Business

Mortgage Rates Hit New Low Amid Economic Uncertainty

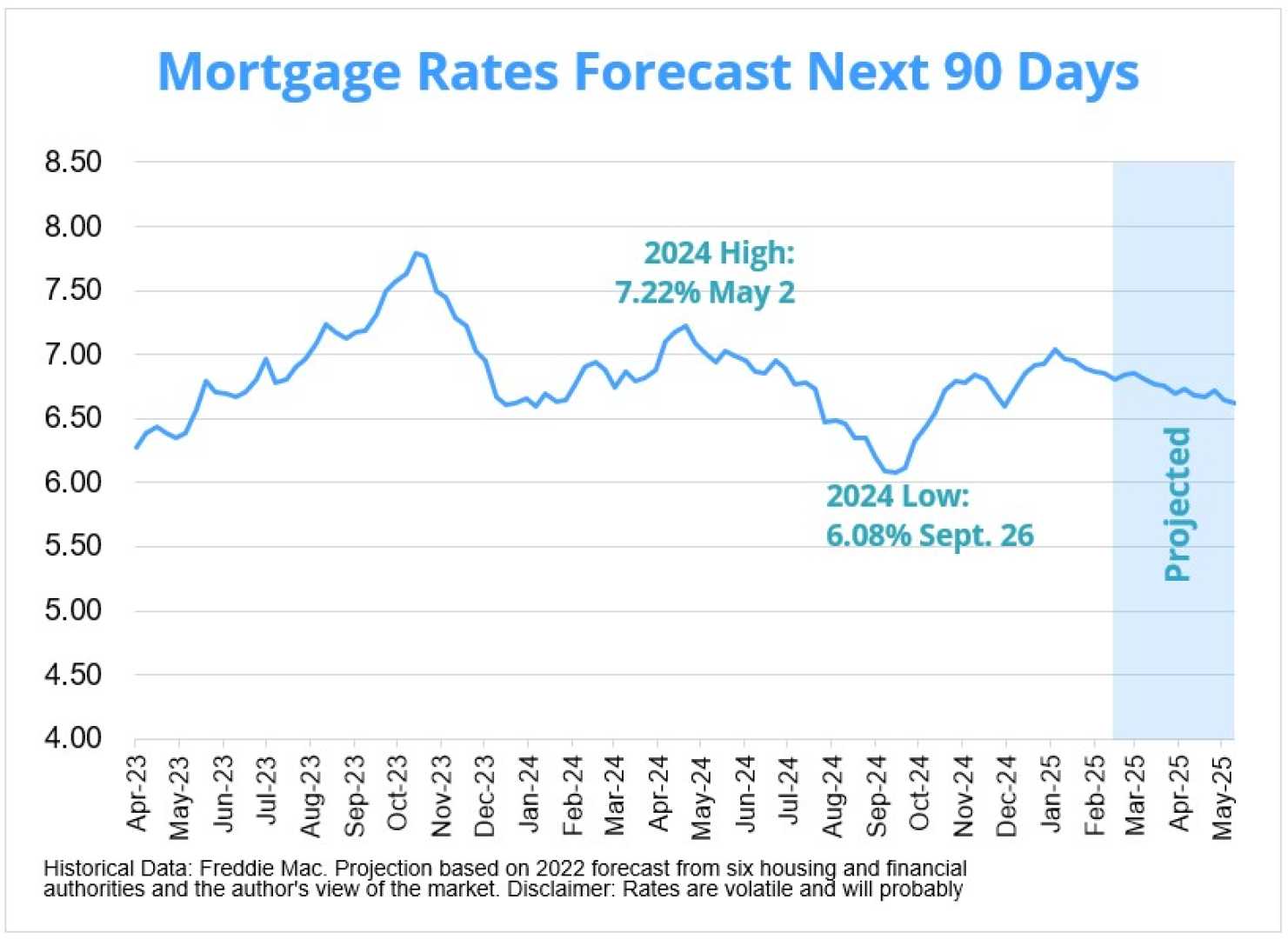

WASHINGTON, D.C. — Mortgage rates dipped again on Friday, bringing the average of new 30-year loans to 6.70%. This marks a decline over five of the past six market days as rates steadily retreated from a six-week high observed in late March.

The decrease of 5 basis points in the 30-year average translates to a total decline of 15 basis points in just over a week, though rates remain slightly above the 2025 low of 6.50%. In January, the average 30-year mortgage rate previously surged to 7.13%, the highest since October.

Despite recent improvements, the current rates are still more than 1.3 percentage points lower than last year’s peak of 8.01%. Comparatively, last September’s averages for 30-year loans dropped to 5.89%, but this relief was short-lived as rates surged by almost 1.25 percentage points in the following months.

Rates for 15-year mortgages also saw a decrease, with the average slipping 7 basis points to 5.77%. This is better than the recent four-month low of 5.60%, yet still elevated compared to the two-year low of 4.97% achieved in September. The 15-year average remains about 1.3 percentage points lower than the historic high of 7.08% recorded in October 2023.

In the jumbo loan sector, 30-year mortgage rates ticked down slightly by 2 basis points to an average of 6.71%. Last fall, jumbo rates fell to a low of 6.24%, but they previously peaked at 8.14% in October 2023, the highest jumbo mortgage rates seen in over 20 years.

Freddie Mac, a government-sponsored buyer of mortgage loans, released its weekly rates, noting that the current average for 30-year loans is slightly lower than prior readings. Their methodology differs from the daily data reported by Investopedia, which may provide a timelier view of rate fluctuations.

As rates continue to shift, financial expert Melissa Cohn warns potential buyers of ongoing uncertainty, stating, “When the higher costs of goods start to push up the rate of inflation, it is quite possible that rates will go back up. I expect to be in a mortgage rate roller coaster for the next few months.”

Homebuyers are encouraged to lock in favorable rates as market conditions remain unpredictable. Borrowers with strong credit profiles could secure even lower rates than averages suggest.

The fluctuations in mortgage rates are attributed to various economic factors, including consumer behavior, inflation rates, and monetary policy. The Federal Reserve‘s actions, particularly tapering bond purchases and altering the fed funds rate, have had a significant impact on mortgage cost trends.

As the Fed holds steady on its current rates, potential reductions are forecasted. At their March meeting, Fed officials projected only two quarter-point cuts for the remainder of the year. Observation of future economic indicators will be crucial for consumers navigating the mortgage landscape.

With current rates hovering between 6% and 7% for the foreseeable future, homebuyers are advised to compare quotes from various lenders to find the best fit for their financial profiles. Lenders recommend obtaining multiple quotes, as doing so can lead to significant savings over the duration of a loan.