Business

Nine in 10 Americans Ignore Social Security Delay Advice

NEW YORK, NY — A recent study by Schroders revealed that nine in ten working Americans plan to ignore financial advice on waiting until age 70 to claim Social Security benefits. This approach could ensure higher monthly payments.

Social Security allows individuals to begin claiming as early as 62, which is before the full retirement age of 67. However, claiming early results in a reduction of monthly payments by about 30%, a decrease that stays locked in for life.

In contrast, waiting until age 70 can increase monthly benefits by approximately 24% compared to claiming at age 67. Financial experts commonly recommend postponing Social Security claims, as early filers might miss out on thousands of dollars in potential payments.

In a survey of 1,500 adults, only 10% of respondents indicated plans to wait until age 70 to file for benefits. Meanwhile, 44% expect to claim before reaching full retirement age, despite recognizing the costs associated with early claiming.

Schroders’ research also noted a gap in public understanding of Social Security. Many Americans lack familiarity with how the program fits into their retirement planning. About one in five believe that Social Security will provide all the retirement income they need, when in fact, it usually replaces about 40% of a worker’s income.

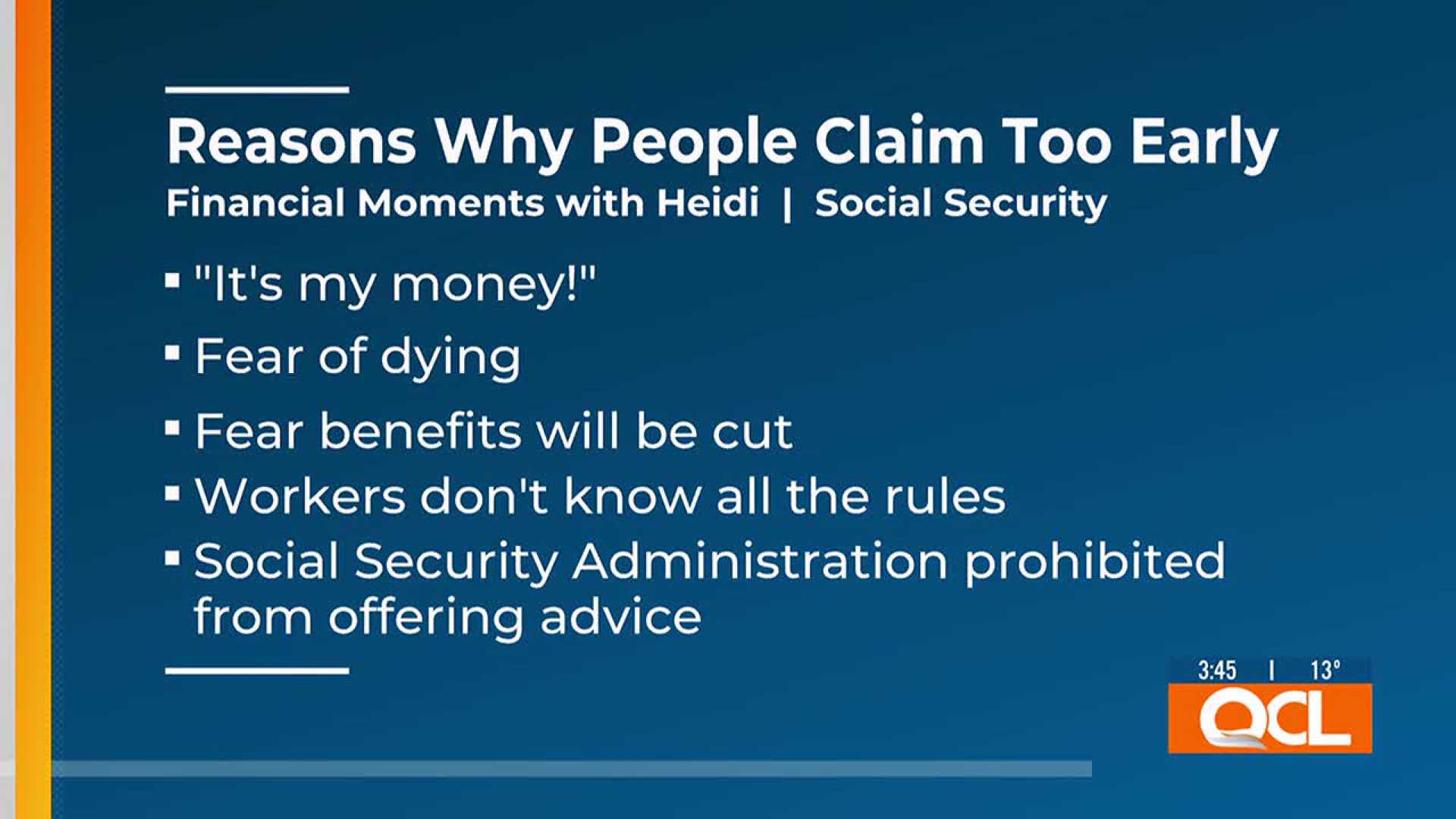

Deb Boyden, head of U.S. defined contribution at Schroders, commented, “The decision to sacrifice extra Social Security income is not an oversight for most Americans. We found that 70% are aware that waiting longer leads to higher payments, yet many still choose to claim early.” Many retirees feel a financial urgency and need Social Security income immediately upon retiring.

Individuals face personal circumstances that influence their decisions as well. Health issues and financial necessities often lead older adults to claim benefits sooner. The break-even point, where total money collected from claiming early equals the amount from delaying, averages around age 80.4 years.

Current life expectancy statistics show a 62-year-old man can expect to live until age 83.6, while a woman can expect to live until 86.5. However, a worrying concern about the program’s future may contribute to the preference for claiming benefits early.

The Social Security program is under financial pressure, as more beneficiaries draw from it than current workers contribute. Trust funds are estimated to be depleted by 2034 unless changes are made. While payments would continue, they could decrease by 20% if the program becomes insolvent, posing a threat to the more than 70 million beneficiaries.

Experts suggest adjustments can secure the program’s finances, such as raising the income cap on Social Security taxes, currently set at $176,100. Non-retired Americans believe they need about $5,032 monthly to retire comfortably, but current retirees average around $3,250 monthly.