Business

Mortgage Rates Rise Despite Cooling Inflation

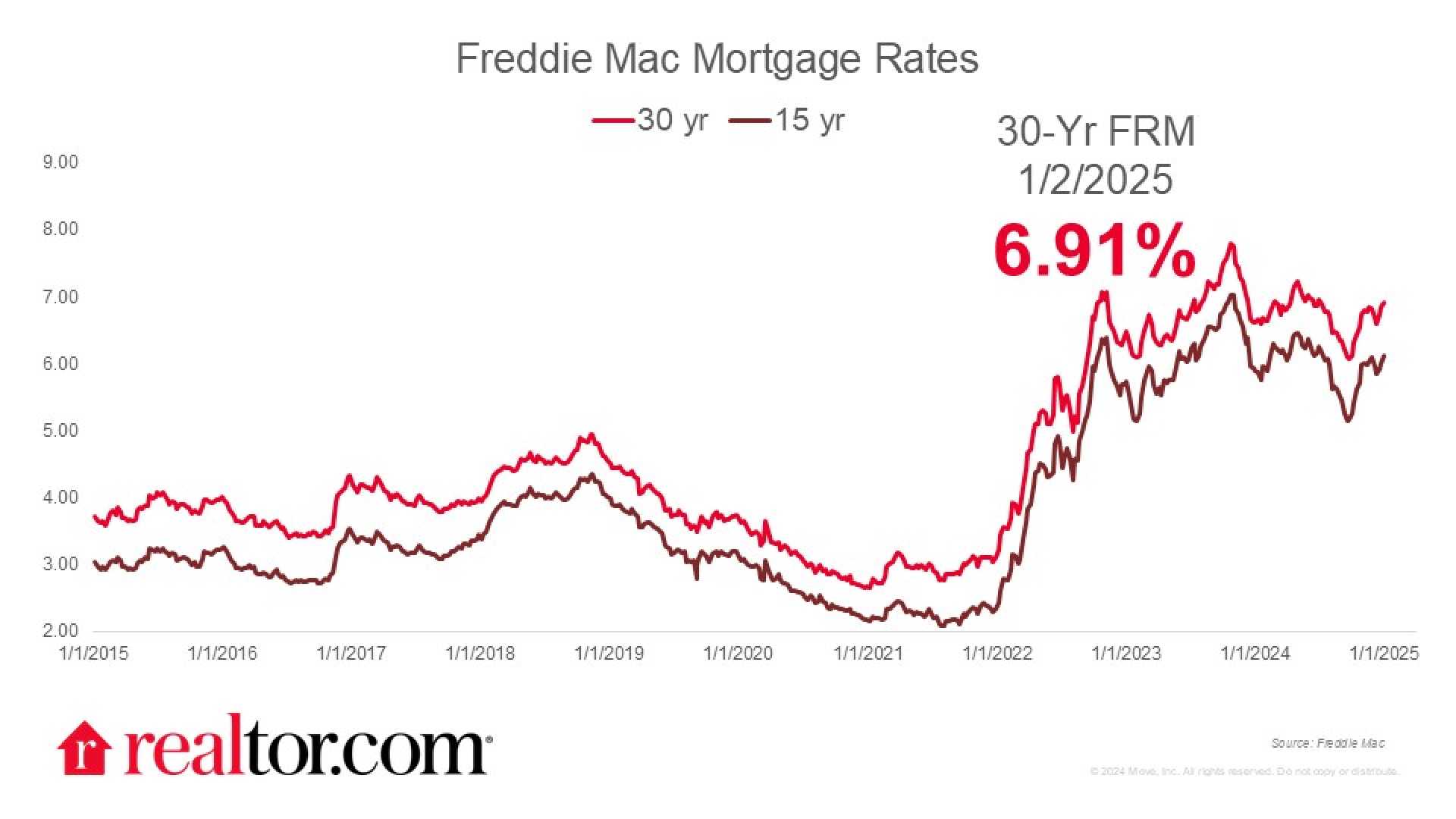

WASHINGTON, D.C. — Mortgage rates increased slightly this week, with the 30-year fixed rate averaging 6.88 percent, up from 6.82 percent the previous week, according to Bankrate‘s latest lender survey.

In detail, this week’s survey indicates that the average rate for a 30-year fixed mortgage stands at 6.88 percent, with 0.32 discount points included. Meanwhile, the rate for a 15-year fixed mortgage is currently 6.09 percent, and 6.90 percent for adjustable-rate mortgages.

Experts note that despite the Federal Reserve’s three consecutive rate cuts last year, mortgage rates continue to be dictated by investor interest, particularly in the 10-year Treasury bonds. Economic uncertainties often lead investors to Treasury bonds, which can drive yields and mortgage rates lower.

Currently, the national median family income is reported at $97,800, with the median price of an existing home sold in March 2025 being $403,700. This results in a monthly payment of $2,123, constituting about 26 percent of a typical family’s monthly income.

“Homebuyers want to see rates decrease further, but it’s likely they will stay in the high 6 percent range this spring,” stated Lisa Sturtevant, chief economist at Bright MLS. Additionally, inflation still hovers above the Federal Reserve’s target of 2 percent, impacting housing and mortgage rates.

Despite ongoing volatility in the markets and pressures due to tariffs, economists predict that rates are not expected to significantly drop. Samir Dedhia, CEO of One Real Mortgage, expressed that with inflation easing, rates may remain within the 6.5 to 7 percent range in the near future.

As of now, mortgage rates continue to reflect wider economic conditions. They have fluctuated significantly in recent months, illustrating the impact of fiscal policy and external market factors.