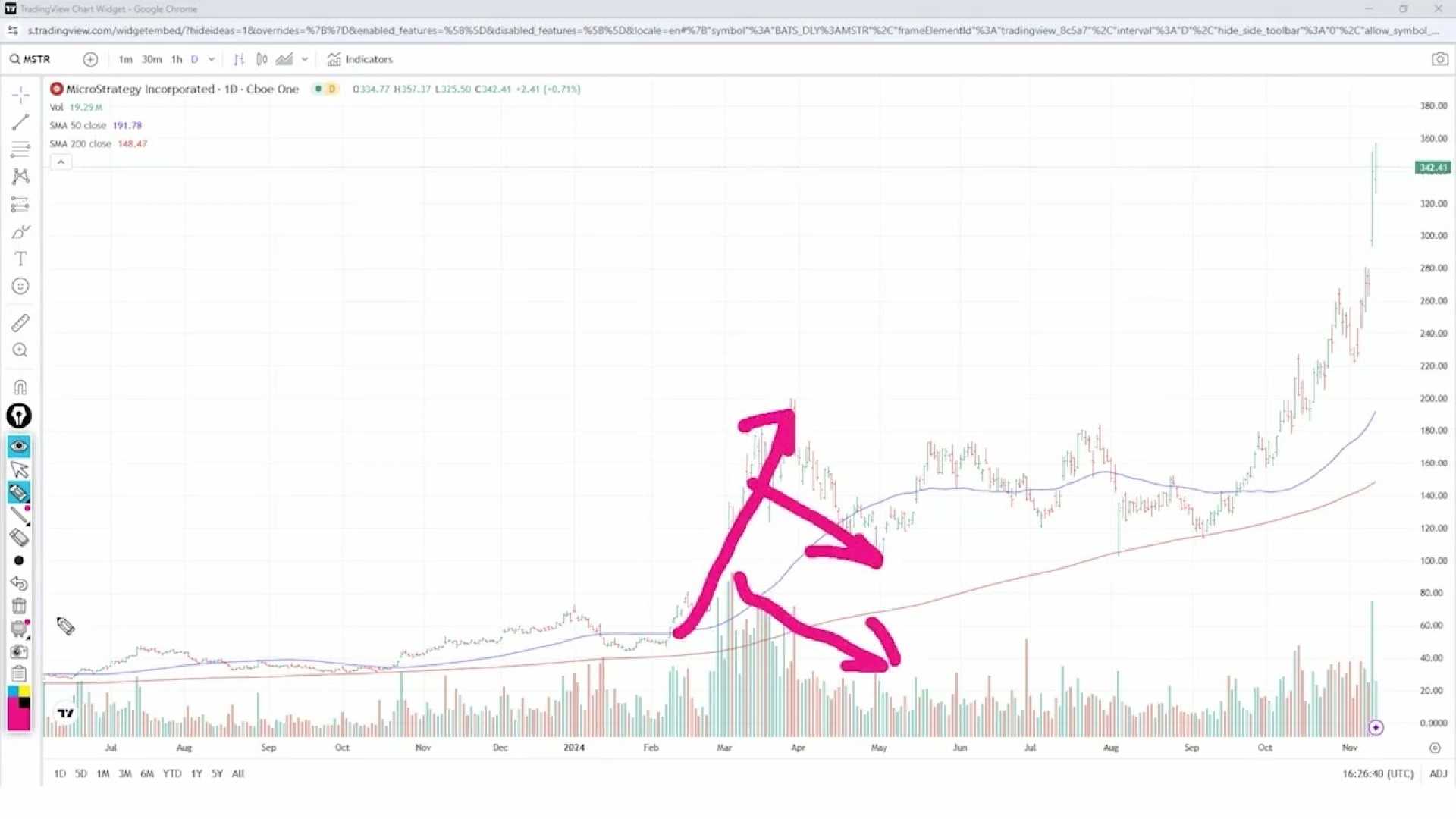

The stock price of MicroStrategy surged by 25% on November 12, 2024, reaching a new record high of $340 and later exceeding $360. This upward trend is closely tied to the performance of Bitcoin, with MicroStrategy’s stock increasingly seen as a vehicle for investors to gain exposure to the cryptocurrency market.

The company’s market cap has significantly increased, now exceeding the value of its Bitcoin holdings. This phenomenon highlights how MicroStrategy has transformed into a de facto Bitcoin holding company, with its stock price heavily influenced by the fluctuations in Bitcoin’s value.

Analysts and investors are now pondering whether it is too late to buy MicroStrategy stock, given its recent rapid growth and the inherent risks associated with its heavy reliance on Bitcoin’s performance. The stock’s technical indicators, such as the 50-day and 200-day moving averages, continue to play a crucial role in its trading dynamics.