Business

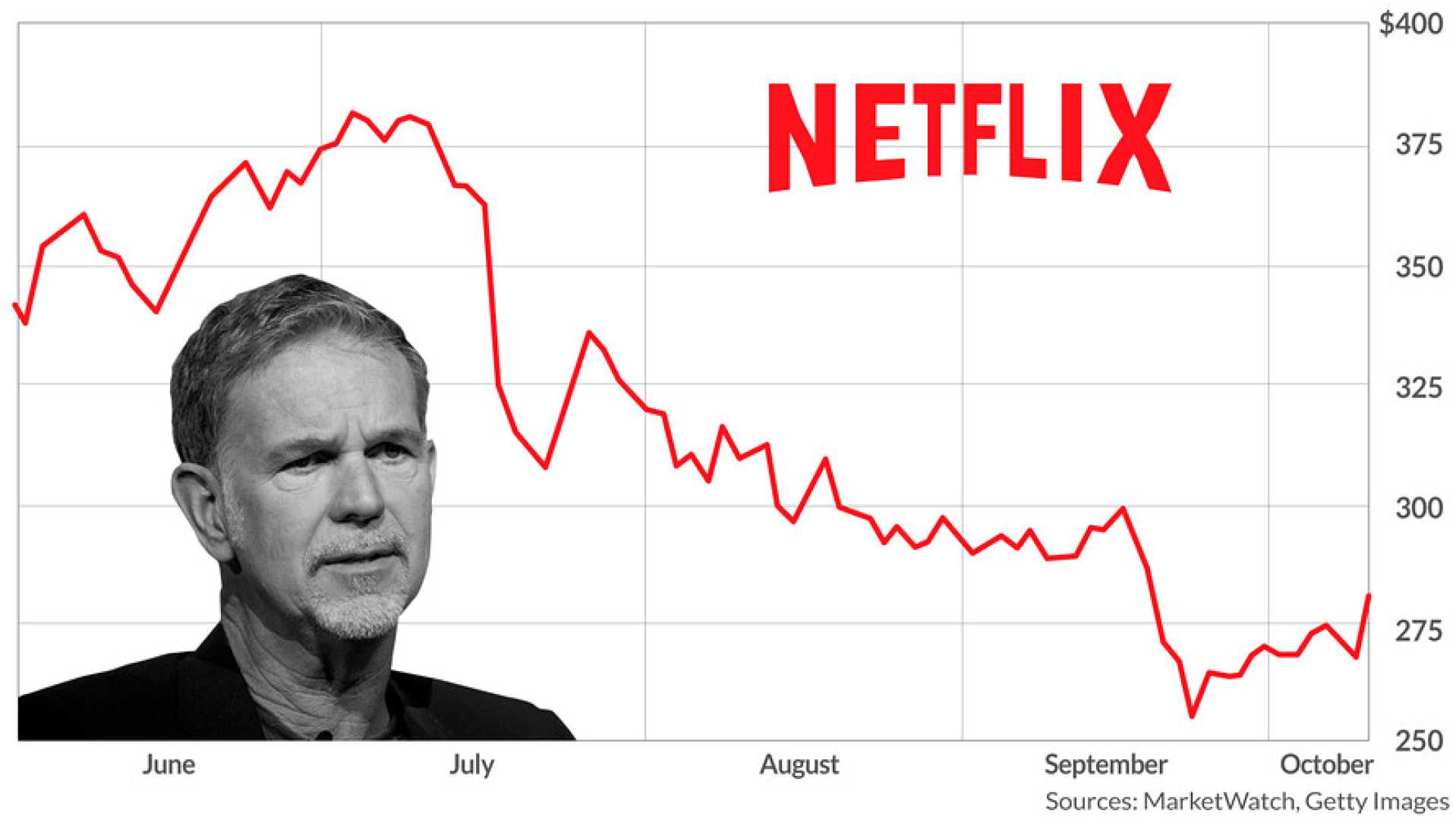

Netflix Shares Plummet Amid Slowing Subscriber Growth Projections

LOS ANGELES, Calif. — Shares of Netflix fell 8.5% on Thursday as investors reacted to analyst projections indicating slowing subscriber growth following the company’s record gains attributed to its password-sharing crackdown last year. The decline in Netflix’s stock coincided with a broader market downturn spurred by President Donald Trump‘s changing policies on tariffs imposed on Canada and Mexico.

Other media and tech stocks suffered similar fates on Thursday, with Spotify dropping 7.4%, Warner Bros. Discovery and Roku each declining 6.4%, and Disney and Meta falling by 3.6% and 4.35%, respectively. Amazon‘s stocks were down 3.7%. In contrast, Paramount Global gained 2.2%, while Comcast and Sony saw slight increases of 2% and 0.3%, respectively.

The market indexes reflected these trends, with the S&P 500 falling 1.78% and the Nasdaq Composite declining 2.61%. This sweeping decline followed President Trump’s announcement that he would suspend new tariffs on most imports from Mexico and Canada until April 2, just two days after initiating a trade battle by announcing 25% tariffs on the two nations.

In a note published Thursday morning, a team of analysts at MoffettNathanson, led by Robert Fishman, highlighted Netflix’s record growth in the latter half of 2024, noting the addition of 24 million new subscribers. While the analysts suggested that Netflix might maintain strong growth for a few more quarters driven by its content offerings and advertising tier, they cautioned that the effects of the password-sharing crackdown are expected to taper off. “It is likely Netflix has a few more quarters of strong subscriber growth driven by its content slate and ad-tier,” Fishman said, but added, “we do expect the benefits of the password-sharing crackdown to slow.”

As of the first quarter of 2025, Netflix ceased providing quarterly subscriber forecasts, choosing instead to focus on financial metrics like engagement and profitability to portray its overall health and trajectory. MoffettNathanson maintained its “neutral” rating on Netflix, with a 12-month price target set at $850 per share. However, they noted that overall engagement statistics indicate a 6% decline in average daily engagement per global subscriber in late 2024. This data implies that the underlying subscriber growth may not represent a substantial expansion of Netflix’s user base but rather signifies a successful monetization strategy involving existing users.

On the previous day, Netflix Chief Financial Officer Spencer Neumann expressed optimism at an investor conference, emphasizing the company’s efforts to attract more global subscribers and grow top-line revenue. “We’re not anywhere near a ceiling” in terms of content spending, Neumann stated, clarifying that Netflix is budgeting $18 billion for cash content this year, reflecting an 11% increase from the $16.2 billion spent in 2024.