Business

Mortgage Rates Decline: What It Means for Buyers and Refinancers

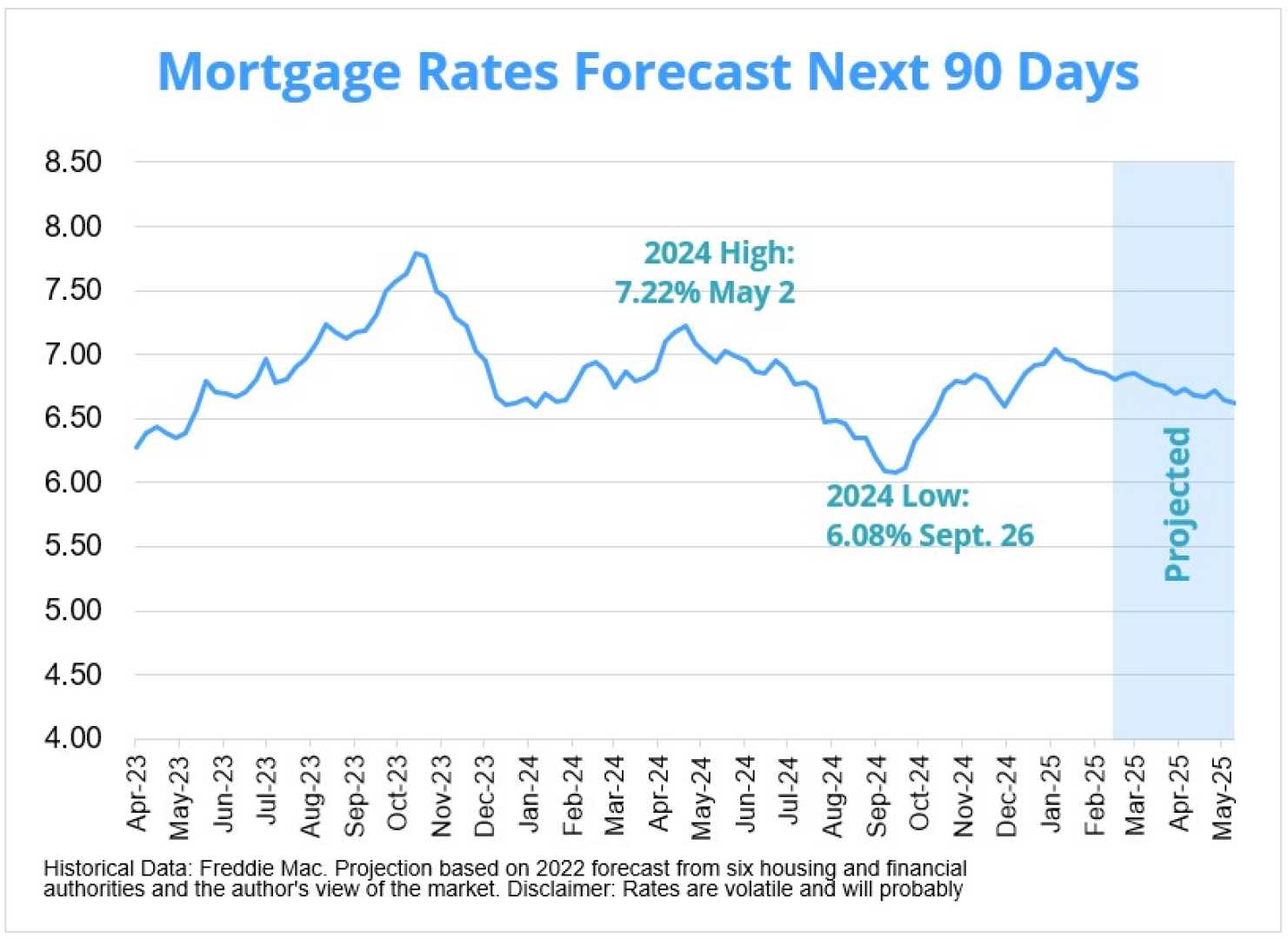

NEW YORK, NY – Mortgage interest rates have fallen across various loan types this week, according to recent data released by Bankrate. As of March 3, 2025, the average rate for a 30-year fixed mortgage is now 6.76%, down from 6.94% the previous week, reflecting a broader trend in the housing market amid fluctuating economic conditions.

The decline in mortgage interest rates is attributed to a mix of factors, including the Federal Reserve’s current stance on interest rates, which remains stable as inflation stays elevated. The most recent Consumer Price Index revealed an unexpected spike in inflation for January while home prices continue to rise, with S&P CoreLogic’s Case-Shiller Index indicating a 3.9% increase annually in December 2024.

“The housing economy is currently in a holding pattern as the impact of the tariffs and persistent inflation is coming into play,” said Dr. Selma Hepp, chief economist for CoreLogic. Hepp noted that while builders are providing incentives, the higher mortgage rates dampen demand from lower-income buyers.

Existing home sales are projected to face challenges due to fewer listings driven by modest buyer activity, according to the analysis.

The average rates for other mortgage types also saw noticeable decreases. The 15-year fixed mortgage rate is now pegged at 6.05%, down from 6.26% last week. Similarly, the 5/1 ARM is at 6.12%, decreasing 8 basis points from the previous week. Moreover, jumbo mortgages have fallen to an average rate of 6.87%, down from 7.01%.

The average monthly payment on a 30-year fixed mortgage, assuming a loan amount of $100,000, is approximately $649.26. This represents a decrease of $12.02 from last week’s payment. On a 15-year fixed mortgage, the payment tallies at around $847 for the same loan amount.

As homeowners consider refinancing, the average refinance rate for a 30-year fixed mortgage is currently 6.77%, reflecting an 18 basis point dip from the previous week. Lawrence Yun, chief economist at the National Association of Realtors, remarked, “Mortgage rates have refused to budge for several months despite multiple rounds of short-term interest rate cuts by the Federal Reserve,” indicating that high home prices continue to exacerbate affordability challenges.

The upcoming Federal Reserve meeting on March 18 and 19 is anticipated to provide updated economic projections which may influence future rate movements. Fluctuations in mortgage rates typically follow changes to the 10-year Treasury yield, which has been minimally impacted by recent economic data.

With 84% of total mortgage debt priced below 6%, homeowners with existing loans might not benefit from refinancing unless their current rates exceed the prevailing levels significantly. “If your intention is to take cash out of your home to pay down credit card debt, I’d urge caution,” said Jeff Ostrowski, principal writer at Bankrate. Ostrowski stresses the need for borrowers to maintain control over their spending before leveraging home equity.

Ultimately, potential homebuyers and current homeowners looking to refinance may find opportunities within the current rate decline. However, economic conditions, inflation rates, and housing demand will continue to dictate the trajectory of mortgage rates as the year unfolds.