Business

Mortgage Rates Hold Steady Around 6.6% as Economic and Inflation Data Influence Future Trends

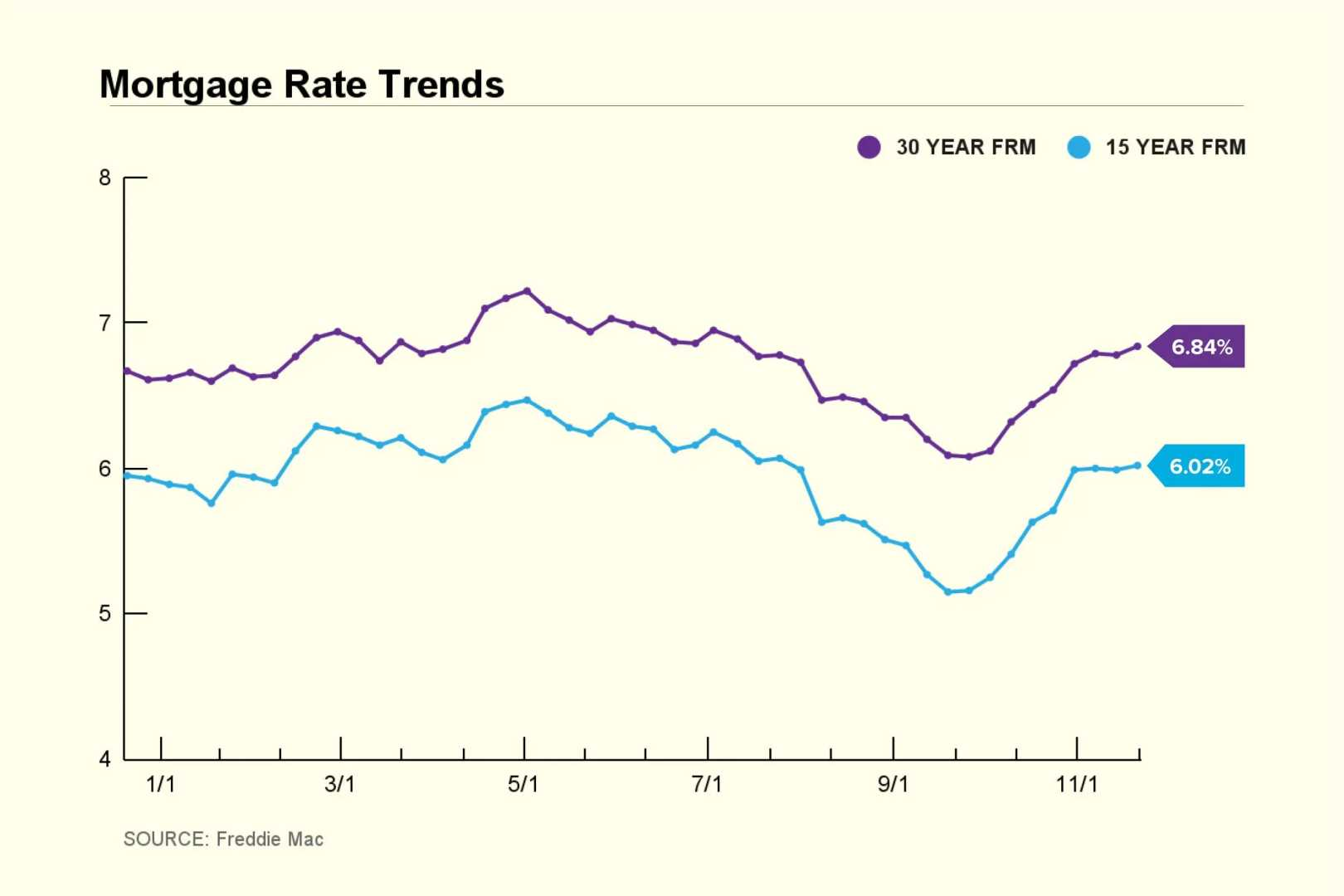

As of November 25, 2024, mortgage rates have remained relatively stable, with the average 30-year fixed-rate mortgage hovering around 6.60%. According to data from Freddie Mac and other lenders, the rates have seen minimal changes over the past week. The average offered interest rate for a conforming 30-year fixed-rate mortgage decreased by just one basis point to 6.78%.

For 15-year fixed-rate mortgages, the rates also saw a negligible decrease, dropping by one basis point to 5.99%. The rates for adjustable-rate mortgages, such as the 5/1 ARM, have been virtually steady, with the initial fixed interest rate increasing by a single basis point to 6.06%.

The stability in mortgage rates is partly due to the recent Federal Reserve meeting, where a 25 basis point cut in the federal funds rate was implemented. However, this cut did not significantly impact mortgage rates, as yields that influence these rates have increased in recent days due to concerns about future budget deficits and government debt.

Looking ahead, mortgage rates are expected to remain elevated in the near term due to a strong labor market and slightly elevated inflation. The Consumer Price Index (CPI) for October came in slightly higher than expected, which has kept mortgage rates from dropping. However, if inflation continues to slow, there is a likelihood that mortgage rates could ease in 2025, especially if the Federal Reserve lowers the federal funds rate further.

Refinance rates have also been elevated, with 30-year refinance rates averaging around 6.35% and 15-year refinance rates around 5.67% last month. Homebuyers and existing homeowners are advised to carefully consider their financial circumstances before deciding to refinance, as the decision should be based on whether the savings from a lower rate can recoup the refinancing costs in a reasonable time.