Business

Mortgage Applications Plummet as Housing Market Faces Demand Crisis

WASHINGTON, D.C. — Mortgage applications to purchase homes fell sharply in the latest reporting week, with a staggering 39% drop compared to the same week in 2019, according to the Mortgage Bankers Association (MBA). This decline signals a significant decrease in demand within the housing market.

The MBA’s data indicates that mortgage applications serve as an early indicator of housing market dynamics, setting the stage for trends in pending and closed home sales. The collapse in purchase applications highlights the extent to which demand has faded following a period of soaring home prices that spiked by over 50% through mid-2022.

This diminished demand is coinciding with a rise in housing supply. Listings are sitting on the market longer, increasing supply to 4.4 months in April, the highest figure for the month since 2016, as reported by the National Association of Realtors. A lack of inventory was previously cited as the reason for collapsing demand last year.

In 2022, many buyers opted to hold onto their existing homes instead of selling, resulting in fewer homes being listed for sale. Now, those homes are beginning to re-enter the market, precisely as mortgage rates have stabilized between 6.6% and 7.1%, with the latest reports indicating an average conforming 30-year fixed rate of 6.92%.

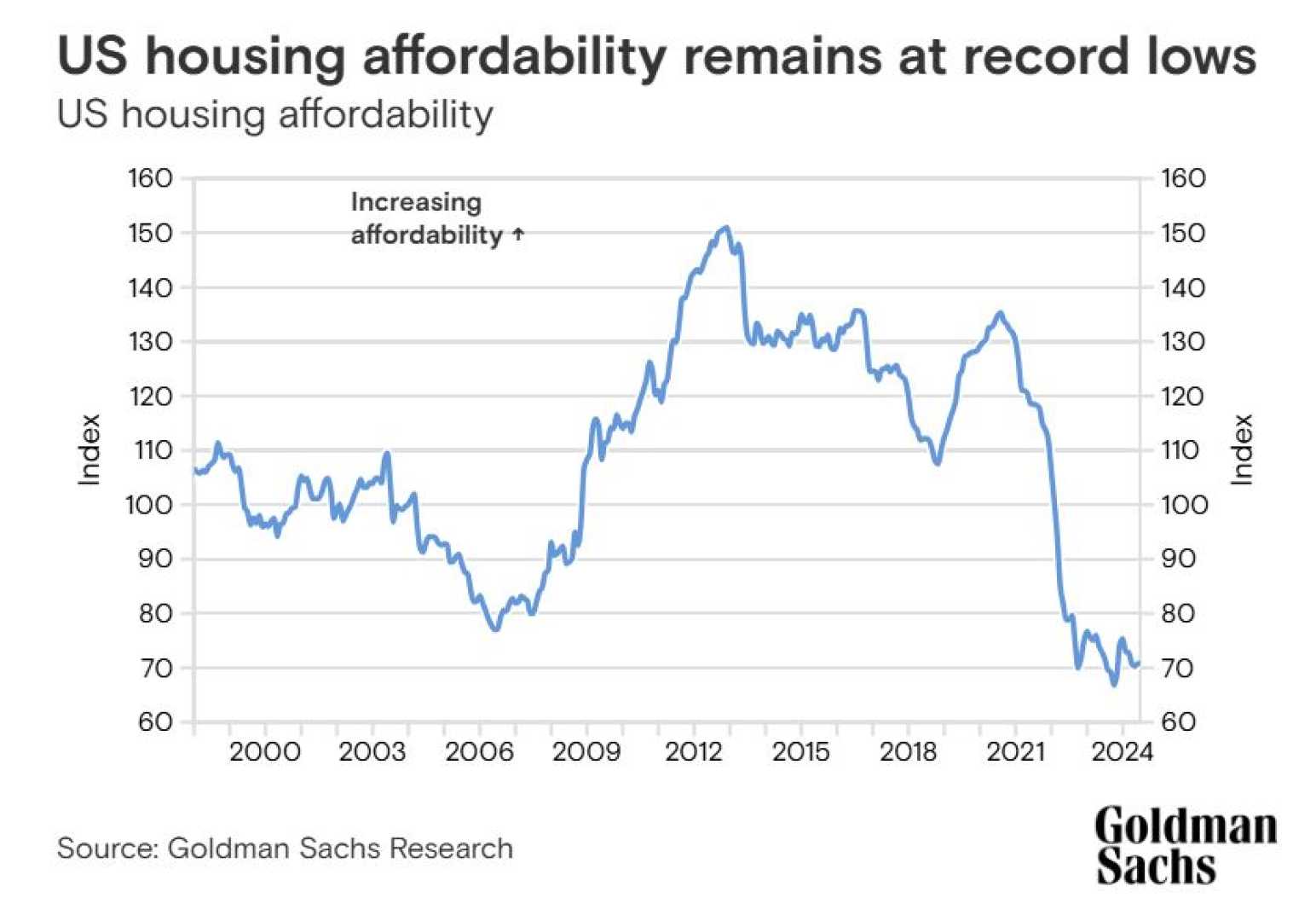

The reality is that while current mortgage rates are relatively stable, the rapid increase in home prices during the 2020-2022 period has created a substantial affordability barrier for prospective buyers. Many are waiting for prices and rates to decrease before entering the market.

The deterioration in mortgage applications has extended to refinances, which have also dropped by 79% from three years ago, illustrating the challenges facing homeowners looking to lower their mortgage rates.

The mortgage lending industry has been hit hard, leading to mass layoffs that have seen employment at nonbank real estate lenders cut by 38% since 2022. For many homebuyers, the waiting game continues as they seek lower prices and more favorable economic conditions.

As housing market distortions persist, it has become increasingly common for potential buyers to find better deals in the rental market than in home purchases, as pressure continues to build within the current economic landscape.