Business

New Tax Deductions for Overtime and Tips Take Effect in 2025

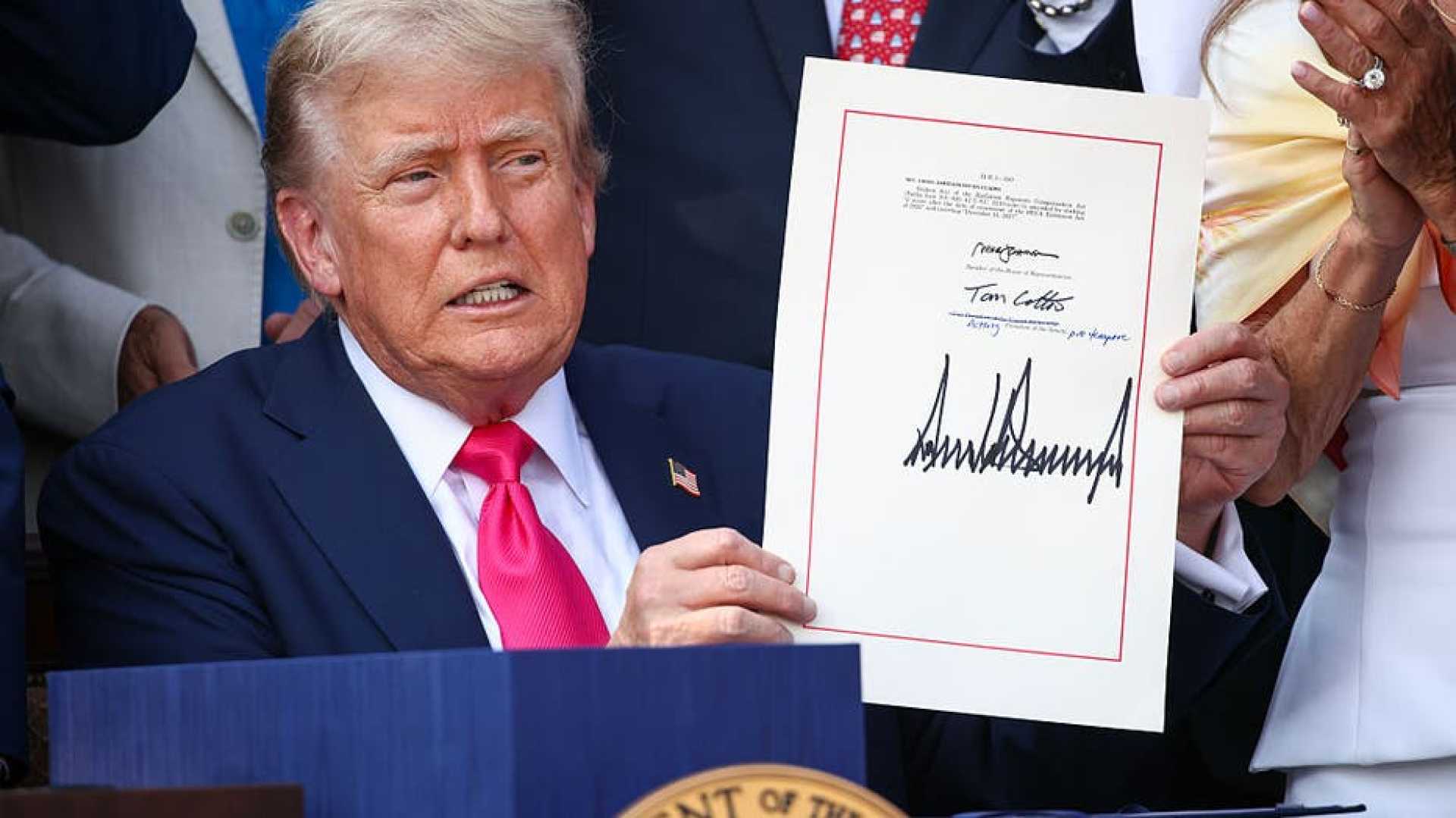

WASHINGTON, D.C. — President Donald Trump signed the One Big Beautiful Bill Act (OBBBA) into law on July 4, 2025, introducing two significant tax deductions: no taxes on overtime and no taxes on tips.

The OBBBA establishes a temporary above-the-line tax deduction for qualified overtime pay, effective retroactively from January 1, 2025. Eligible employees can deduct up to $12,500 as a single filer or $25,000 as a joint filer, with the deduction phasing out for those earning more than $150,000, or $300,000 for joint filers.

This deduction applies only to overtime wages that exceed an employee’s normal hourly rate, which is defined under the Fair Labor Standards Act (FLSA). For example, an employee earning $20 an hour could claim a deduction for the $10 extra earned for overtime at $30 per hour. However, not all overtime qualifies; it must adhere to federal law requirements.

Employers must report qualified overtime payments on W-2 forms, with new guidelines likely to be issued by the IRS later this year. Businesses are encouraged to collaborate with tax professionals to track eligible overtime wages properly.

In addition to overtime, the OBBBA also eliminates taxes on tips, allowing specific workers to deduct up to $25,000 in tips from their taxable income. This deduction will also phase out for higher earners under similar conditions. The IRS is expected to release a list of occupations eligible for this deduction by October 2, 2025.

Tipped workers must prove that tips were voluntarily given, as mandatory service charges will not qualify. Moreover, whether tips are provided in cash or via card does not affect eligibility for the deduction.

Despite the tax relief, workers in certain specified service trades, such as law and health care, are excluded from the deduction. The OBBBA aims to provide assistance to workers, but it has sparked debate regarding its impact on the labor market and federal deficit.

As of now, several states are considering or have already introduced similar measures to exempt overtime from state taxes, potentially further altering the landscape of labor compensation in 2025 and beyond. Businesses and employees alike will need to adapt to the new changes and seek guidance to ensure compliance.