Business

Pi Network Price Surges Amid Binance Listing Speculation

Auckland, New Zealand — Pi Network (PI) has captured attention in the cryptocurrency space as speculation grows about a potential listing on Binance, one of the largest global exchanges. On March 8, 2025, the token’s price rebounded to $1.7650, up nearly 190% from its low of $0.6156 on February 20, following its mainnet launch.

The surge in market interest has been fueled by the project’s resilience, which has allayed fears that Pi Network might be a scam. Initially, many questioned its legitimacy following significant price volatility after the mainnet launch. With a market capitalization exceeding $13 billion, Pi Network is now larger than other cryptocurrencies that have recently applied for exchange-traded funds (ETFs), such as Stellar and Litecoin.

Pi Network has gained substantial traction, boasting daily trading volumes that exceed $800 million. It is already listed on multiple exchanges, including OKX, MEXC, and Gate.io, although tier-1 platforms like Binance and Coinbase have yet to include it. Determining whether these platforms will feature Pi is critical, as community sentiment indicates strong support for a possible Binance listing. In a recent poll conducted by Binance, 86% of participants expressed a desire for Pi to be listed.

“A Binance listing would be a game-changer for Pi Coin. We could see prices soaring all the way to $10 if that happens,” stated crypto analyst Master Ananda, highlighting the importance of exchange availability and liquidity in driving investor interest.

However, potential risks remain. Pi Network’s maximum supply is capped at 100 billion tokens, with only 7 billion currently in circulation. New token unlocks, expected to release over 1.4 billion tokens throughout 2025, may lead to price dilution for existing holders. Analysts closely monitor this dynamic as it could counter price appreciation depending on market reception.

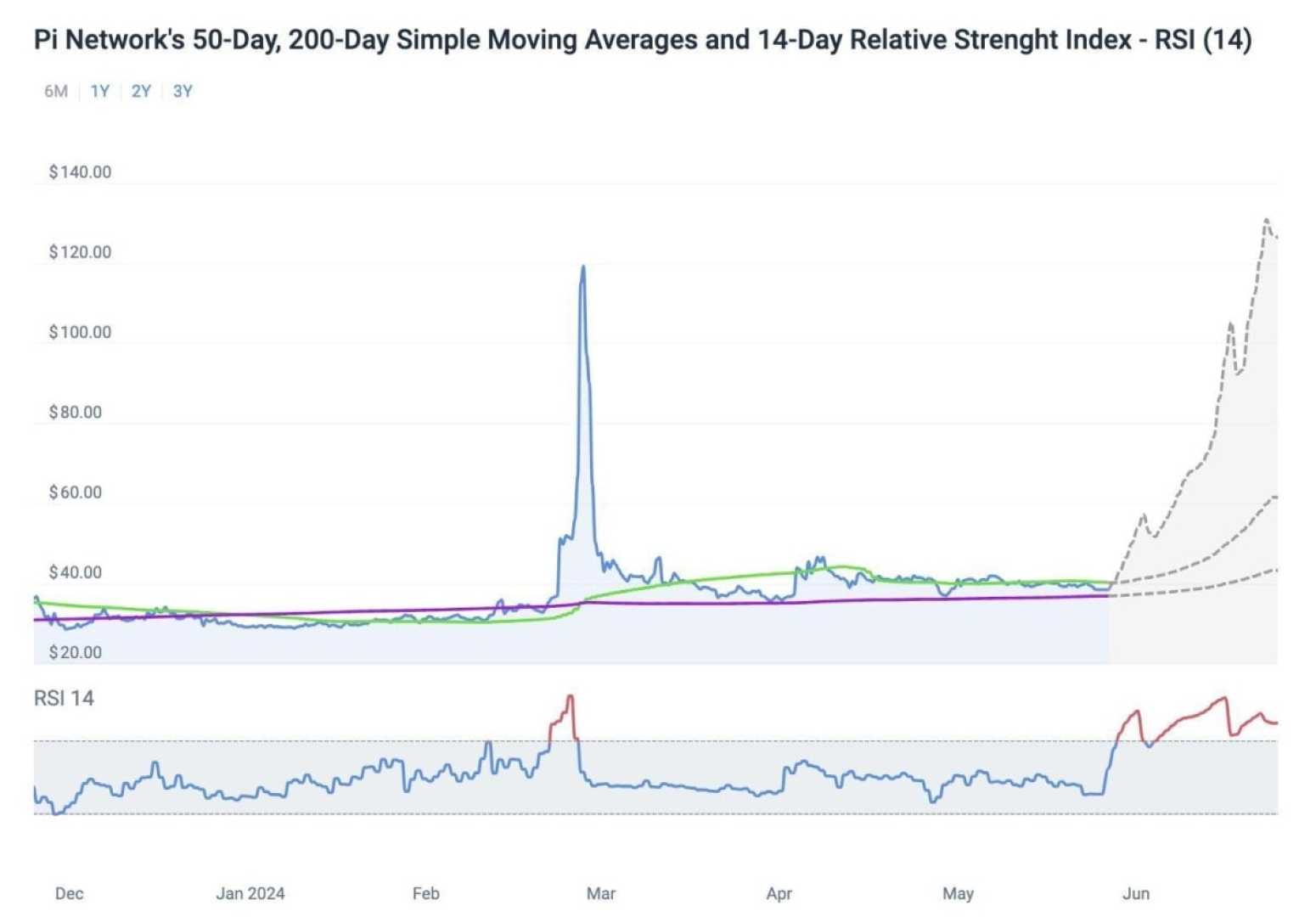

Currently, the Pi token is hovering around $1.80 after peaking at $2 earlier in the week. Technical analysis reveals the formation of a wedge pattern, indicating potential market bearishness unless it surpasses key resistance levels around $2.21. On the downside, a failure to maintain support above $2.10 could lead to further declines towards $1.50 or even $1.00.

In addition to the Binance speculation, the Pi Network team announced an extension for its Know Your Customer (KYC) verification deadline to March 14, 2025. This delay aims to allow more users ample time to verify and transition to the new system, a step the organization emphasizes as crucial to its security and overall success.

Market analysts are cautiously optimistic about Pi’s future, with projections suggesting the potential for a spike to $5 if bullish sentiment endures. However, the road ahead will see ongoing scrutiny over market trends and exchange developments. Analysts warn against overwhelming enthusiasm without official confirmation of a Binance listing, as events could sway either way.

As speculation swirls and March unfolds, the Pi Network is poised to either solidify its place in the crypto realm or struggle under the weight of market volatility. Investors remain alert to time-sensitive developments impacting Pi Network’s value in the broader cryptocurrency landscape.