Business

New SBA Loan Rules Target Fraud, Impact Small Business Applications

GLASGOW, Scotland — The Small Business Administration (SBA) has implemented new rules for loan applicants in response to concerns over potential fraud, following an announcement from the Department of Government Efficiency (DOGE). As of 2023, the SBA guarantees loans for small businesses across the United States, facilitating access to essential funding by reducing lenders’ risk.

Among the recent changes, applicants will now be required to submit their date of birth. Furthermore, direct loans will no longer be accessible to individuals younger than 18 or older than 120 years. This announcement follows a concerning report from DOGE, which revealed that between 2020 and 2021, there were 3,095 loans totaling $333 million granted to borrowers aged over 115 who were still marked alive in the Social Security database. Notably, one applicant listed as being 157 years old received a loan of $36,000.

The number of centenarians in the U.S. is approximately 100,000, according to the Pew Research Center, with none exceeding 114 years of age. In light of these findings, the SBA is taking steps to ensure the integrity of its loan application process. DOGE stated in a social media post, “Basic sanity checks like these are initial steps toward minimizing fraud in government payment programs.”

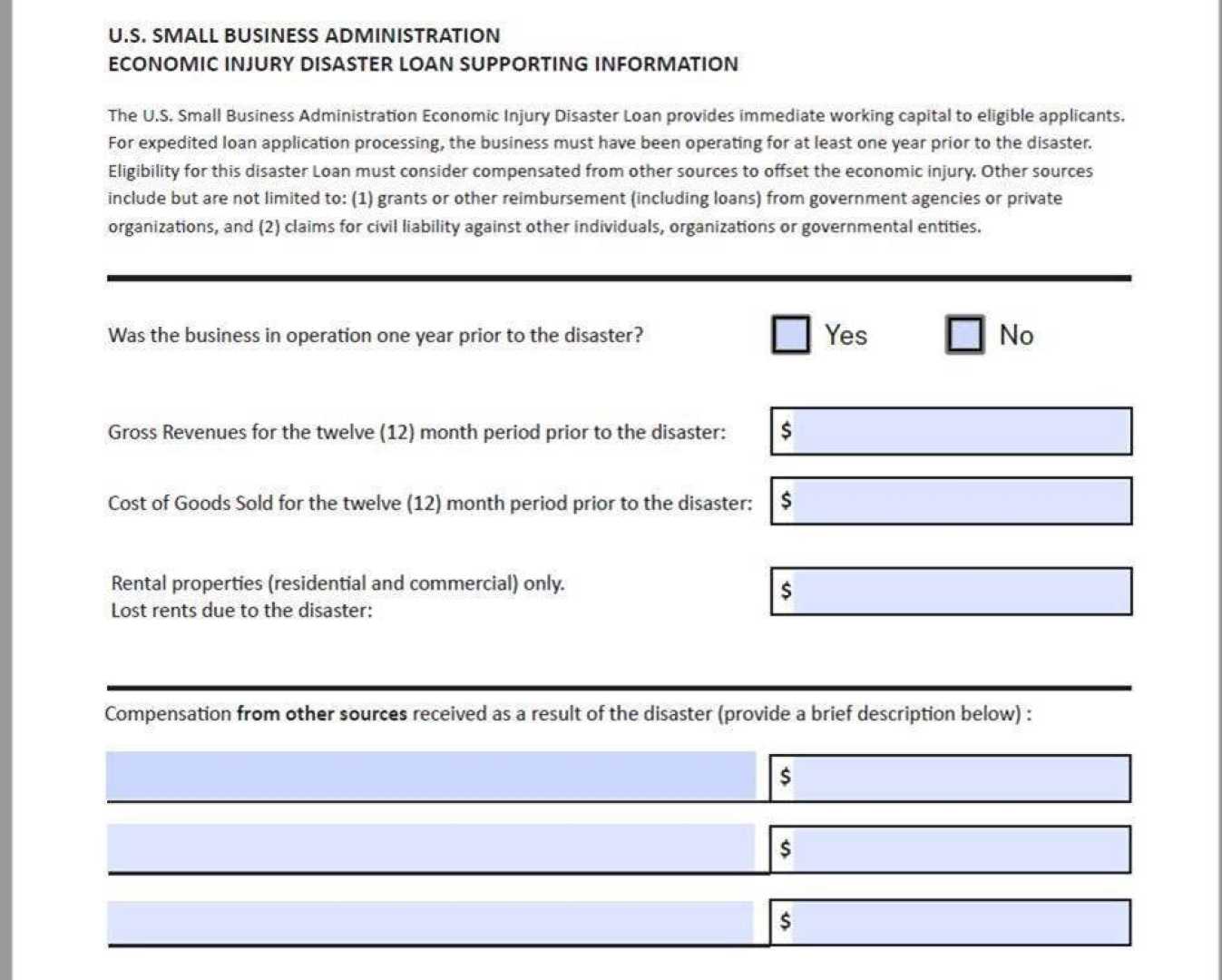

The Paycheck Protection Program (PPP), which was established to help businesses retain workers during the COVID-19 pandemic, ended in May 2021. The Economic Injury Disaster Loan (EIDL) program offered similar support, providing loans and advances to help various organizations recover from economic disruptions.

In addition to revising loan policies, the SBA recently announced significant workforce reductions, cutting its staff by 43 percent, which equates to approximately 2,700 jobs within its nearly 6,500 employees. This decision is based on a combination of voluntary resignations, terminations of temporary positions established during the pandemic, and some layoffs. The SBA indicated that these cuts are part of a “strategic reorganization,” aiming to return to its original focus on promoting small businesses.

SBA Administrator Kelly Loeffler remarked, “The SBA was created to be a launchpad for America’s small businesses by offering access to capital, which in turn drives job creation and innovation.” Loeffler emphasized the agency had strayed from its mission over the past four years, ballooning in size and becoming mired in mismanagement.

Despite the staffing cuts, the SBA assures that core services, such as loan guarantees and disaster assistance programs, will not be affected. The SBA is also set to take over the administration of student loan servicing from the Department of Education, further expanding its role.

The immediate changes to loan applications aim to protect against fraud, while the anticipated staffing adjustments at the SBA are expected to unfold in the coming months. The agency’s recent regulations appear to be steps towards securing the financial integrity of its loan programs during an era marked by unprecedented challenges for small businesses across the nation.