Business

Mortgage Rates Drop to Lowest Levels in Recent Months Following Economic Data

WASHINGTON, D.C. — Mortgage rates for new 30-year loans have decreased significantly, averaging 6.81% this week, following the release of disappointing economic data. Last Wednesday, consumer inflation data indicated a faster-than-expected acceleration, causing rates to spike. However, recent numbers, particularly weaker Retail Sales figures, have contributed to a reversal.

The decrease in mortgage rates marks a notable shift as many lenders reevaluate their offerings. Rates had initially surged last week, reflecting the market’s response to the Consumer Price Index (CPI) report released on February 12, 2025, revealing a year-over-year inflation rate of 3%. This figure stirred concerns about persistent inflationary pressures.

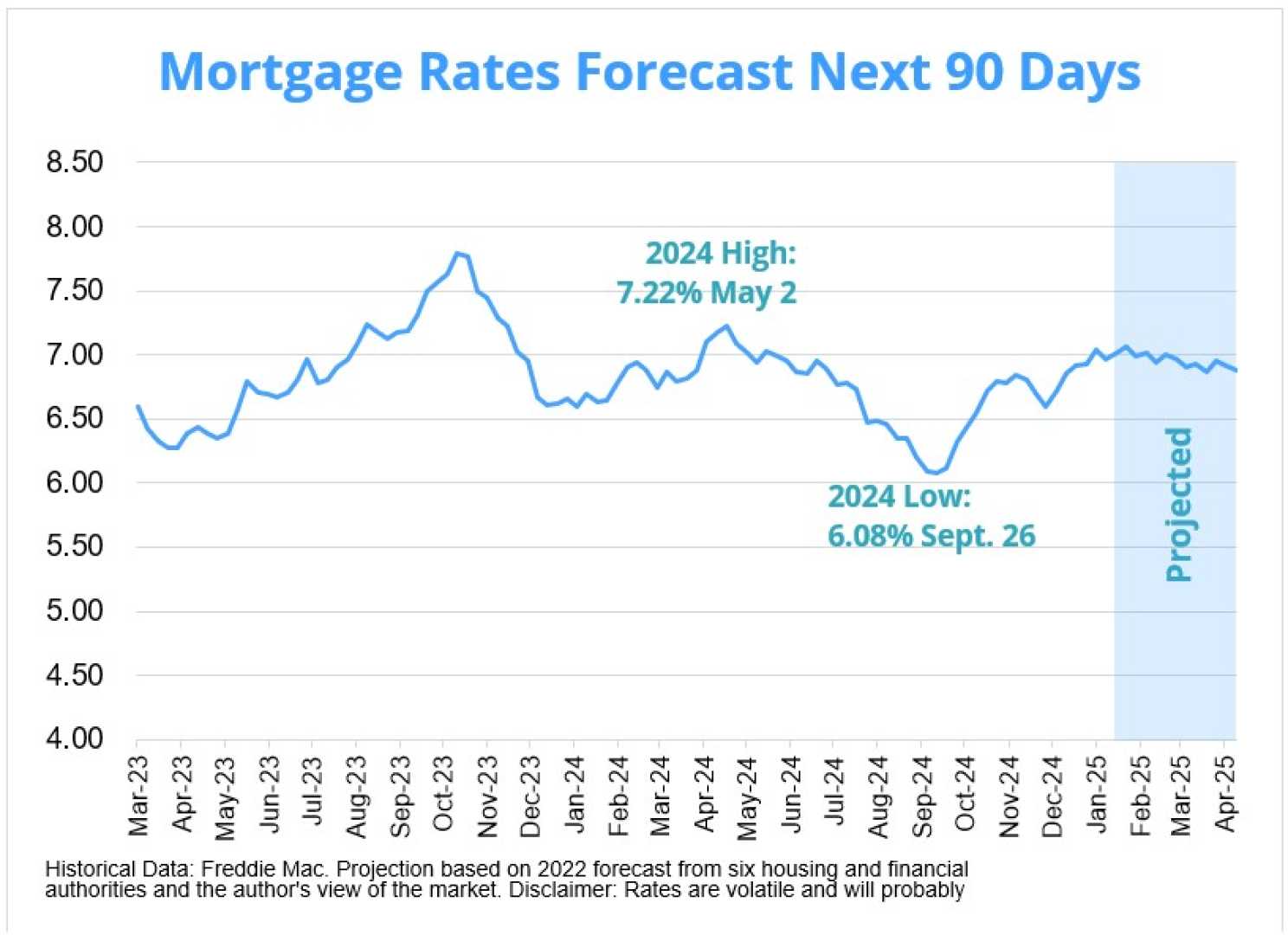

From a recent high of 7.13% four weeks ago, the average 30-year fixed mortgage rate is now edging down, approaching levels not seen since late December. According to Bankrate’s latest survey, this represents a decrease of 3 basis points from last week’s average of 6.84%. Additionally, the 15-year fixed mortgage rate also fell to 5.97%. These rates are reflective of a broader trend of mortgage costs, which have surged high over recent months.

“We are seeing a more quiet period as the market digests the latest economic indicators,” said Freddie Mac‘s Chief Economist, Sam Khater. “Overall, lower-than-expected Retail Sales suggest cautious consumer behavior, which could lead to a sluggish economic outlook and, consequently, lower rates.”

Mortgage rates have experienced volatility over the previous months, initially falling to a two-year low of 5.89% in September 2024 before climbing back up. The current average rates stand in stark contrast to the previous year’s peak of 8.01% recorded in October 2023. The variation in mortgage rates across lenders requires potential buyers to actively shop for the best interest rates.

In the context of these changes, some experts suggest borrowers take advantage of lower rates before potential hikes return as the Federal Reserve’s influence continues to linger. Historical trends indicate that mortgage rates typically follow the movements of the 10-year Treasury note, which is currently fluctuating around 4.46%, providing a margin that impacts mortgage pricing.

A common they see in the industry relates to borrowers’ behavior in anticipation of more favorable rates. Home buyers are increasingly advised to mobilize quickly in the current environment, as more favorable rates could prompt an uptick in demand and subsequently push rates up again. “Procrastination can cost buyers significantly, especially in these fluctuating times,” cautioned Lawrence Yun, Chief Economist at the National Association of Realtors.

The interplay between macroeconomic indicators and mortgage market rates is complex. Recent increases in Treasury yields due to higher inflation expectations could create further upward pressure on mortgage rates in the future. Consequently, potential borrowers must remain informed and flexible as they navigate through these market dynamics.

Looking ahead, it is essential to consider various lending criteria such as credit scores, which can markedly influence mortgage offers. The current conditions suggest a cautious optimism regarding rates but call for vigilance as economic trends evolve. On Monday, bond markets and lenders will be closed in observance of a holiday, potentially affecting rate fluctuations next week.