Business

U.S. Mortgage Rates Show Minimal Changes Amid Economic Uncertainty

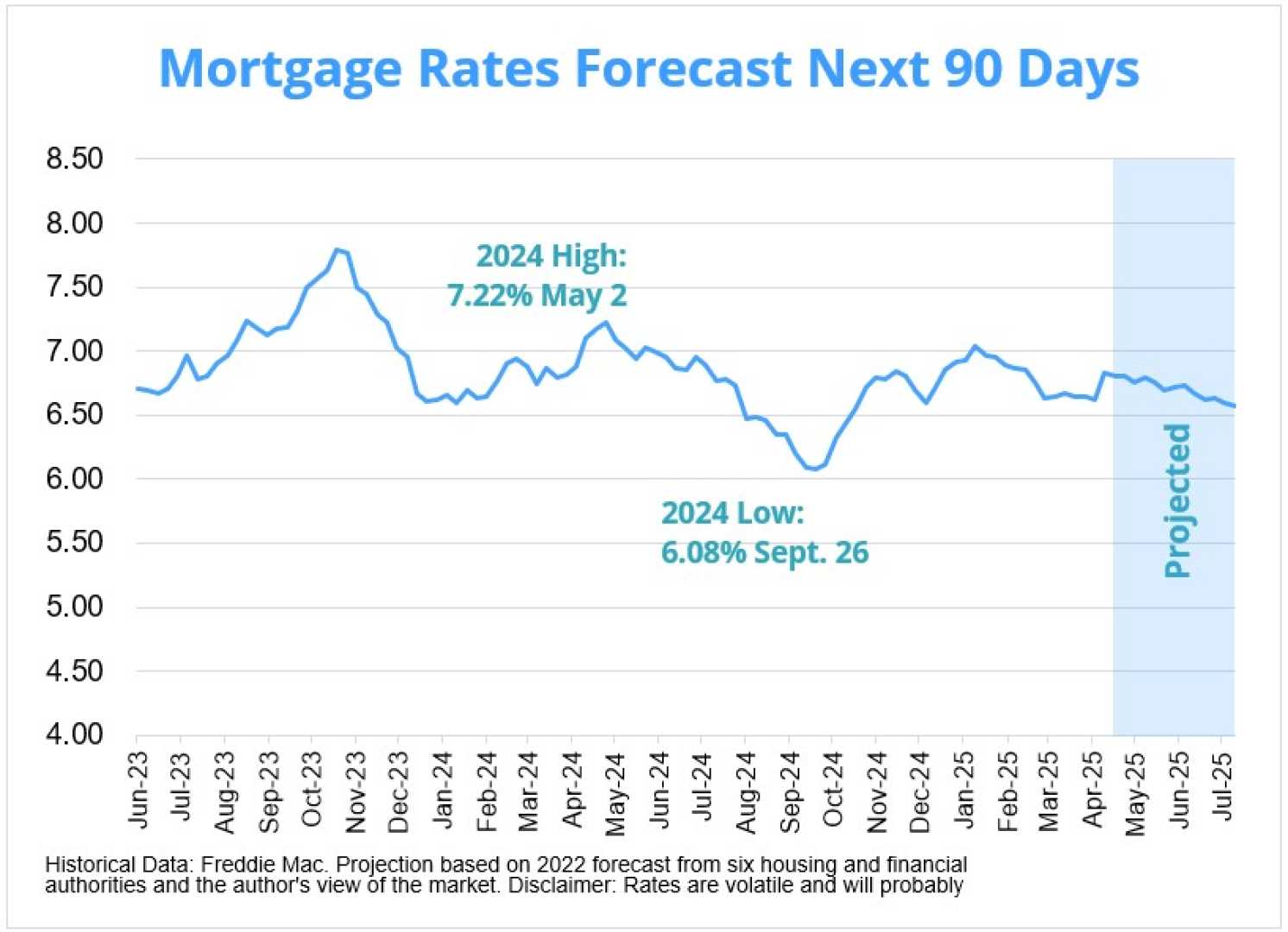

WASHINGTON, D.C. — The average interest rate for a 30-year fixed-rate mortgage loan in the United States has slightly decreased to 6.797% as of June 25, 2025, according to Optimal Blue, a mortgage data company. This marks a reduction of approximately 1 basis point from the previous week.

Despite expectations that the Federal Reserve’s recent rate cuts would lead to lower mortgage rates, the impact has been limited. Rates briefly fell before the September Fed meeting last year but quickly rebounded. By January 2025, the rate for 30-year fixed mortgages exceeded 7% for the first time since May 2024, a stark contrast to the record low of 2.65% seen in January 2021 during the pandemic.

Experts suggest there is little chance of returning to the remarkably low rates of 2% to 3% in the foreseeable future. However, they remain hopeful that rates approaching 6% are feasible, provided inflation is controlled and the economy stabilizes.

Recent trends show a slight dip in mortgage rates at the end of February, hovering close to 6.5% but later rising again. The prevailing economic uncertainty, influenced by potential government policies under President Donald Trump, has caused concern among analysts regarding inflation and the labor market.

Homebuyers today face the challenge of high mortgage rates, which could make affordability a concern. Some buyers may negotiate rate buydowns with builders when purchasing new homes to mitigate costs.

Current rates reflect a broader historic perspective where rates around 7% were common from the 1970s to the 1990s, following significant spikes in the early 1980s. For example, mortgage rates exceeded 18% in late 1981. This historical context does not provide much consolation for homeowners locked into lower pandemic-era rates, sometimes referred to as “golden handcuffs.”

The overall health of the U.S. economy significantly influences mortgage rates. As inflation concerns persist, lenders may raise rates to safeguard their profits. Additionally, the national debt and consumer demand for mortgages also play critical roles in rate fluctuations.

Mortgage rates are not directly set by the Federal Reserve but are influenced by the federal funds rate and the Fed’s management of its balance sheet. In recent months, the Fed has allowed its balance sheet to shrink by not replacing maturing assets, which can drive rates higher.

Applying for different types of loans and shopping among various lenders remains essential for homebuyers seeking the best mortgage terms for their unique situations. Freddie Mac research indicates that homebuyers could save $600 to $1,200 annually by applying with multiple lenders. As the market changes, staying informed about mortgage rates and options becomes increasingly important for potential homeowners.